Australian Dollar Tipped to Capitalise on Pound's Weakness

- Written by: Gary Howes

Image © Adobe Images

Now could be the time to engage pound vs. Australian dollar downside.

The pound fell sharply against its peers on Wednesday after the UK released a surprisingly sharp slowdown in inflation.

Looking ahead, strategists see further weakness in the currency as markets ramp up bets for as many as three more interest rate reductions at the Bank of England.

In fact, the odds of a third cut were lifted to 70% from 40% after the ONS reported UK inflation fell to 3.2% y/y in November.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

With rate cut bets on the up, UK bond yields are going in the opposite direction: the two-year UK bond yield is down to 3.7%, its lowest since August 2024.

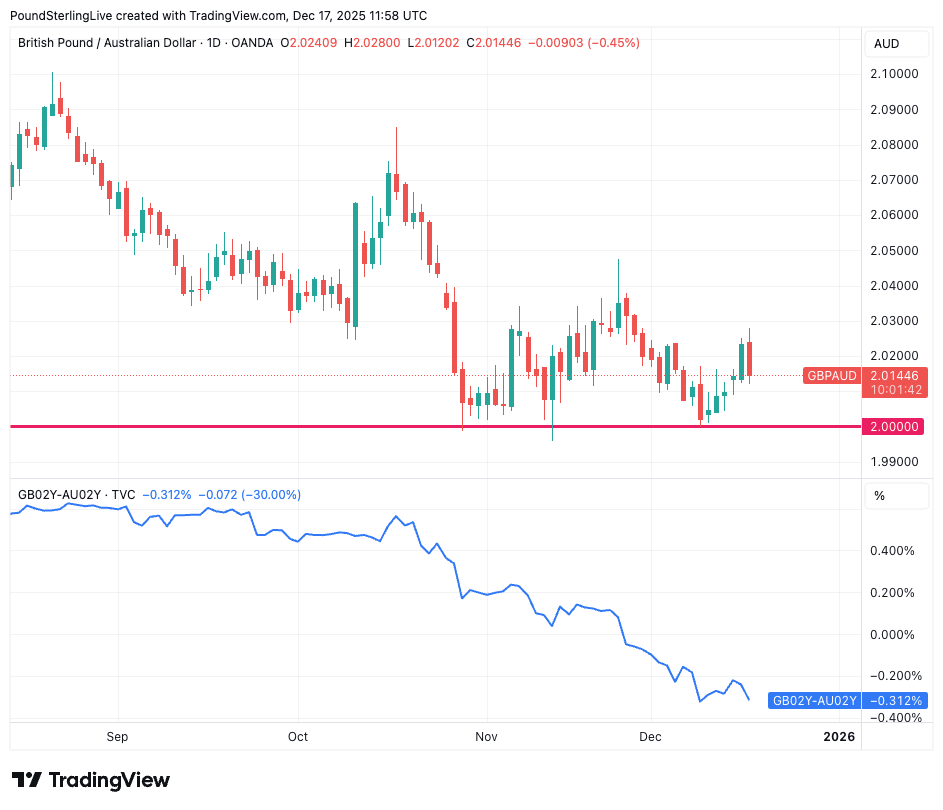

Interest rate movements, in particular the differential between rates from one country to the next, matter greatly for currency values. The differential between the UK and Australian dollar two-year bond has shrunk further in favour of AUD (see lower panel):

If anything, the above chart suggests GBP/AUD might be lagging the move in the yield differential.

Kit Juckes, head of FX strategy at Société Générale, thinks the pound is particularly vulnerable to losses against the Aussie dollar:

"There's still room to get short GBP/AUD," he says.

🔒Lock in today's exchange rate to secure a future payment. You may also book an order to trigger your purchase when your ideal rate is achieved. Learn more.

The pound to Australian dollar exchange rate has been under pressure since August, falling from 2.10 to 2.0 by late October.

It has since rallied to 2.02, but gains here look to be a counter-trend relief-style bounce.

The fundamentals for GBP/AUD downside and an eventual break below 2.0 are compelling:

With the Bank of England looking to cut on a number of occasions, the contrast between the UK and Australia interest rate outlook is stark. Not only has the RBA signalled it is done cutting, but the market thinks the next move will be a rate hike.

The textbook suggests this divergence in interest rate policy could weigh heavily on GBP/AUD.