Pound-Euro Week Ahead Forecast: Data Deluge Set to Dominate as 1.18 Enters Pipeline Multi-week

- Written by: James Skinner

- GBP/EUR supported at 1.16 & eyeing 1.18 multi-week.

- UK data deluge & raft of central bank speeches ahead.

- But yields & economy aid GBP as ECB weighs on EUR.

- Economic, monetary policy divergence key theme now.

Image © Adobe Images

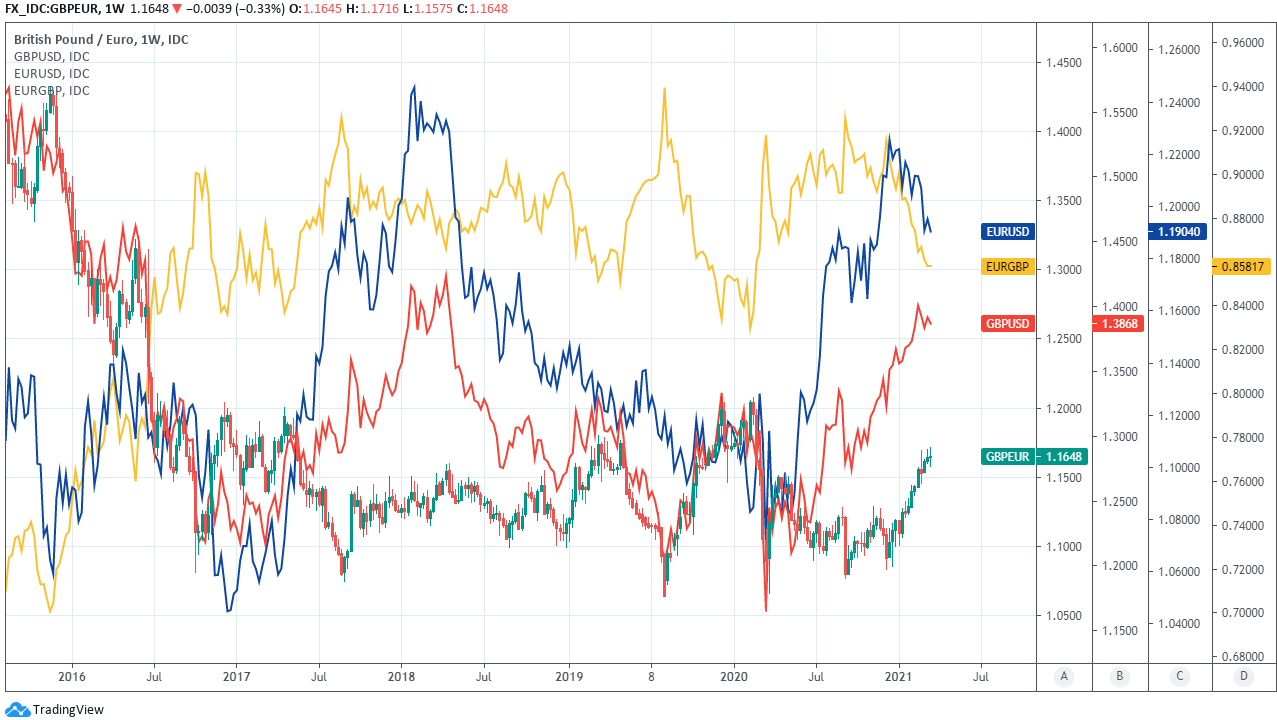

- GBP/EUR: spot rate at time of writing: 1.1648

- Bank transfer rate (indicative guide): 1.1300-1.1381

- FX specialist providers (indicative guide): 1.1432-1.1525

- More information on FX specialist rates, here

- Set an exchange rate alert, here

The Pound-to-Euro exchange rate is well supported on the charts and likely has scope to reach 1.18 over the coming weeks but must first navigate a deluge of economic data and speeches from Bank of England (BoE) rate setters.

Sterling's performance was chequered in a week dominated by a resurgent Dollar, rising bond yields and central bank policy decisions.

The Pound-to-Euro exchange rate ended the period 0.02% higher and effectively unchanged after three times having probed above the 1.17 threshold, although appetite for Sterling will be tested over the coming days by a raft of economic data and remarks from BoE rate setters.

"We continue to suspect a correction higher is likely. However, we will need a close above the 20 day MA," says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank, referring to EUR/GBP. "While it continues to close below the 20 day ma, downside risks remain."

Sterling's 21-day moving-average, located around 1.1613 on Friday, has so far succeeded in keeping GBP/EUR upright even in adverse market conditions and as long as this is left intact on a daily closing basis the balance of technical risk is to the upside, according to the Commerzbank team.

Above: Pound-to-Euro rate shown at hourly intervals alongside EUR/GBP (yellow line).

Commerzbank looks for Sterling to splutter and EUR/GBP to turn higher in the weeks ahead but notes that a move above 1.1719 by the Pound would indicate a further rally to 1.1813 is likely instead.

"EURGBP has retested and again held key Fibonacci supports," says David Sneddon, head of technical analysis at Credit Suisse. "This suggests a better floor is in place for now and we look for a recovery to emerge."

In addition to its 21-day average Sterling also benefits from Fibonacci support near 1.16 and around 1.1522 if the move in play is taken as the leg higher from January 13, with similar in effect if taking it back to January 06.

