Swiss Franc Forecasts Amidst the Italian Political Flare-up

- Franc a beneficiary of political woes in Italy because of safe-haven credentials

- USD/CHF remains in a bullish trend which is expected to resume

- EUR/CHF in a strong downtrend but is oversold; GBP/CHF has just bounced off 200-day MA

© Andrey Popov, Adobe Stock

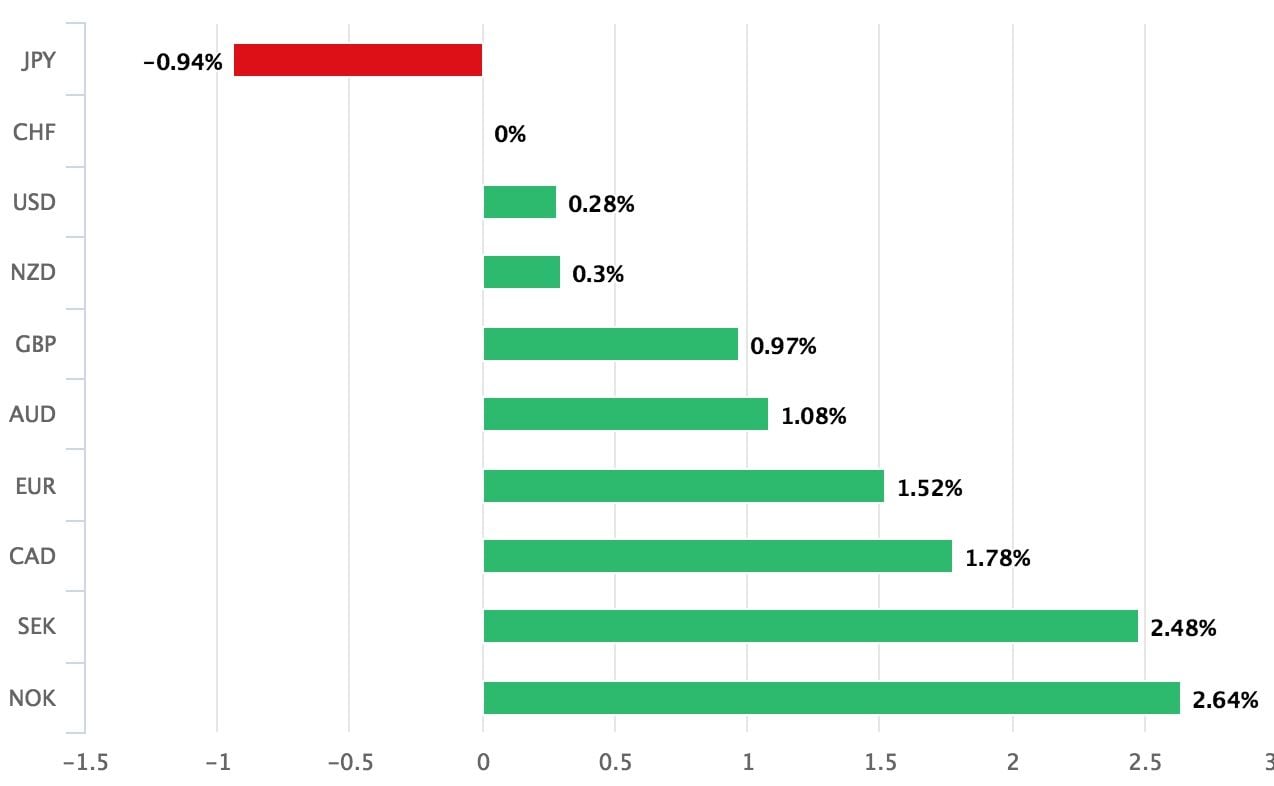

The political intrigue in Italy has allowed the Japanese Yen and the Swiss Franc to shine.

The two are currently bid as a result of an increase in safe-haven flows due to the political crisis which has set the country once more on the path to the ballot box, and markets are concerened that the two anti-EU parties that triumphed in the last round of elections will only find their position emboldened, lending yet more support to the Franc.

The Franc looks particularly strong against the Euro; "the Swiss franc has strengthened further against the Euro, and is now stabilising at levels below the 200-day average, having appreciated by almost 4% in less than one month," says Intesa Sanpaolo economist Luca Mezzomo.

Above: CHF performance over the course of the past week.

In the absence of crystal ball, speculation of the outcome of politico-economic fundamental drivers can become an extremely hit-and-miss affair. In these cases, it can be useful to look for tried and tested signals from price charts to help forecast whether the next turn of events are going to be positive or negative for a currency, as these can provide a more objective basis for speculation.

Here we assess the charts of the three main Franc pairs - the USD/CHF, EUR/CHF and GBP/CHF.

