Five-Day Pound-to-Euro Rate Forecasts: The Next Targets

Our technical studies confirm the British Pound is likely to maintain a bullish temp over the course of the coming week with a bullish flag formation on the charts giving us some possible targets to aim for.

The Pound-to-Euro exchange rate moved within a range-bound corridor between 1.12 and 1.14 over the course of the past week - the market is at the top of the range at the start of the new week.

The Pound has moved back towards the 1.14 level amidst broad-based Euro weakness stemming from the uncertainty created by the German federal elections which show that Merkel is going to have to work hard at building a new governing coalition.

Whether or not Sterling can break to new highs will however partly depend on the market's structure.

Indeed, technical studies are suggesting the Pound could be getting ready for another rally versus its counterpart.

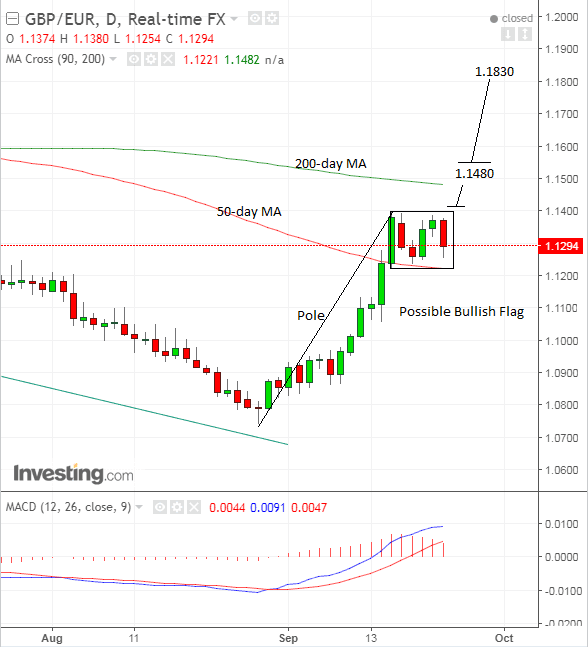

The main feature of the daily chart below is the bullish flag pattern which has formed after the pair went sideways for most of last week.

Coming as this range did, after the long, strong rally up from the late August lows at only 1.07, the whole sequence looks like what is called a ‘bullish flag’.

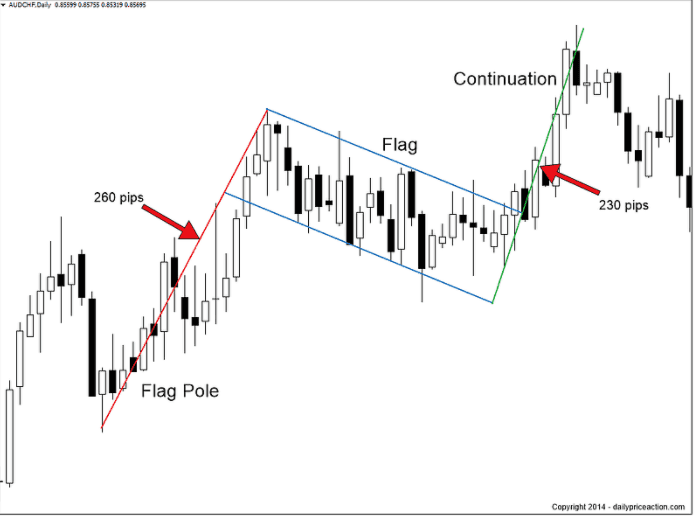

These patterns, as their name suggests, are indicators of further upside and are shaped like flags: the first part is always composed of a steep rally which forms the ‘flag pole’ and the second part is the box-shaped sideways move after the rally, which is the square of the flag.

The pattern resolves in a strong breakout from the box-range higher and a continuation of the steep rally to a length roughly equal – or at least 61.8% - of the length of the pole.

The only fly in the ointment in this particular example is the 200-day moving average situated not far above the flag at 1.1482 because this will almost certainly provide an obstacle to further gains.

Moving averages are not just levels which give an indication of long-term fair value but also dynamic levels of support and resistance in themselves, which often stop and reverse the direction of trending markets, therefore we are concerned the 200-day could likewise stall the upside break and possibly reverse it.

As such, we see the 200-day presenting a truncated, initial upside target for a breakout from the flag, either has a possible ‘station’ on the way higher or as a final target.

In order to confirm a break higher, we would want to see a break above the highs of the box and the 1.1410 level, with the target at 1.1480 two pips under the MA.

