U.S. Dollar Hits the Ropes after Trade Tensions Start to Bite Economy

- Written by: James Skinner

Image © White House

- USD retreats after survey suggest 'trade war' biting economy.

- Risks inciting further bets that Federal Reserve will cut rates.

- USD outlook clouded, but other G10s to see continuous pressure.

- U.S. will to fight multiple trade battles further unnerves markets.

The U.S. Dollar was in a mire Friday after an influential indicator suggested that President Donald Trump's trade war with China may now be beginning to bite the economy, driving off a safe-haven bid and playing music to the ears of those betting the Federal Reserve (Fed) could cut interest rates before the year is out.

America's Dollar hit the ropes in noon trading when the Institute for Supply Management Chicago PMI was shown rebounding to only 54.2 in May, from 52.6 previously, when markets had looked for it to reclaim the 55.1 threshold.

The index has fallen from a high of 64.7 in February to a low of 52.6 in May, with the steepest decline coming last month, as the economy slowed during the first quarter and U.S. international trade rhetoric became more hawkish.

The PMI survey measures changes in Chicago activity by asking 200 respondents to rate conditions for employment, production, new orders, prices, deliveries and inventories. A number above the 50.0 level indicates economic expansion while a number below is consistent with contraction.

Markets care about the data because it is an important indicator of momentum within the economy. And economic growth has direct bearing on consumer price pressures, which dictate where interest rates will go next. Chicago is the third largest city in the U.S.

"The troubles at Boeing - based in the city - and the trade war presumably are hurting, and the prospect of a deeper, longer dispute with China and now with Mexico too cannot be good for industrial sentiment," says Ian Shepherdson, chief U.S. economist at Pantheon Macroeconomics.

Above: Dollar Index shown at hourly intervals.

Friday's data is significant because it could suggest the U.S. trade war is beginning to bite the economy, which might simply encourage increased speculation about Federal Reserve interest rate cuts.

Interest rate decisions have influence over capital flows, which tend to move in the direction of the most advantageous or improving returns. A threat of lower rates can see investors driven out of and deterred away from a currency.

The market is betting on one Fed rate cut before year-end and flirting with the idea of pricing-in another, which is something that analysts say will eventually lead the U.S. Dollar to unwind a two-year rally higher. Until Friday, 'safe-haven' flows connected to the 'trade war' with China had kept the greenback supported.

"Global yields continue to fall sharply especially in the US where the yield on the 10-year US Treasury bond hit a new intra-day low overnight of just 2.17%. It is now well below the Fed funds effective rate at 2.39%. It provides a strong signal that market participants believe that the current Fed policy setting it too tight in light of the deteriorating growth outlook, and inflation undershoot," says Lee Hardman, a currency analyst at MUFG.

Above: Dollar Index shown at weekly intervals.

The trade war between the U.S. and China has escalated dramatically in the last month and the world's two largest economies are now on the verge of an all-out economic conflict after the White House drew a 'blacklist' from its arsenal of economic weapons and used it against China's Huawei.

Hui Xijin, Editor-in-Chief of China's Global Times and perceived by some in the market as an unofficial spokesperson for the government, said in a social media post Friday that China would retaliate. Soon after the Ministry of Commerce said it's creating a "list of unreliable entities".

The ministry is yet to say which U.S. companies will be added to this list or what awaits those who are eventually featured on it, but the announcement demonstrates an intent by government to match U.S. moves against China.

"The recent re-escalation in trade tensions between the US, China, and Mexico have clearly heightened concerns over downside risks to the global growth outlook," says Hardman writes, in a note to MUFG clients.

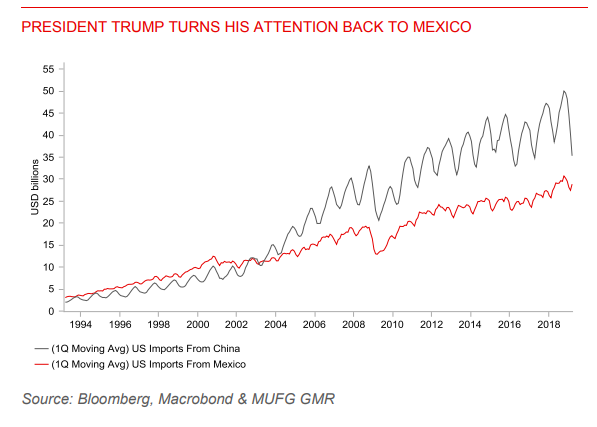

Above: U.S. trade with China and Mexico.

Until recently the U.S. and China were content to just levy ever-increasing tariffs on each other's good, albeit that the latest increase was a dramatic one. President Donald Trump recently lifted from 10% to 25% the tariff on $200 bn of U.S. imports from China and threatened a 25% levy for all of China's U.S trade.

The use of a 'blacklist' marked step-change in the conflict that was followed by another significant development this Friday when President Trump showed the U.S. is willing, contrary to much speculation, to fight a so-called trade war on more than one front at a time.

Trump said Friday that from June 10, a tariff of 5% will be applied to all goods imported into the U.S. from Mexico, citing illegal migration from Mexico into the U.S. as the reason behind the move.

"President Donald Trump’s shock announcement of tariffs on Mexican imports could be challenged by Congress, but the possibility that both Mexican and Chinese imports might be subject to a blanket 25% tariff presents a significant additional downside risk to the US economy, at a time when it already appears to be losing momentum," says Andrew Hunter at Capital Economics.

....at which time the Tariffs will be removed. Details from the White House to follow.

— Donald J. Trump (@realDonaldTrump) May 30, 2019

Multiple so-called caravans of migrants have travelled from across South America in the past year, through Mexico and up to the U.S. border where they have attempted to gain legal or illegal entry into the country.

Trump has repeatedly called for Mexico to do more to prevent those 'caravans' from passing through its territory and now appears prepared to use coercive measures like trade tariffs to have the Mexican leadership fall into line.

The move comes as lawmakers from the U.S., Mexico and Canada step up efforts to ratify the United-States-Mexico-Canada-Agreement (USMCA), which is the new NAFTA agreement, but ratification of it is now in doubt.

"While the tariffs on Mexico are likely to have a less of a global spillover (in comparison to the US-China trade dispute), it is nonetheless a negative for risk sentiment as it shows that US administration is not afraid of a multi-front trade war. This in turn keeps the threat of auto-tariffs on EZ car exports very much alive," warns Petr Krpata, a strategist at ING.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement