New Zealand Dollar Underperformance to Resume says JP Morgan

- NZD one of best performers of past month

- But could be living on borrowed time

- RBNZ policy set to return as prime downside driver says JP Morgan

Above: RBNZ Governor Orr. File image © Pound Sterling Live, Still Courtesy of RBNZ

- GBP/NZD spot rate at time of publication: 1.9630

- Bank transfer rates (indicative guide): 1.8941-1.9080

- Transfer specialist rates (indicative guide): 1.9350-1.9450

- More on transfer specialist rates here.

Foreign exchange strategists at Wall Street investment bank JP Morgan are expecting further declines in the New Zealand Dollar over coming weeks, as the market one again turns its attention to the issue of New Zealand interest rates which could be cut to 0% or below as early as November.

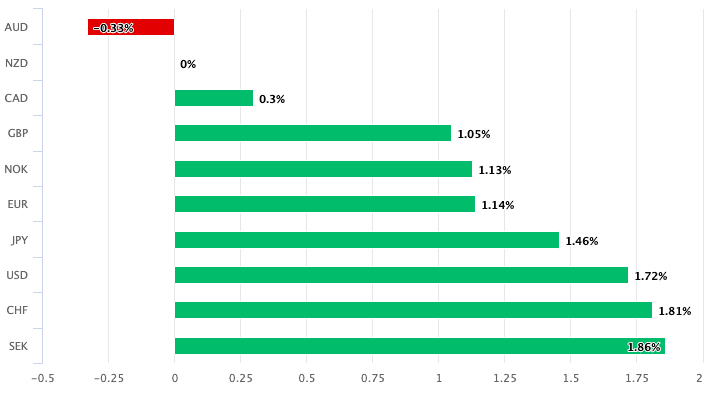

The call by JP Morgan comes following a spell of outperformance by the NZ Dollar which is now the second-best performing major currency in the G10 space, with only the Australian Dollar doing better.

The August-September rally has been attributed by Patrick R Locke - strategist at JP Morgan - as being due to "reflationary momentum." Indeed, it was a good month for global equity markets, commodities and 'risk on' assets in general, which are conditions that typically favour the antipodean currencies.

"The move higher in longer-end yields likely helped catalyse some NZD capital inflows, as is historically the case," says Locke.

Above: The NZ Dollar has outperformed its peers over the course of the past month. If you would like to lock in current rates for future use, or automatically book a better rate on future NZD weakness, please learn more here.

The Pound-to-New Zealand Dollar exchange rate has retreated from its mid-August highs above 2.0, and has fallen for three weeks in succession to trade back at 1.9629.

The Euro-to-New Zealand Dollar exchange rate has meanwhile fallen back from an August 20 high at 1.8223 high to 1.7651 and the New Zealand-U.S. Dollar exchange rate has maintained a bull market to rise to 0.6693 at the time of writing.

However, this theme of New Zealand Dollar outperformance is expected by JP Morgan strategists to fade once the market turns focus on the likelihood of further interest rate cuts at the Reserve Bank of New Zealand (RBNZ) which should put downward pressure on New Zealand yields.

"We have been advocating NZD shorts since the end of July in anticipation of significantly more aggressive monetary easing from the RBNZ. This ultimately performed well leading into, and in the immediate aftermath of, the August MPR meeting," says Locke.

In August the RBNZ boosted its quantitative easing programme while confirming that cutting interest rates to 0% or below remained a strong possibility in future months. Commenting on the moves at the time Sharon Zollner, Chief Economist at ANZ, said "it is hard to imagine a more dovish set of policies and commentary".

Yet, mid-August looks to have been a low point for the NZ Dollar suggesting there was no real follow-on from the RBNZ's actions.

This might soon change however. Locke notes that communication from Governor Adrian Orr was last week "fairly explicit regarding moving towards negative rates and is generally advocating a "least regrets" approach to policymaking."

Accordingly, JP Morgan expect a move to negative at either the November or February meetings.

"Should the pro-growth and reflationary mood temper in coming weeks, we would expect NZD to underperform as markets once again shift their focus back to the RBNZ’s aggressive policy and the attendant complications for negative rates in a current external deficit economy," says Locke.

The RBNZ is certainly on an easing bias, releasing a statement on Sunday confirming further easing measures were underway. "We are now actively preparing a package of additional monetary policy tools to support the economy if required. The additional tools include negative wholesale interest rates and direct funding to banks," read a statement from the Bank.

The rule of thumb is that a currency tends to weaken when its central bank maintains a bias for further rate cuts or quantitative easing, which is currently the case for the New Zealand Dollar with regards to RBNZ policy.

"The RBNZ yesterday released a statement to say it was preparing a package of additional easing measures should they be required. These were highlighted as negative rates and direct funding to banks (buying of foreign assets wasn’t mentioned here). We suspect the RBNZ will be doing battle with a strong NZD/USD on the back of a soft dollar story, meaning that some of these more aggressive easing measures may have to be rolled out after all," says Chris Turner, Global Head of Markets and Regional Head of Research for UK & CEE at ING.

The New Zealand Dollar's recent rise could meanwhile become a factor to watch, amidst suggestions from some economists that it is making the RBNZ's job at boosting growth and inflation all the more harder.

Typically, a stronger currency raises the cost of New Zealand exports on the international market while also lowering the returns for domestic exporters once they have converted their foreign exchange back into Kiwi Dollars. A strengthening currency in times of economic crisis - as is the case following New Zealand's aggressive covid-19 lockdowns - is seen to be a headwind, that could blow stronger.

Governor Orr said last week that for now the exchange rate was of little concern.

However unless the NZ Dollar turns lower over coming weeks the central bank might become increasingly frustrated with its value and be inclined to bring forward measures that might weaken it and herald underperformance into year-end.