Australian Dollar is July's Laggard as Markets Brace for RBA Response to Lockdowns and Economic Contraction

- Written by: Gary Howes

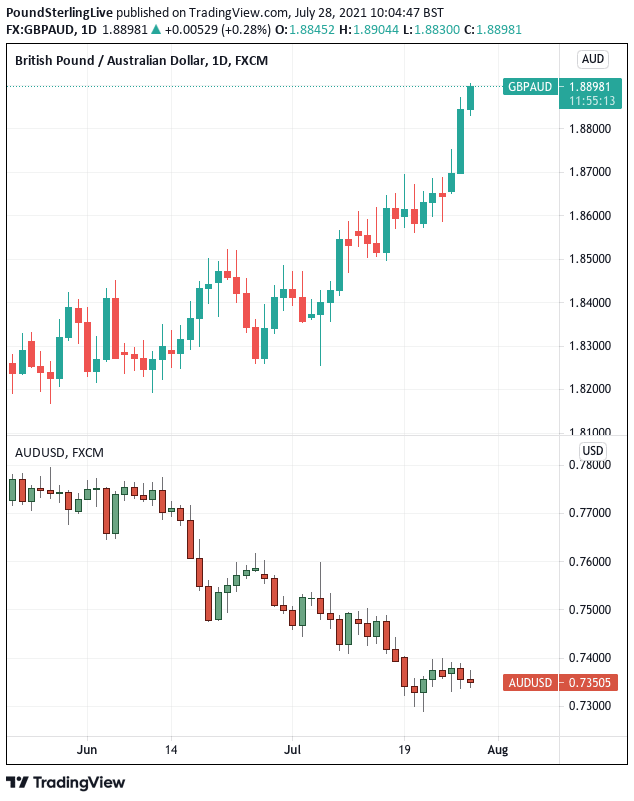

- GBP/AUD's stellar run continues

- Westpac says RBA should boost quantitative easing

- NAB says RBA to defer taper until 2022

Above: Vaccination centre signage, Australia. Image © Rafael Ben-Ari, Adobe Images

- GBP/AUD reference rates at publication:

- Spot: 1.8892

- Bank transfer rates (indicative guide): 1.8232-1.8364

- Money transfer specialist rates (indicative): 1.8723-1.8760

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Australian Dollar looks set to round of the month of July as the second-worst performer in the G10 space, burdened by expectations that a slew of lockdowns to contain Covid-19 will result in an economic contraction in the third quarter of the year.

The Reserve Bank of Australia (RBA) is now widely tipped by economists to shirk at the prospect of reducing its quantitative easing programme in September, opting instead to maintain generous levels of support for longer.

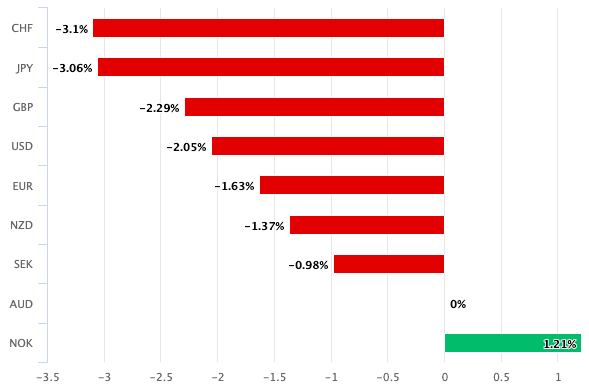

The Australian Dollar is now in the process of adjusting to this reality with losses coming against the majority of its major peers, apart from the Norwegian Krone:

Above: Australian performance over the past month

The Pound-to-Australian Dollar exchange rate meanwhile continues its run higher, netting handsome gains for those strategists who have been inclined to bet on gains of late, as we noted in our piece out yesterday.

Looming as a near-term driver for the Australian Dollar will be the RBA policy meeting, due August 06, where the response to recent lockdowns will be laid out.

The RBA said at its July policy update it plans to begin tapering bond purchases under its quantitative easing programme from September, a development the market held to be a net positive for the Australian Dollar.

But that was at a time of strong economic growth and an outlook assured by the country's covid-free status.

Ensuing lockdowns and resultant forecasts for negative economic growth in the third quarter throw these expectations out of the window, which poses a degree of policy uncertainty for Governor Philip Lowe and his team.

Currencies tend to wilt in the face of such uncertainties and the underperformance of the Australian Dollar in the current climate is testament to this fundamental relationship.

The Australia's Treasury expects lockdowns in New South Wales (NSW) to cost A$750MN per week, with the lockdown now expected to extend into September.

Economists at Westpac have released estimates that point to a likely contraction in the national economy of 0.7% in the third quarter, at a cost of around A$8BN.

For NSW specifically output is estimated by Westpac to contract by around 3.1% in the third quarter.

"Evidence from the partial data that Australia is heading towards a contraction in the September quarter is likely to elicit further support from the fiscal and monetary authorities," says Bill Evans, Chief Economist at Westpac.

