Pound-Dollar Week Ahead Forecast: Pumping Iron to 1.43 as GBP Sets Stage for Fresh USD Depreciation

- Written by: James Skinner

- Aided by brightening UK backdrop, global FX reserve recycling.

- Creates space in EUR TWI for fresh rally & further USD decline.

- GBP/USD spot rate at time of writing: 1.4014

- Bank transfer rate (indicative guide): 1.3624-1.3722

- FX specialist providers (indicative guide): 1.3804-1.3916

More information on FX specialist rates here

The Pound-to-Dollar exchange rate more than doubled its 2021 gain last week as Sterling took the market by storm, but with enthusiasm building among a broad array of participants and in a still-Dollar bearish market, the British currency could now have scope to attain three-year highs above 1.43 by March.

Pound Sterling has benefited from its "strongest real money buying ever" thus far in February in addition to a likely accumulation as well as diversification of foreign exchange reserves among global central banks.

All of this has been made possible by a brightening economic backdrop and an upbeat Bank of England (BoE) stance on the monetary policy outlook.

"The scaling back of BoE rate cut expectations continues to be supported by building optimism over a stronger recovery in Q2 onwards given the relatively fast vaccine roll out. Recovery optimism appears to have been captured in the latest PMI surveys," says Lee Hardman, a currency analyst at MUFG. "Strong bullish momentum suggests further near-term gains. A break above the 1.4000-level could open the door to a retest of the April 2018 high at 1.4377."

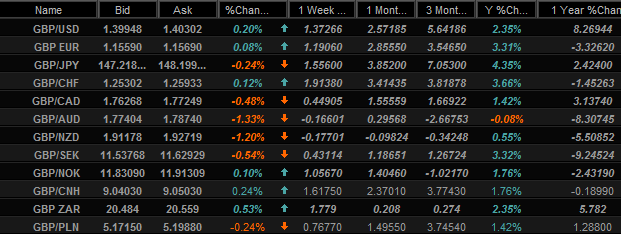

Above: Sterling Vs the majors over selected timeframes. Source: Netdania Markets. Click for closer inspection.

The BoE was bullish in its assessment of Britain's economic recovery prospects this month and confident that its 2% inflation target will be attained over the medium-term, which was effectively an all-clear for the market pile into the Pound and one that has since given way to a sharp rally.

This has seen the Pound-to-Dollar exchange rate rise above the 1.40 handle during the last week after entering the February month around 1.36, in line with Pound Sterling Live's forecast which may have seemed to many a reader like a wildly bullish, if-not unlikely projection.

"The main news next week will be Johnson's speech on Monday setting out how COVID-19 restrictions will be eased. Labour market data for December (due on Tuesday) will probably show that the unemployment rate ticked up again from 5% to 5.1%. And half the MPC will be interviewed by the Treasury Committee on Wednesday, which may give us some insight into how policy evolves as the recovery begins," says Thomas Pugh at Capital Economics.

Above: Pound-Dollar rate at weekly intervals with Fibonacci retracements of 2018 fall indicating resistance at 1.4379.

The rally is not yet over, however, according to multiple analysts. Sterling may be bolstered as soon as Monday when Prime Minister Boris Johnson is expected to set out to parliament a plan for enabling the country to exit 'lockdown'. A reopening as soon as quarter-end would put the UK on course for a return to normal months ahead of some European economies, supporting the relative growth outlook and Sterling in the process.

"GBP/USD is interesting, the market filled its time zone gap and shot higher, we have to assume that it is still bid. Attention remains on the topside and our longer term target is the 2018 peak at 1.4377," says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank.

Jones and the Commerzbank team are buyers of the Pound from 1.38 and are looking for a move up to 1.4240 initially followed by 1.4350 where they intend to exit the position. These levels would leave the Pound at three-year highs and could be seen as soon as this week.