GBP/CHF

The GBP/CHF pair is no different from the other Franc pairs as it too has been correcting back from a previous peak, which in the case of GBP was at 1.3856.

The correction has been quite steep, similar to EUR/CHF, but downside may become more difficult from here on down since the pair has just met the 200-day moving average (MA) which is likely to present an awkward obstacle to more selling.

Large moving averages often act as barriers to the dominant trend as they are popular indicators and there, therefore, tends to be more buying and selling around them which can distort price action, almost always stalls the trend and sometimes even leads to stronger reversals.

Despite the location of the 200-day impeding the downtrend, however, that trend is still intact and likely to extend providing the exchange rate can break clearly below the MA, which would be confirmed by a break below the 1.3107 lows, with the next target to the downside at the 1.3000 psychological round-number level.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

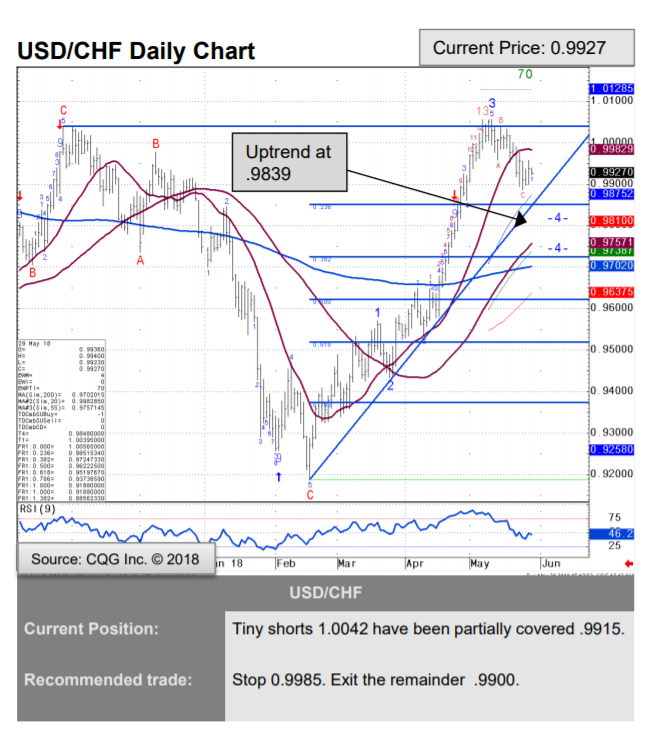

USD/CHF

The USD/CHF pair is a little bit of an anomaly as it actually looks reasonably secure in its established uptrend despite having corrected back ever since peaking at 1.0056 on the 9th of May.

The pair is currently trading at 0.9917 and although it is not showing any bullish signs yet we expect the pair to resume its uptrend eventually.

The pull-back since the May 9 highs is rather shallow compared to the steepness of the prior trend and this indicates to us that it is but a mere correction rather than a reversal of the trend, and therefore has a finite lifespan.

We would want to see a break above the 1.0056 for confirmation of a continuation higher as things stand, although the evolution of an uptrend on the 4-hr time period chart could also be used for confirmation and entry at an earlier stage.

Some analysts even think the pair has completed its correction and is likely to start rising sooner.

"USD/CHF we suspect that the correction may have terminated ahead of initial support at the 0.9845 January high and the 0.9848 uptrend, we favour recovery from here," says Karen Jones of Commerzbank.

(Image courtesy of Commerzbank)

EUR/CHF

The EUR/CHF pair is showing the steepest decline of al CHF majors as the Euro has become the weakest counterpart due to Italian political risk factors and slowing growth.

EUR/CHF has sold off steeply since peaking at 1.2005 in mid-April and there is nothing in the price action which suggests the sell-off is complete and the pair is going to turn around and start going higher - in contrast to USD/CHF where the pull-back has been much shallower and a resumption is expected.

"EUR/CHF has made new lows, confirming an underlying bearish trend. Break of support would suggest an extension of bearish pressure to key support at 1.1463," says Peter Rosentriech, a chief market analyst at Swissquote.

Not all analysts are confident the downtrend will extend, however, and Commerzbank analyst Karen Jones, for example, sees EUR/CHF as "Oversold and exhausted," and a "bounce (is) possible".

Two indicators are suggested the pair is at an overstretched extreme.

"We have an oversold RSI and a TD perfected set up, which suggest that the down move is exhausted for now. We would allow for a correction back to the 200-day ma at 1.1656," says Jones.

The pair is only temporarily exhausted, however, and rebounds are not expected to rise very high.

"We look for losses eventually back to the February low at 1.1448 (55-week ma at 1.1501)," says Jones.

"Failure at 1.1448 would target a move to the August 2017 low at 1.1259," she adds.

(Image courtesy of Commerzbank)

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here