GBP/NZD is a Buy

The Pound to New Zealand Dollar exchange rate might be about to form a base and draw a line under its long-term downtrend.

And this, say analysts at Credit Suisse, represents a buying opportunity.

In a ‘Trade Idea’ note to clients analyst David Sneddon says should the GBP/NZD exchange rate move above 1.80 we will have seen an important reversal.

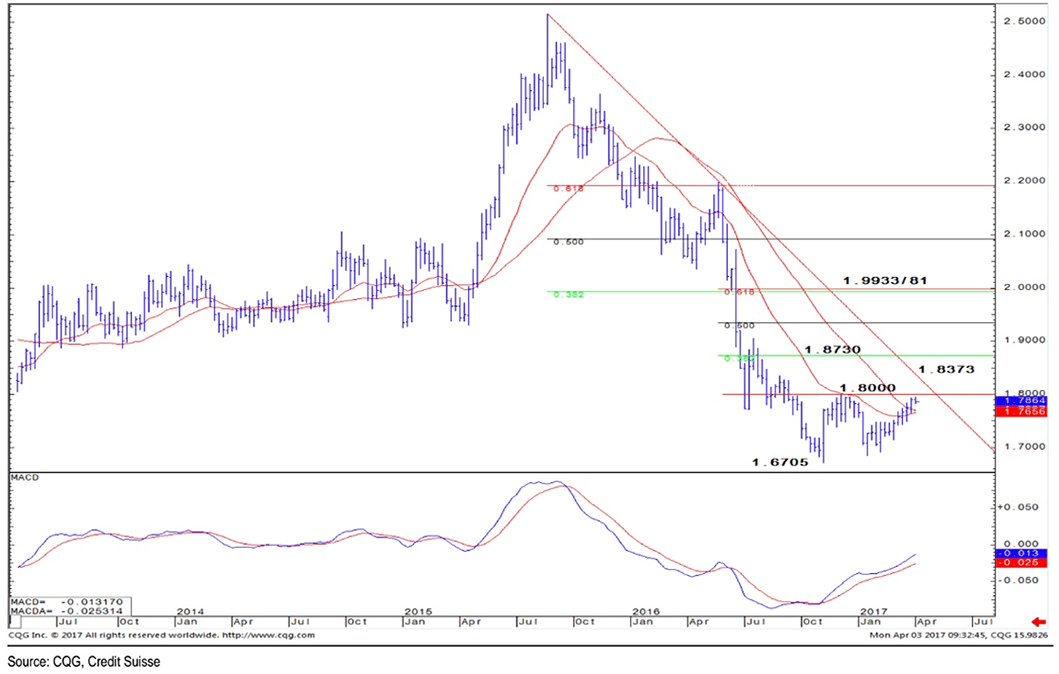

Sterling has seen a significant fall in value against the New Zealand Dollar since mid-2015 when it was touching highs around 2.5.

Sneddon however believes the conversion finally found a floor in November 2016 at 1.6705.

GBP/NZD has subsequently traded in a sideways range.

“The spotlight is now firmly on the top of the range at 1.8000, the high of December, above which would see a medium-term base established,” says Sneddon.

Sneddon believes that were Sterling to move above 1.8000 the market would see the core trend turn bullish for a test of resistance seen at 1.8350/73 initially – the potential downtrend from mid-2015 and late August high.

“Above here can maintain the bullish tone for more important resistance at 1.8730 – the 38.2% retracement of the May/November 2016 fall – which we expect to cap at first,” says Sneddon.

Credit Suisse say they will allow for some correction here, before a break in due course for 1.9052 – the high of July 2016 – then 1.9295/356 – the 50% retracement and measured target from the base – which they see as capping.

Support is seen at 1.7650 initially, then 1.7484/34 – near-term basing support and the high of February – which we look to ideally hold.

Below would curtail thoughts of a base for now.