Given the minimum reach of the flag is higher than that at 1.1830, however, we see a possibility the pair could either break straight through the MA and continue higher or perhaps continue after a brief consolidation at the level of the MA.

In order to confirm the second stage of the bull flag’s move was in play, we would want to see a clear break above the 200-day, manifested by a clearance above the 1.1550 level.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Data and Events for the Pound in the Coming Week

As noted earlier the economic data calendar for sterling in the week of 25-30 of September lacks any significant releases which could lead to surprise volatility.

Nevertheless Kathy Lien at BK Asset Management notes, speeches by Bank Of England’s (BOE’s) Carney on Thursday and Broadbent on Friday could provide potential focal points for Sterling traders.

The current market view is that the BOE is embarking on a tightening cycle with analysts now even pencilling in the likelihood of a November rate hike; and the speeches need to be read in light of that more hawkish backdrop.

Clearly an increase in hawkishness via stronger confirmation of a November rate move by either speechmaker would lead to fresh gains for the Pound, which is positively correlated to interest rates.

Apart from that, the next most significant release could be the Current Account for Q2, at 9.30 BST on Wednesday, September 27, which is forecast to show a slight reduction in the deficit to -15.8bn from -16bn in Q1. A deeper contraction could help the Pound, although so far stronger exports due to the weak pound, have been offset by higher imports due to the resilient UK consumer.

At the same time as the Current Account data is released Business Investment data will also be released for Q2 and will offer a further insight into the strength and resilience of the economy.

Against this, of course, as always lies the background of EU-UK Brexit negotiations, which following May’s Florence speech, with its 2-year transition and chief EU negotiator Barnier’s moderately positive reaction to the speech, seems to be biased to supporting rather than undermining Sterling.

Euro Outlook Dominated by Politics

The market is digesting results which saw Chancellor Angela Merkel ultimately secure an historic fourth term but her mandate has been hollowed out by her party having recorded its worst result since 1945.

Merkel’s CDU party saw its vote share slip by about 8% which is similar to the increase in vote share enjoyed by the Far Right’s AfP.

The problem for markets is the uncertainty posed by the horse-trading required by Merkel to form a Government.

The SPD, Germany’s second largest party disappointed having secured only 20% of the vote, much less than had been anticipated by the polls.

Although they could have formed a coalition with Merkel’s CDU Party, which would have been a smooth way for Merkel to form a government, they have ruled themselves out of power and said that they will remain in opposition for Merkel’s fourth term as Chancellor.

“This leaves investors’ facing a period of uncertainty as Merkel tries to form a coalition government with the smaller parties,” says Kathleen Brooks at City Index.

Most analysts believe coalition talks are likely to centre on the “Jamaica” coalition, made up of the CDU, FDP and the Green Party, which would scrape Merkel through to power with just over a combined 50% of the vote.

The head of the FDP and the head of the Green Party have both said that they are ready to hold coalition talks and take on the responsibility of government.

“If this positive momentum continues then a coalition deal to be sewed up fairly quickly, which could have a calming effect on the markets and ensure that volatility in German stock markets remains subdued,” says Brooks.

However, Christian Gattiker, Chief Strategist and Head of Research at Julius Baer warns of a tedious negotiation process that should last well into the year-end. Accordingly tax cuts and stimulus spending decisions are likely delayed into 2018 while the European reform project might see some delays too.

"Uncertainties are Bund-friendly, peripheral bonds unfriendly, neutral for equities and negative for the Euro," says Gattiker.

Draghi in the Limelight

Further pressure was heaped on an already under-pressure Euro at the start of the week following the appearance of European Central Bank chief Mario Draghi who bit deeper into the subject of exchange rate strength before a European parliament committee.

The ECB president warned again that the eventual shape of the central bank's tapering measures will be contingent in-part on where the exchange rate goes over the coming weeks.

Tapering refers to the ending of the Bank's monetary stimulus programme that includes the printing of money to purchase Eurozone bonds. The Euro has been running higher through 2017 on the assumption that the programme's end will be announced near year-end.

Draghi told the European Parliament Economic and Monetary Affairs Committee that, the recent volatility in the exchange rate represents a source of uncertainty which requires monitoring, saying:

"Downside risks continue to exist, mainly related to global factors and developments in foreign exchange markets."

The Euro has risen sharply over the course of 2017, with a 13% gain on the US Dollar being of potential unease to policy makers as a stronger Euro caps inflation. The ECB has been implementing extraordinary policy measures over recent years to try and push inflation in the Eurozone back to 2.0%.

We expect the issue of the German election to ultimately fade over coming days and markets will once again start focussing on ECB policy as a driver once more.