South Africa Rand Recovery Forecast to Remain Intact

- GBP/ZAR downtrend can continue

- 20.77 an approximate target

- Goldman Sachs says the Rand is a buy

Image © Adobe Images

- GBP/ZAR spot at time of writing: 21.55

- Bank transfer rates (indicative guide): 20.80-20.95

- FX specialist rates (indicative guide): 21.00-21.36

- More information on specialist rates here.

The South African Rand's ongoing recovery against the British Pound and other major developed market currencies is seen extending over the short-term courtesy of a supportive technical configuration, meanwhile analysts at Goldman Sachs say the demand by investors for high-yielding and high-risk financial assets should also aid further gains.

From a technical perspective, momentum favours the South African currency against Sterling.

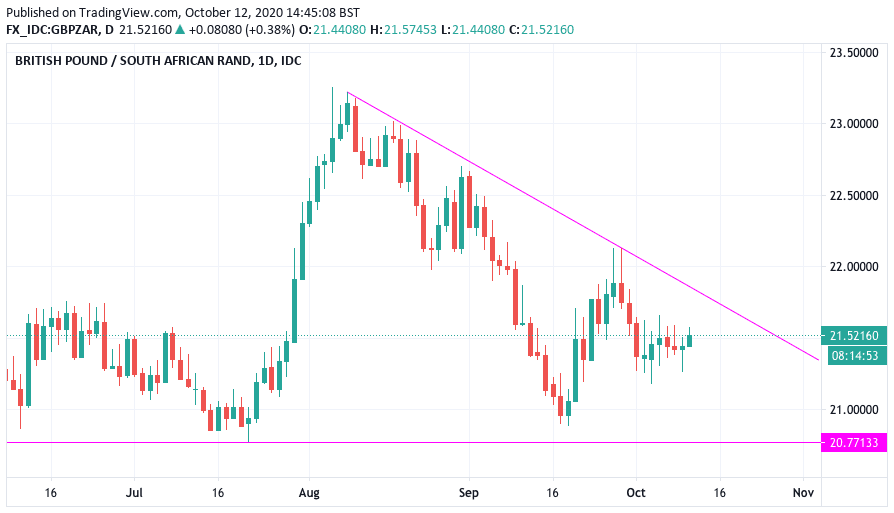

The Pound-to-Rand exchange rate has been in decline since early August when a rally topped out around 23.00 and subsequently reversed, indeed a look at the daily chart indicates a trend line that is consistent with a short-term negative outlook:

Should losses extend over coming days and weeks then an initial target at 20.77, the July 22 low, comes into view. We see some decent support for Sterling around this vicinity, noting that a falling GBP/ZAR exchange rate has arrested declines in this area on three occasions in 2020.

If you are looking to buy Rand and would like to capture current levels for use in the future, please see what tools are available to you here.

The Rand suffered significant losses at the start of the year when 'risky' emerging market assets were sold off in favour for safer investments, but the subsequent recovery in confidence has seen investors return to the Rand.

This trend could well continue according to analysts at Goldman Sachs, who have told clients this week they are initiating a new recommendation that investors buy the Rand alongside the Mexican Peso and Indian Rupee.

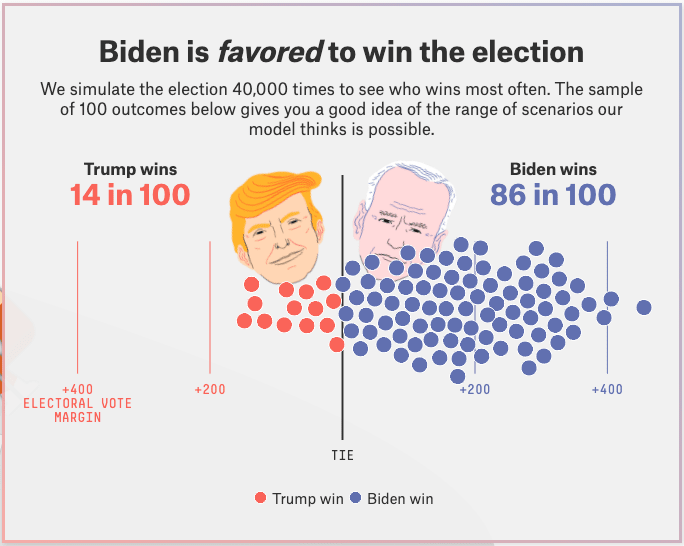

Goldman Sachs says that the likelihood of a strong win by Joe Biden in the November U.S. election combined with the likely approval of a vaccine provide the fundamental rationale for betting on further upside in this 'risk on' group of currencies.

"Two events are likely to shape FX market performance into year-end: the US election and the output from phase three trials for the leading coronavirus vaccines," says economist Zach Pandl at Goldman Sachs in New York. "Although there are uncertainties around both, the risks are skewed toward USD weakness, and we see relatively low odds of the most Dollar-positive outcome—a win by Mr. Trump combined with a meaningful vaccine delay."

The Wall Street bank has noted Biden’s commanding lead in both the national and battleground-state polls.

Above: Election outcome simulations by FiveThirdyEight.

But, it is not just Biden who is being tipped to win the White House, polling also points to the prospect of the Democrats taking control of the Senate, ensuring full control of the legislative agenda.

Markets appear to be of a view that a 'blue wave' outcome would be beneficial for stocks and investor sentiment owing to the prospect of a powerful fiscal support package being the first major gift of a Democrat administration.

Such a package, while desired by both Republicans and Democrats, is currently hamstrung by divergent views on its scale and makeup, while some analysts note the Democrats are increasingly seeing the strategic benefits of not gifting Trump a support package this close to the vote.

Goldman Sachs cite event prediction markets and prominent public models that now put the odds of a “blue wave” at greater than 60% for being positive on the outlook for stocks and other 'risky assets'. However, it is not just U.S. politics that matter for the outlook, a 'silver bullet' to end the covid-19 pandemic is also seen as highly supportive.

"We are also approaching major news on the two leading coronavirus vaccines: Pfizer has said it expects a “conclusive readout” by the end of October and Moderna has indicated that the first interim analysis of its phase three trials should be available in November. If the vaccines are highly effective, these early results may be sufficient to imply a high probability of emergency FDA approval by year-end," says Pandl.

Given the prospect of these twin developments Goldman Sachs are of the view risk/reward is, "leaning strongly Dollar-negative into year-end."

They recommend buying the South African Rand, Mexican Peso and Indian Rupee against the Dollar as a result.