Pound-to-Euro Exchange Rate: 5-Day Technical Forecast, Data and Events to Watch

Our technical studies have us maintaining a bullish view for Pound Sterling over the coming week but a series of PMI data releases, the Conservative Party conference and brewing political instability in the Eurozone must be watched.

The British Pound trades higher against the Euro on Monday, October 2 at 1.1359 having opened the day at 1.1333. The move higher in the GBP/EUR exchange rate are largely down to the Euro's weakness with investors eyeing weekend events in Spain's Catalonia.

Turnout in the election was seen at 46% despite the Spanish government's attempts to stifle the vote. The outcome of the referendum saw 90% of voters opt for independence which tells us the appetite for such an outcome is certainly present and one would expect any official vote to comfortably see secession.

Yet, for now Catalonia will remain part of Spain so the impacts to the Euro are likely limited. Yet, ithe event should give the Euro a bad hangover in the near-term as it reminds traders that European political unity is in constant flux.

"The violence characterising Sunday’s Catalan referendum overshadows the actual outcome of the vote and may actually strengthen the Catalan quest for independence. Markets have not cared much so far, but that is about to change," says Jan von Gerich at Nordea Markets. "For the ones not having Catalonia on their list of political risks, now is high time to add it."

Further Gains for the Pound Expected

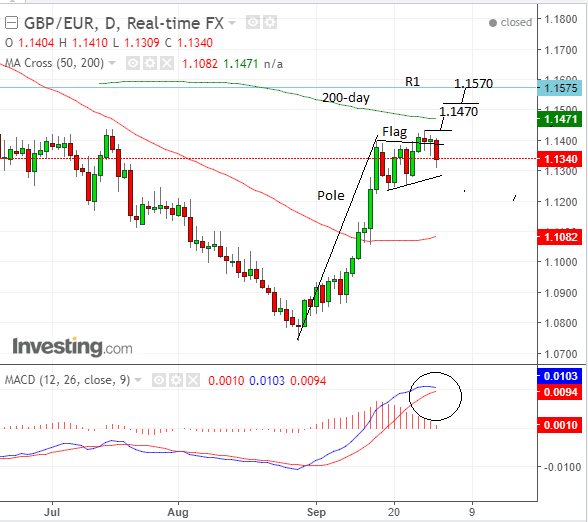

Concerning the outlook for GBP/EUR, the exchange rate's chart shows the formation of what is known as a bullish flag pattern, which when initially identified had us believing further gains were to come.

However, the call was incorrect and Sterling fell back down to its current level in the 1.13s.

Yet, based on the look-and-feel of the chart and the fact the short-term trend is bullish we still think the flag pattern is 'valid' despite the false breakout, and think that eventually the exchange rate will break higher again and start moving up towards a target at 1.1570.

Flags move the length of the pole extrapolated higher from the flag square which would suggest a rise up to the 1.17s/1.18s, however, t the close location of the 200-day MA at 1.1480 is an impendiment to upside progress and the exchnage rate could very well stall just underneath it, which is why our preliminary target is at 1.1470.

The R1 monthly pivot level, whicb is another layer of resistance, is also not far above at 1.1575 and provides us with our second target.

A break above the 1.1437 highs would be required as confirmation of more upside before expecting the exchange rate to reach the 1.1470 level, with a break above 1.1510 leading to a continuation to R1 and the 1.1570 target

Pivots are levels used by traders to trade against the prevailing trend so tend to present obstacles to prices.

The MACD is rolling over and closing in on its signal line, which is, unfortunately, a bearish indication, but momentum alone is not a sufficient indicator to expect lower prices.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

News and Data for the Pound

The main releases for the Pound in the week ahead will be September Purchasing Manager Survey data which will give us insights into the health of the manufacturing, constructing and service sectors for the month of September.

"Next week’s PMI reports will be exceptionally important. If manufacturing, service and construction activity accelerates, it would validate the BoE’s calls for tightening and reinvigorate the rise in Pound Sterling. However, if manufacturing- and/or service-sector activity slows, it would cast doubt on the central bank’s plans and cause the currency to give up some of the gains that it enjoyed in September against the dollar and the euro," says Kathy Lien, Managing Director at BK Asset Management.

The first release is Manufacturing PMI on Monday at 9.30 BST, which is forecast to show a slowdown to 56.4 from 56.9 in the previous month of August.

Construction PMI is out at the same time on Tuesday and is forecast to show a slowdown to 50.8 from 51.1.

Finally, Services PMI is out at 9.30 on Wednesday and is forecast to remain unchanged at 53.2.

Politics will also be in focus with the Conservative party conference taking place in the first-half of the week.

However, it will be Prime Minister Theresa May's speech on Wednesday that has the most market-moving potential as she is expected to touch on the issue of Brexit.

May's speech on the issue of Brexit delivered in Florence on September 22 was widely credited with giving Brexit negotiations a fresh impetus with the outcome of the fourth round of negotiations showing fresh progress.

However, there is still much progress to be done and markets will be interesting if May is willing to deliver further clarity.

Furthermore, there are concerns May's position is in jeopardy with persistent talk of senior figures within the Conservative party willing to challenge her for leadership of the party.

“We think the risk/reward of being long GBP is not attractive and prefer selling into rallies,” says Hans Redeker at Morgan Stanley. “The Conservative Party Conference in the coming week (begins at weekend) also poses a risk event, where signs of a split within the Tory Party may weigh on GBP as it raises concerns about PM May's leadership.”

It goes without saying that any successful challenge opens up the door to fresh uncertainty. If a new Prime Minister were to be installed over coming weeks or months the pressure for another general election mounts.

If there is one thing the Pound detests, it is is uncertainty.

"The UK’s Conservative Party Conference introduces downside risks for GBP. While attempts to extend the status-quo relationship to the transition period seemed to bode well for the currency, the Conference could provide a chance for a reassessment of the relative strengths of the leadership members, adding headline risks," say Barclays in a week-ahead note to clients.

News and Data for the Euro

Politics are back on the Euro's radar following the German federal election outcome in which German Chanceller Angela Merkel was handed a weakened hand by the electorate. An unexpected surge in support for the Afd party reminds markets that popular discontent remains a force to be reconded with.

As such, this Sunday's independence referendum in Spain's Catalonia region is attracting attention with increased unrest amidst Madrid's determined refusal to prevent the vote from proceeding.

The vote will almost certainly not be reconised but the issue is becoming increasingly divisive for one of Europe's key economies.

“The bigger risk to the Euro is unlikely to come from Germany, but instead could come from Spain where the Catalan region is planning to hold an illegal referendum on independence on 1st October,” says Kathleen Brooks, research director at City Index.

From a hard data perspective the main release in the coming week, is Eurozone Unemployment in August, out at 10.00 BST on Monday, October 2, which is expected fall again to 9.0% from 9.1% where it got stuck in July, however, given the widespread habit of taking the month off in many continental countries that forecast is arguably optimistic.

The next major release is Retail Sales in August, which is expected to bounce back by 0.3% from a -0.3% result recorded in July.

Finally, the minutes of the last European Central Bank (ECB) meeting in September will be published at 12.30 on Thursday, October 5, and may provide further clues as to the ECB's thinking in terms of the implementation of its phasing out of quantitative easing (QE), which is expected to be more seriously discussed and announced at the next October meeting.

If it shows strong signs of unanimity on the idea of reducing QE quickly or any detail on tapering (unlikely), the Euro could rise.

Further vacillation and vagueness, might increase uncertainty, on the other hand, and lead to a weakening of the Euro.