Demand for Pound Sterling Ramps Up and these Analysts Forecast Further gains against Euro and Dollar Near-term

- Written by: Gary Howes

- "GBP upside" likely says BofA

- GBP/EUR back at 'fair value' says ING

- Citi says 'fast money' buying GBP

Image © Adobe Images

- Market rates at publication: GBP/EUR: 1.1645 | GBP/USD: 1.4120

- Bank transfer rates: 1.1420 | 1.3825

- Specialist transfer rates: 1.1560 | 1.4020

- Get a bank-beating exchange rate quote, here

- Set an exchange rate alert, here

The British Pound holds onto the lion's share of the gains it registered against the Euro, Dollar and other major currencies at the start of the week, with analysts saying there is scope for further advances.

Sterling earlier this week rose in value on a combination of fading domestic political risks and an ongoing repricing by markets for a more 'hawkish' Bank of England, given the ongoing economic rebound the country is undergoing.

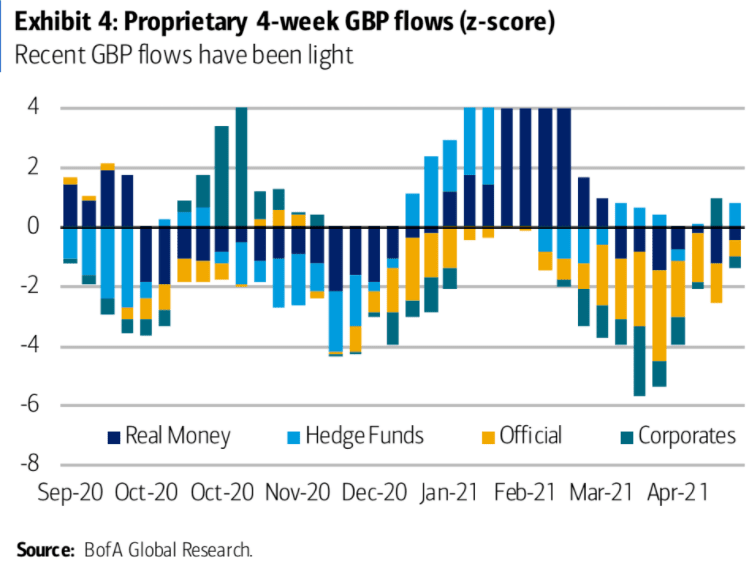

Proprietary order flow data from Bank of America shows a strong improved demand for the Pound amongst investors and businesses, something they say could extend.

"Following strong demand for GBP early this year, recent flows have been much lighter. Reopening, the hawkish BoE, and the results from last week’s elections, all point to GBP upside, in our view," says Athanasios Vamvakidis,

FX Strategist at Bank of America.

Citi - the world's largest dealer of foreign exchange - meanwhile say they have noted "fast money names" buying the Pound in the wake of weekend news that the Scottish National Party (SNP) failed to secure an outright majority in last week's vote.

Citi's spot trading desk have communicated to clients "there is enough for the bulls as we see a very low risk of a second referendum over the immediate term with focus and price action likely to be dominated by the reflation/reopening/Covid situation in the UK."

Indeed, the Pound-to-Euro exchange rate (GBP/EUR) experienced its largest single day gain in 13 months on Monday as demand for Sterling rose as the faded Scottish political risks allowed markets to fully absorb last week's decidedly more 'hawkish' slant from the Bank of England.

The Pound had failed to advance in the wake of the Bank of England's Thursday May 06 announcement that it would reduce its quantitative easing programme while raising its economic forecasts, with analysts saying the Scottish parliamentary elections proved a distraction.

"After trading with a persistent risk premium over the past three weeks (largely due to political risks) the sterling rally yesterday all but fully closed the short-term valuation gap, with EUR/GBP now at trading at its short-term financial fair value," says Petr Krpata, Chief EMEA FX and IR Strategist at ING.

The sense is that with the SNP falling short of a majority markets are able to now fully price in the more optimistic narrative the Bank of England offers the Pound and this story can run further in the near-term.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The Pound-to-Dollar exchange rate (GBP/USD) rose 0.94% on Monday and a further 0.20% on Tuesday and touched a multi-week high at 1.4158, with gains coming on a combination of genuine Sterling demand but also a broad based aversion to the Greenback.

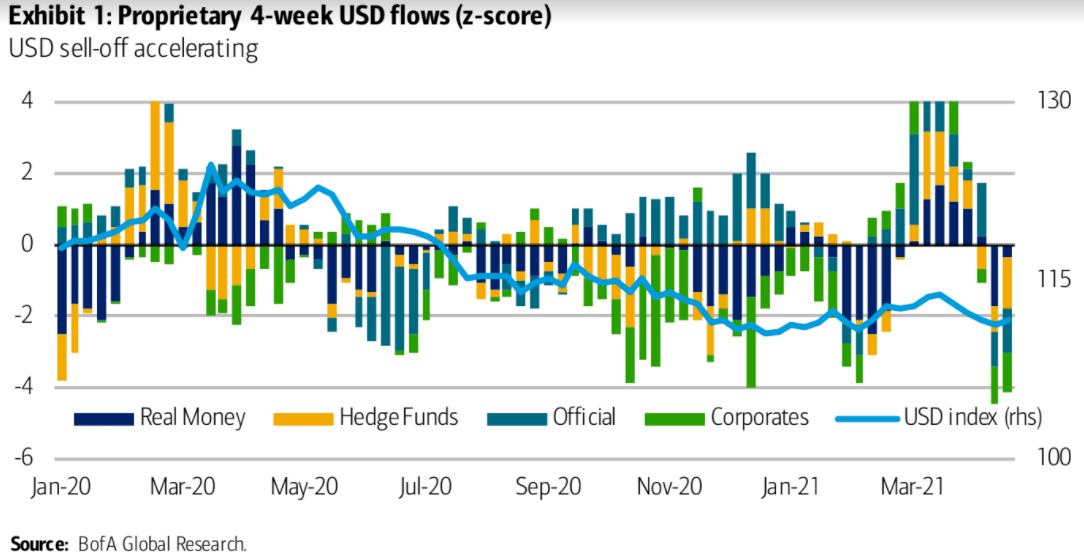

A look at U.S. Dollar flow dynamics meanwhile suggests to Bank of America that the USD is "in trouble", thereby providing further scope for GBP/USD upside in their opinion.

"Our latest proprietary flows are strongly negative for the USD. Last week real money did buy the USD, but after substantial selling the week before and ahead of what was a very weak NFP. Hedge funds continued selling the USD across the board. Official and corporate USD flows have also turned negative in recent weeks," says Vamvakidis in a briefing note out on Tuesday.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The UK's economic revival is meanwhile being tipped to step up a gear next week when the third phase of economic reopening takes place.

Economic activity is expected to receive a boost with a meaningful return of the hospitality sector, indoor dining, cinemas and the normalisation of higher education.

"With the UK government confirming the next step of the reopening of the economy, the solid UK data points this quarter should benefit GBP," says Krpata.

ING look for EUR/GBP to converge to the 0.85 level (GBP/EUR 1.1764) in coming weeks and further gains in GBP/USD.

Foreign exchange strategists at Citi say they see momentum as being likely to extend as Sterling was able to hold onto the "robust gains" registered on Monday.

As CitiFX strategist Adam Pickett says that with the SNP failing to score a majority GBP/USD's rally is justified.

CitiFX Strategy see a low likelihood of a second Scottish independence referendum until the SNP obtain a majority.

Even if Westminster was to allow IndyRef2, Citi's base case would be that the path only begins well past the end of the UK’s pandemic recovery, with a date around 2024.