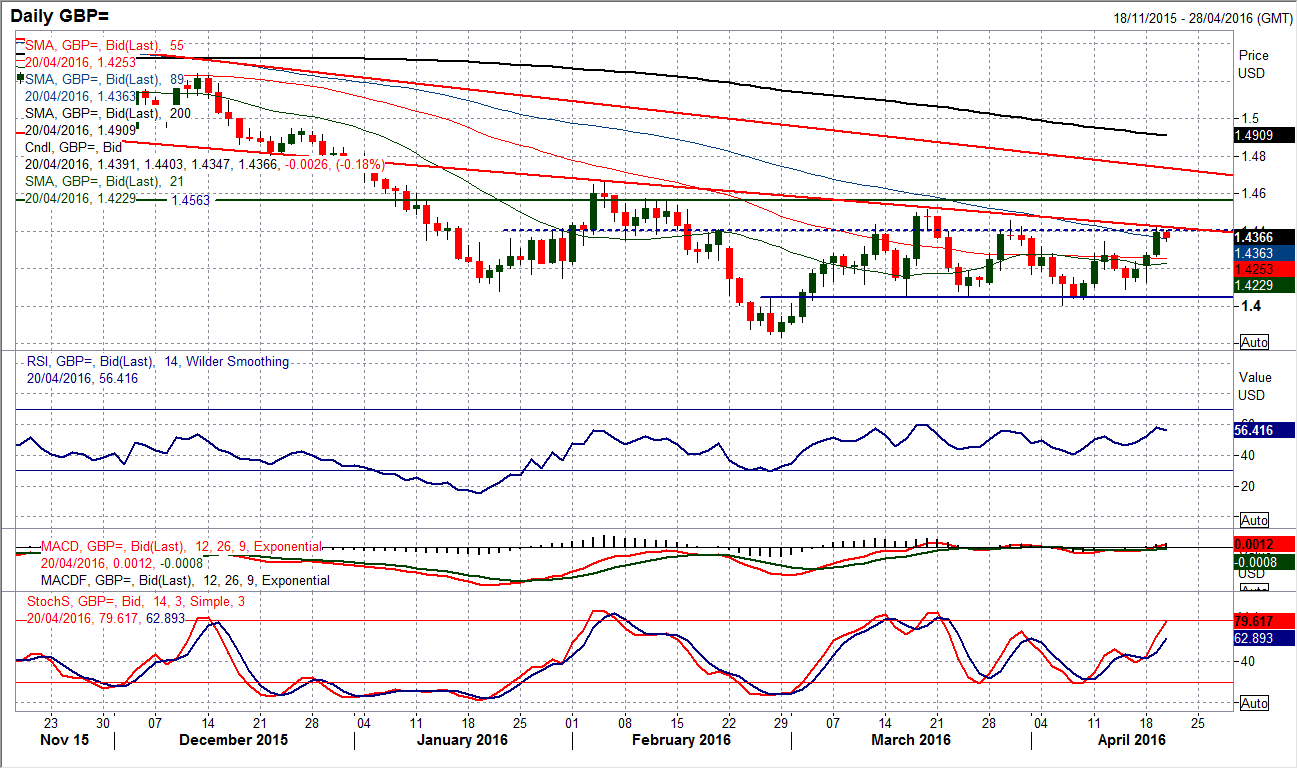

Pound / Dollar Rate Breaks a Critical Resistance Area Forecasts Eye Target at 1.4515 Pivot

A strong supply of sterling above 1.4350 could keep the pound to dollar exchange rate strength contained, but there are reasons to expect further advances to be squeezed out of the market.

- Supply of GBP now matched by demand note CitiFX

- Underwhelming UK labour market data has little negative impact on sterling

- Current short positioning potentially sees GBPUSD staging a further corrective move towards 1.4515

The British pound continues to trade above levels not seen since late March against the US dollar, the poor UK employment data released mid-week has not done enough damage to suggest a reversal in the short-term recovery is over.

Britain’s job market showed more fragility, keeping the door shut to a Bank of England rate rise, as paychecks grew at the slowest rate in a year, up 1.8 percent annually in February. Unemployment idled at 5.1 percent.

Sterling's reaction confirms the currency is detached from economic fundamentals at present and remains a play on risk sentiment. This is particularly true of the GBP/EUR, GBP/USD and GBP/JPY pairs - when European markets are rising, so sterling rises against these G5’s.

(In fact, over recent days sterling has risen even without stock markets!)

A number of technical indicators suggest the market is still subject to positive upside momentum; we note the pair resides above the 20, 50 and 100 day moving averages while the Relative Strength Index is trading at a level of 58.9.

Latest Pound / US Dollar Exchange Rates

| Live: 1.3612▲ + 0.61%12 Month Best:1.3867 |

*Your Bank's Retail Rate

| 1.3149 - 1.3203 |

**Independent Specialist | 1.3421 - 1.3475 Find out why this is a better rate |

* Bank rates according to latest IMTI data.

** RationalFX dealing desk quotation.

Indeed, price action on Thursday the 21st of April confirms that the 50 day moving average at 1.4330 is acting as a support area at which a strong supply of buyers can be found.

Should the pair close the day above here the prospect of further advances remain alive.

“A second consecutive strong bullish candle has put Cable back at a medium term crossroads. The break above the near term resistance at $1.4347 means a new high for April has been posted and there is now some key overhead resistance under threat,” says Richard Perry, a technical analyst with Hantec Markets.

A break above resistance would be a sign of intent by the bulls and could well take the pair higher. Perry says the key lower reaction high at $1.4460 protects the March high at $1.4515 and this 55 pip band of resistance is key for the medium term outlook.

Others believe the selling pressure is only likely to grow from here.

“GBPUSD looks likely to advance towards 1.4438 but we reckon that this level would likely stall further gains for some time,” say Hong Leong Bank in a note to clients, betraying a sense of nervousness amongst speculators at these rarefied heights.

Nerves could be justified with the CitiFX Flows team, a unit at the world's largest currency dealing institution, noting demand for GBP-USD north of 1.4350 now appears to be matched by supply.

Speculative markets remain heavily pitched against sterling, which could actually play into further strength.

As negative bets on the currency are closed out by wrong-footed traders demand for the currency is created.

A bet against the pound requires selling it, and when those bets are closed the opposite must hold true.

“Sterling was little changed though near three-week peaks against the U.S. dollar. Market positioning on short sterling bets has become a popular play that has helped lend support, albeit tentatively, to the pound,” says Joe Manimbo, Senior Market Strategist with Western Union.

CitiFX reckon the current short positioning potentially sees GBPUSD staging a further corrective move towards 1.4515 pivot though Brexit concerns make it unlikely the unit will break above that level.

Genuine risks for the pound, stemming from Brexit uncertainty, remain which can slow and undercut moves higher.

Too Early to be Tactically Bullish on GBP/USD

Meanwhile analysts at United Overseas Bank (UOB) in Singapore suggest it may be too soon to be long on the British pound against the US dollar saying that from a strategic standpoint they are neutral.

“The undertone for GBP is clearly positive but as mentioned in recent updates, only a daily closing above 1.4455/60 would indicate that the month long neutral phase has shifted to bullish,” say analysts in a note to clients.

Furthermore, they concede that this appears to be a likely scenario unless there is a move back below 1.4320 in the next 1 to 2 days.