St. George Bank have updated their forecasts and also expect the national economy will contract by 0.7% in the third quarter 2021, assuming the current lockdown in NSW does not last much beyond 8 weeks and Victoria’s lockdown is relatively short lived.

Commonwealth Bank of Australia say they expect the Australian economy to contract by a more sizeable 2.7% over the third quarter, following a forecast 0.6% increase in the second quarter of the year.

Above: GBP/AUD in top panel, AUD/USD in lower panel.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The severity of the RBA's response to the pandemic and economic developments will likely inform the outlook for the Australian Dollar over coming weeks.

The RBA said it would reduce its quantitative easing programme from A$5BN to A$4BN per week starting in September, but Governor Philip Lowe has stated they remain flexible on the matter and they could in fact increase purchases if required:

"There should be flexibility to increase or reduce weekly bond purchases in the future, as warranted by the state of the economy at the time".

Westpac expect the RBA to lean on this flexibility and "at the least it could announce that the taper in purchases from $5 billion to $4 billion which was planned for early September will be deferred."

This would represent a relatively muted RBA response and could therefore offer some support to the Australian Dollar.

But Westpac's Evans says a more aggressive stance might be warranted.

"A better approach, in keeping with the need to be seen to be supporting the economy at a difficult time, would be to announce a review of the program at or before the September meeting where the current purchase rate of $5 billion per week could be lifted to $6 billion rather than reduced to $4 billion," he says.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

"A decision to immediately lift purchases to $6 billion per week would certainly send the right signal that the Bank is responsive to economic developments and is prepared to use its new flexible policy tool accordingly," he adds.

Economists at NAB say the taper to quantitative easing will be put on hold, saying they expect the announcement to be made at the August meeting.

NAB, St George Bank and Westpac all say they expect economic activity in Australia to bounce back rapidly once restrictions are eased.

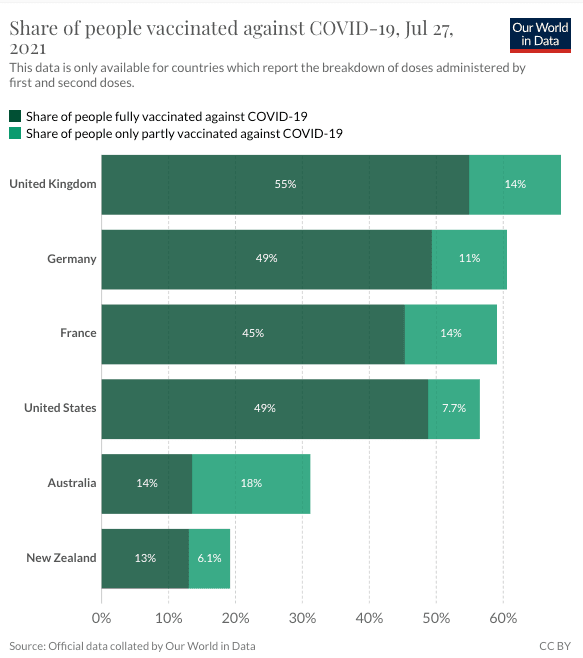

However, with Australia's vaccination rate remaining slow, combined with evidence that vaccinations alone won't achieve a desired population-level herd immunity, the country potentially faces a tough few months ahead where lockdowns are lifted to only be reinstated.

"For those economies that have adopted a zero Covid policy, Delta may pose greater challenges. Australia has already been forced to put half its population into lockdown to contain the spread of Delta, and greater restrictions may be necessary in the future if the zero Covid policy is maintained," says Ben May, Director of Global Macro Research at Oxford Economics.

"Much depends on how long the lockdown lasts and how long it takes to contain the virus. The longer it takes, the bigger and longer the impact on economic activity. It remains a situation that is evolving," says Jarek Kowcza, Senior Economist at St. George Bank.

Economists at St. George Bank say vaccines are the key to averting future lockdowns, and on this metric the outlook remains challenging.

"The lockdowns demonstrate the importance of the vaccine rollout and ensuring a sufficient proportion of the population is vaccinated for restrictions to lift and remain lifted in the future," says Kowcza.

Kowcza says Australia still significantly lags international peers as it currently has the lowest share of its population fully vaccinated of all OECD countries.

The government's vaccination strategy includes an expected expansion in the number of doses allocated across the country to around 3 million per week to late August.

From September, doses allocated are expected to increase to over 3 million per week, before reducing to over 2 million per week from October.

The strategy points to December as being a period at which restrictions might be eased with more confidence and a more robust rebound in activity can transpire.

NAB expect 80% of adults will be vaccinated by mid-November, "a high vaccination rate, along with activity rebounding could then see a more aggressive QE taper in 2022," says Alan Oster, Group Chief Economist at NAB.

NAB expect the total quantitative easing programme envelope from September to total around A$150BN with tapering to occur progressively before ending in mid-to-late 2022.