{wbamp-hide start}

GBP/EUR Forecasts Q2 2023Period: Q2 2023 Onwards |

"Both the Bank of England (BoE) and the US Federal Reserve left policy settings unchanged this week, which contrasted with last week’s announcement from the ECB that the pace of asset purchases would be stepped up to contain bond yield rises," says Hann-Ju Ho, an economist at Lloyds Commercial Banking. "The difference in approach may reflect relative risks to the economic outlook, which in turn relate to trends in Covid infections, the speed of the vaccination rollout and also fiscal stimulus measures."

The Pound-to-Euro exchange rate has slowed in its uptrend alongside many other currencies following a strong earlier rally and amid sharp gains for bond yields in the U.S. and elsewhere.

But by many accounts and at least as it relates to Sterling, this is merely a speed bump which is likely to be overcome in the days and weeks ahead.

"The MPC largely endorsed market pricing, noting this as a reflection of higher real yields," says Sanjay Raja, an economist at Deutsche Bank. "The MPC acknowledged that the US' new fiscal package would have positive "spillover effects for demand across the world including the United Kingdom"."

Above: Pound-to-Euro rate shown at daily intervals alongside EUR/GBP (yellow line).

With the U.S. yield rally aside, fundamental forces at work in the market continue to argue for GBP/EUR upside.

"Europe’s handling of the Covid-19 crisis certainly seems to be taking its toll on the EUR. Third waves now look a reality for the likes of France, the Netherlands and Italy, triggering fresh lockdowns and delaying the day when Europe can play its part in the global recovery. The slow roll-out of the vaccines and safety concerns over the AZ vaccine clearly have not helped either," says Chris Turner, global head of markets and regional head of research at ING.

Europe's vaccination programme and the political response to it have set the Eurozone economy back by months compared with the UK and already compelled the European Central Bank (ECB) to bring forward bond purchases under its quantitative easing programme to prevent borrowing costs rising for sovereigns, companies and households.

This and rising infection numbers are why Italy and France returned many large population centres to all-out 'lockdown' last week and German officials warned that current restrictions on social contact and commercial activity may have to remain in place for longer than has so-far been planned.

"We've yet to see a reason why the relative outperformance of the GBP vs other European currencies should grind to a halt in the near future," says Stephen Gallo, European head of FX strategy at BMO Capital Markets.

Above: 10-year British government bond yield alongside 10-year yields of French (blue) and Italian (purple) governments.

"The BoE didn’t deliver the modest tapering that we expected, but that announcement doesn’t change our position view on the currency. We see the UK economy as still on track for a mini consumer boom from Q2 to Q4, and the UK’s vaccination programme continues to stand out," says Paul Robson, head of G10 FX strategy EMEA at Natwest Markets. "We thus stay short EUR/GBP and long GBP/CHF. GBP/JPY also has further upside, in our view."

Infection numbers are declining in the UK, the economy is set to reopen through summer and the BoE has indicated it's comfortable with recent increases in bond yields or Sterling exchange rates.

Yields are returning from record lows and the BoE's judgement is for now at least that the UK economy can weather recent increases as well as current levels, which argues for a GBP/EUR trend that favours Sterling.

"The BoE joined policymakers elsewhere in largely sidestepping the thorny issue of higher yields. This leaves us looking for two way risks to prevail in cable as the USD leg continues to dominate. Elsewhere, however, we think GBP is more interesting on the crosses," says Jacqui Douglas, chief European macro strategist at TD Securities. "We look for sterling to outperform EUR but to lag the NOK as the theme of intra-European divergence begins to get more traction."

Above: Selected yields. Green & Red (10-year Norwegian yield) Blue line (10-year GB yield), Red line (10-year U.S. yield). Yellow line (10-year Italian yield). Clicking this image will enlarge it within a new broswer tab.

Virus and vaccination trends are key determinants of recovery prospects and with cross-country divergence now meaningful the pandemic picture is now leaving a mark on the relative stances of central banks and having greater influence on the outlook for exchange rate trends.

"We expect a delayed and more modest economic recovery, due to recent negative epidemiological developments," says Christian Keller, head of economic research at Barclays, referring to the Eurozone.

The UK's leading position in the vaccination race continues to underwrite Sterling's recovery prospects but the British currency will likely have to navigate a deluge of economic data due out over the coming days, beginning with unemployment figures for February which are due for release on Tuesday.

Job figures are out at 07:00 and will be followed by speeches from Monetary Policy Committee members Andy Haldane, John Cunliffe and Bank of England Governor Andrew Bailey between 08:40 and 11:50.

Above: Pound-to-Euro rate shown at weekly intervals with EUR/GBP (yellow), EUR/USD (blue) and GBP/USD (red).

Wednesday sees February inflation data released at 07:00, with any meaningful increases likely to feed upside risks for bond yields and the Pound. CPI data is followed at 09:30 by March PMI numbers with Eurozone surveys also due out around the same time All are followed in the noon by a speech from ECB President Christine Lagarde at an online event hosted by Project Syndicate.

The data highlight of the week for the Pound is BoE Governor Bailey's participation in a virtual panel discussion hosted by the Bank for International Settlements at 09:30 on Thursday, which also sees the lates European Union economic summit getting underway and running through until Friday.

However, this week and thereafter the thematic highlight for all currencies is the advent and likely proliferaton of divergence in the outlook for global central bank monetary policies. This is a negative development for some European currencies and a positive one for others.

"We need to wait until April to see a more meaningful jump in prices. The January unemployment rate (Tuesday) should remain stable, March Service PMI (Wed) should move back in the expansionary territory but February Retail sales (Fri) are expected to only partially recover after January's sharp fall," says Petr Krpata, chief EMEA strategist for FX and interest rates at ING. "UK data releases next week should be no game changer for the GBP."