Dollar Limps to Session Low after another Blow from Manufacturing Sector

- Written by: James Skinner

Image © Adobe Images

- USD slides after Empire State Manufacturing index posts record fall.

- Manufacturers suffering from trade war, ahead of crunch Fed meeting.

- Fed could take opportunity this week to tee up markets for rate cuts.

The Dollar sank to a session low Monday after receiving another blow from the now-beleaguered manufacturing sector, which comes just days ahead of Wednesday's Federal Reserve (Fed) meeting, which some say could herald an end to the central banks interest rate hiking cycle.

The Empire State Manufacturing index fell 26 points in June to settle at -8.6, the largest fall on record, which leaves the barometer of manufacturing activity in New York State at its lowest level since May 2016.

New orders for manufacturers fell during June while unfilled orders, delivery times and inventories all also declined. The index that assesses the six-month outlook for manufacturers also fell during June.

"This looks terrible, but it won’t last. The survey is conducted during the first 10 days of the month so it likely reflects the peak of Mexico tariff fear. President Trump tweeted the tariff threat on May 30 and abandoned it June 7. During that period, businesses appear to have panicked," says Ian Shepherdson, chief U.S. economist at Pantheon Macroeconomics.

Shepherdson says Monday's data is at least partly the result of a May threat by President Donald Trump to impose tariffs on goods imported from Mexico due to its failure to prevent thousands of South American migrants transiting its territory on route to the U.S. border. That should mean the fall is temporary.

However, Monday's number comes closely behind other surveys that have also shown activity in the manufacturing sector waning during recent months, which economists had connected to the trade war with China and a resulting slowdown in global economic growth.

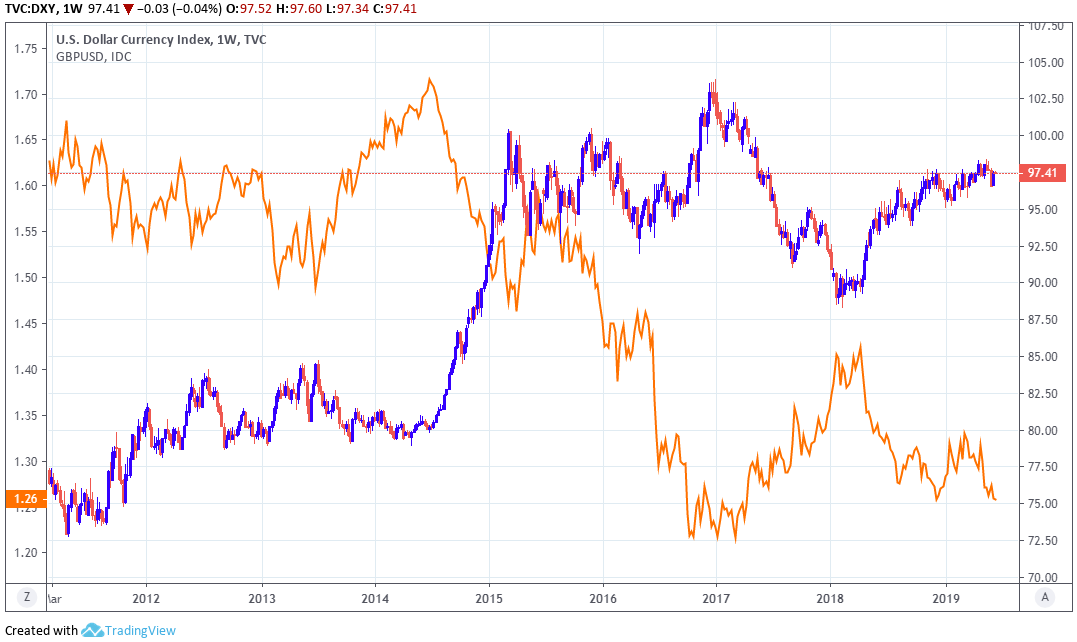

Above: Dollar Index shown at daily intervals, alongside Pound-to-Dollar rate (orange line, left axis).

President Trump lifted in May, from 10% to 25%, the tariff on around $200 bn of imports from China. The remaining $300 bn of China's annual exports to the U.S. are expected to be hit by a 25% tariff after the G20 if Jingping doesn't agree to enter a deal that his negotiators only recently backed out of.

Both Trump and President Xi Jingping are expected to meet on the sidelines of the latest G20 summit in Osaka, Japan at the end of the month although analysts see the meeting, which is yet to actually be scheduled, as merely a prelude to the next increase in U.S. tariffs.