{wbamp-hide start}

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

"We can see resistance at 1.4091 next with our first major objective at 1.4302/77 – the key 2018 highs and 50% retracement of the 2014/2020 bear trend – which we expect to cap for a fresh consolidation phase. Big picture, we continue to look for an eventual move to 1.49/1.51," says David Sneddon, head of technical analysis at Credit Suisse. "Near -term support moves to 1.3830."

Signals coming off the charts are bullish ahead of Johnson's statement but placing emphasis on this next week would be to overlook the role played by Sterling in resolving bigger problems beyond Britain's shores. Sterling's rise against the Dollar is lifting GBP/EUR in price action that is essential for the U.S. Dollar to depreciate anew in 2021, because without further gains in GBP/EUR, EUR/USD's scope to rise is very limited.

"EURUSD is a core component of broad trends in the USD, but USD weakness has experienced a number of headwinds along this axis in recent months," says Stephen Gallo, European head of FX strategy at BMO Capital Markets. "The size of the COVID-19 shock means exchange rates carry more weight in the policy mix than during normal times. But the ECB's rhetoric suggests that the exchange rate is closer to being a direct input into monetary policy."

Above: Pound-Dollar rate shown at daily intervals alongside EUR/USD (red) and U.S. Dollar Index (blue).

The U.S. Dollar has long been seen as overvalued by many analysts but with the Federal Reserve's (Fed) interest rate and quantitative easing policies incentivising the sale of it, expectations for a 2021 depreciation are widespread, while January remarks from new Treasury Secretary and former Fed Chair Janet Yellen before Congress indicated strongly that there's also a political desire to see the currency depreciate. But without a EUR/USD rally, depreciation will be difficult because of the Euro's Titanic size.

"ECB policymakers have recently spoken to media (privately and publicly) in what resembles a campaign to implicitly cap the currency," says Juan Manuel Herrera, a strategist at Scotiabank. "For now, the common currency’s slump through early-2021 is getting a helping hand from the slow roll-out of vaccines in the Eurozone but as inoculations become more wide-spread in the continent, the ECB may again be challenged by a stronger EUR—with no conventional (or appropriate) tools at its disposal."

This is where the Pound, its rally and the European Central Bank (ECB) enter the fold. EUR/USD has been roadblocked since January by the ECB, which has objected to its earlier surge due to fears that too fast an increase in its trade-weighted exchange rate will cheapen the cost of imports and endanger Europe's ever-elusive inflation target. But price action in Pound Sterling could see the ECB and U.S. Dollar afforded a win-win solution over the coming weeks.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

February's Pound-Dollar rally has lifted GBP/EUR above 1.15 and would take the latter to 1.17 or higher if GBP/USD rises to 1.43 this week and EUR/USD remains contained in its recent 1.1960 to 1.2170 range. This would reduce the trade-weighted Eurozone exchange rate such that EUR/USD could rise further and as far as 1.27 during the second and third quarters, without lifting the trade-weighted Euro too far for the ECB to tolerate.

The trade-weighted Euro would rise with EUR/USD, which has 20% share of the barometer, unless GBP/USD increases by enough to lift GBP/EUR into an offsetting move. The Pound has only a 15% share of the TWI so it and GBP/USD have a lot of ground to cover in order to facilitate a fresh EUR/USD rally and a U.S. Dollar depreciation.

"Should Chair Powell deliver a cautious message on Tuesday that (a) won’t increase expectations of imminent QE tapering and (b) underscores the outlook for the deeply negative front end US rate rates, the upside pressure on GBP/USD should remain in place," says Petr Krpata, chief EMEA strategist at ING. "Domestically, the focus will be on PM Johnson, who is set to unveil the roadmap for reopening the economy on Monday. While the underlying message is likely to be cautious with no formal dates set, the fact that the UK is moving towards such a roadmap underscores the constructive outlook of GBP for the coming months, particularly vs other European currencies."

Above: Pound-Dollar rate shown at weekly intervals alongside EUR/USD (red) and GBP/EUR (blue).