"Now that the Mexican tariff threat is over, and if we’re right in our views that tariffs will not be applied to imported Chinese consumer goods, and that real progress will be made at the Osaka G20 summit, it would be reasonable to expect the uptick in China’s PMIs to support better U.S survey readings over the next few months," Shepherdson says, in a note to clients.

Shepherdson is says the two national leaders could actually reach a deal at the forthcoming summit, which would be positive for both the U.S. and global economies if it happens, although news of an accord will not come before Wednesday's Federal Reserve interest rate decisions.

The Fed is expected to update its economic forecasts and guidance for interest rates at 19:00 London time Wednesday and financial markets are increasingly of the view that it could use the meeting to prepare investors for a change of policy in the months ahead.

Investors are already betting the Fed will cut rates as many as three times this year, but there's no telling what they might subsequently begin to price-in for the following year if the bank does go ahead and play to its audience.

"A rate cut this week seems extremely premature. But the Fed can make some communications tweaks that at least open up the possibility for a cut in July. The question is how flexible that messaging will be," says Elsa Lignos, head of FX strategy at RBC Capital Markets. "We find it hard to believe that the Fed would cut rates if post-G20 for example there were a de-escalation of tensions."

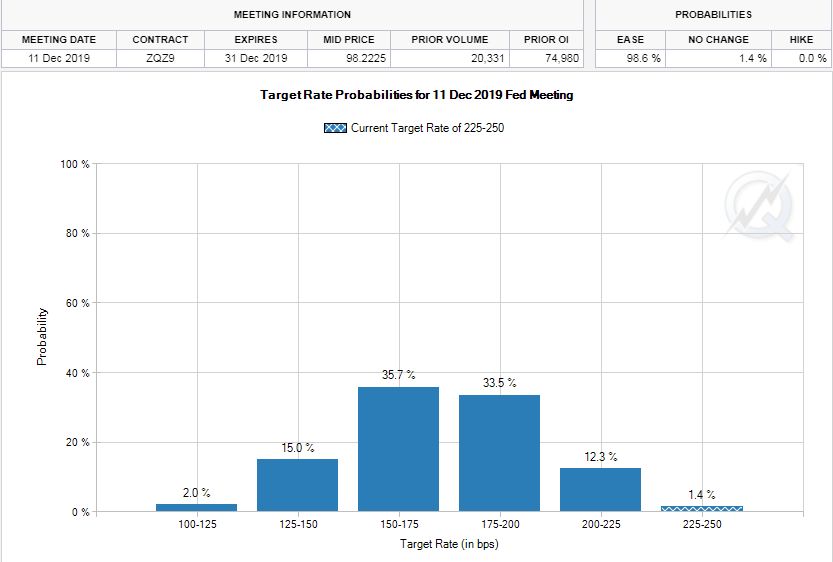

Above: Market-implied probabilities of Fed Funds rate ranges by year-end. Source: CME Group

CME Group data suggests that there's just a 1.4% probability that the Federal Funds rate range will remain at the current 2.25%-to-2.5% setting in December 2019, and no investors at all appear to expect that interest rates will be any higher than that. Substantially all are anticipating rate cuts this year.

Any cuts, if they're forthcoming, could bring an end to the 18-month Dollar rally that has crushed nearly all other G10 currencies since early 2018. The Fed's interest rate, at 2.5%, is the highest in the G10 world and has sucked capital out of, and deterred it away from, other currencies for some time now.

The Fed said last month that a combination of "moderate" economic growth and below-target inflation would mean it could be "patient for some time" before adjusting rates again. This came after it shifted to the sidelines of the interest rate field in January, telling markets it'd be "patient" before moving again.

Above: Dollar Index shown at daily intervals, alongside Pound-to-Dollar rate (orange line, left axis).

U.S. policymakers have said repeatedly that their move to the sidelines was the result of concerns about "global economic and financial developments" and the potential for a slowdown overseas to hurt the U.S. economy. There are now clear signs that U.S. growth is slowing.

"We imagine we will see the Fed put two rate cuts in for this year with stable policy next year," says James Knightley, chief international economist at ING Group. "Markets are anticipating around 100bp of easing over the next twelve months with the first cut around 80% priced for July. We think this may be a little too aggressive and look for two 25bp moves in September and December."

Interest rate decisions are normally made in relation to the inflation outlook but impact currencies through the push and pull influence they have over international capital flows. Rising rates normally draw bids for currencies while declining rates tend to drive flows away from them.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement