Pound-to-Euro Exchange Rate in the Week Ahead: Set For a Recovery back into the 1.12s, Awaits Crucial Political Developments

Image © Melinda Nagy, Adobe Stock

- Pair bouncing off long-term range lows

- Showing potential for recovery into 1.12s

- Politics to drive Sterling this week; economic sentiment important for the Euro

The Pound-to-Euro rate has slid down to 1.1137 in early European trade having started the new week at 1.1167.

The previous week saw what amounted to a 0.7% gain in the pair with the improved tenor to Pound Sterling trade coming despite the GBP/EUR exchange rate briefly slipping below the 1.10 threshold midweek in the Apple-inspired Asian currency 'flash crash' which rippled right across the market.

The pair rose amidst technical position adjustments (GBP/EUR tends to bounce off any test of the 1.10 area), while fundamental support came in the form of the release of stronger-than-expected UK services data for December which led to renewed confidence in the resilIence of the UK economy.

The Euro, meanwhile, remained under pressure due to lingering doubts about growth and inflation, highlighted by the rather unspectacular core inflation reading on Friday, which showed prices in the Eurozone rising by only 1.0% in December - as expected, but - no faster than it did in the previous month of November.

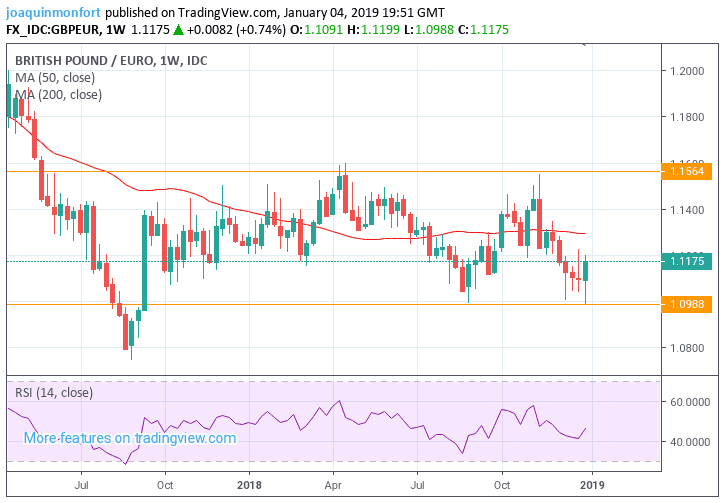

The technical outlook remains marginally bullish. The pair appears to have risen off the floor of a long-term range between 1.10 and 1.15.

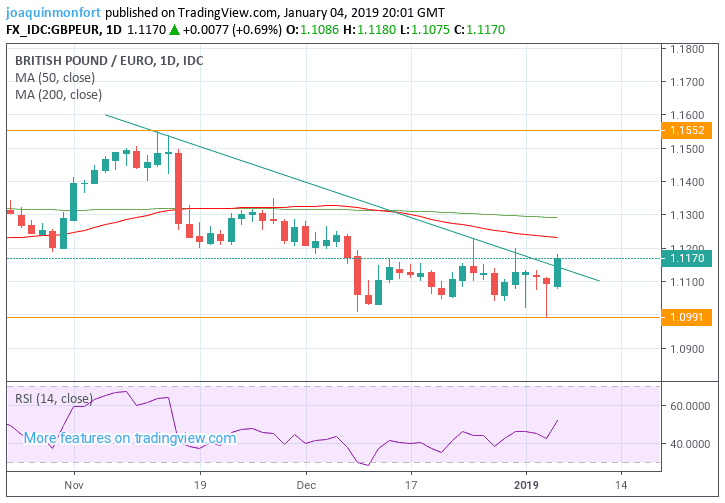

First it formed a bullish ‘hammer’ candlestick pattern on Thursday which was then confirmed by a bullish candlestick on Friday. The combination of the two is a short-term signal the pair will probably rise.

Previous to that, the pair had been bumping along the bottom of the range, raising doubts about whether it could recover, but it now appears to have started a new more bullish phase, suggesting a rebound is still possible.

Another sign the pair may be on the rise is that it has broken above trend line drawn from the November highs. The break has now been confirmed on a daily close basis, further supporting its validity. This is strong evidence the short-term trend could be changing.

A break above last Friday's highs at 1.1180 would supply confirmation for a continuation higher, with a strong case for an extension up to an initial target at 1.1230, followed by the possibility of a continuation up to a second target at 1.1270 at the R1 monthly pivot, a common level of support and resistance on charts, where, as the name suggests, prices are prone to reversal.

An even more concerted rally might even reach 1.1350 and the key late November highs. The time horizon for these gains is a week or two.

Advertisement

Bank-beating exchange rates. Get up to 3-5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The Pound: What to Watch

The UK enters a critical three week period as parliamentarians return to Westminster to debate the merits of the Government's withdrawal deal with the EU. A vote is due in the week commencing January 14.

At present, the deal is expected to be voted down by legislators amidst a lack of fresh concessions from the EU. The government is expected to bring the deal back before parliament for a second vote in the event of the first vote failing.

However, any second vote must contain some material changes, so we expect the EU to offer something in the near future as they will know only too well that the deal they worked on over the past 2 years will not pass in its current form.

Sterling will likely trade relatively subdued, range-bound levels until the point it becomes clear that either 1) May's deal will pass or 2) a No Deal Brexit is going to happen in March 2019. We will be watching the newswires for any indications that a decisive shift in either direction has occurred.

The Pound's rise on Friday was in part driven by the release of better-than-expected services sector data, but in the week ahead the focus will be more on the heavier parts of the economy with industrial and manufacturing production data for November scheduled for release, as well as, of course, GDP.

Industrial production is forecast to end a 3- month losing streak in November, when it is released at 10.30 GMT, on Friday, and forecast to show a 0.2% rise. Manufacturing is forecast to show a 0.4% gain when it is released at the same time: these would contrast with -0.6% and -0.9% respectively in October.

Monthly GDP data for November is also out at the same time on Friday and is expected to show a 0.1% rise month-on-month, the same as it did in October, and a 1.3% rise year-on-year.

Despite growth in the UK being weak, it remains about the same as in the Eurozone.

“Despite the Brexit gloom and gridlock in Parliament over the withdrawal deal, the UK economy does not seem to have slowed down anymore than its European counterparts and probably managed growth of 0.1% in November, estimates are anticipated to show.” Says Rafi Boyadjian, an analyst at broker XM.com.

The other key economic release for the Pound is trade balance data, also out on Friday.

The Euro: What to Watch

Sentiment often leads hard facts, so Eurozone sentiment data for December, scheduled for release on Tuesday, is probably the most important economic release on the calendar for the Euro in the week head.

Economic sentiment has fallen for 11 months in a row and forecasters expect more of the same in December, when it is estimated to decline from 109.5 to a new 2018 low of 108.4. If they are right, it could weigh heavily on the single currency.

Eurozone business confidence, out at the same time of 11.00 GMT, has been in a step decline for most of the year too, reaching a trough low in October when it fell to 1.01. Although it has since rebounded to 1.09 investors will want to see a more sustained rally in December to regain confidence. The consensus from forecasters, however, is that it will fall even lower to 0.99.

Another major release for the single currency is the minutes of the December meeting of the European Central Bank (ECB) scheduled for release at 13.30, on Thursday, January 10.

The ECB sets monetary policy in the Eurozone which is a major driver of the exchange rate, so what they think about the economic situation, as divulged in the minutes can sometimes impact on Forex, especially if it diverges from currency market thinking.

In December the ECB made the historic decision of ending quantitative easing (QE), whereby the central bank purchases debt instruments from Euro-area financial institutions in an effort to liquify the system and keep lending affordable. This removal of QE was a sign the ECB had more faith in the economy and lent support to the Euro.

Some analysts, however, argued the withdrawal of stimulus was premature as the region still needs QE. If this view is echoed in the minutes it could lead to expectations the ECB may continue with easy monetary policy and weaken the Euro.

The ECB is widely expected to continue to tighten policy in the region in 2019 and even hike interest rates in September, however, a feeling that the economy is still vulnerable as introduced doubts it will be able to go ahead. If the minutes back this view up it could weigh heavily.

Other major releases for the Euro include the unemployment rate which is expected to come out at 8.1%, when it is released at 11.00 on Thursday, and retail sales for November, which is forecast to show a rise of 0.1% in November, when it is released on Monday at 11.00.

Advertisement

Bank-beating exchange rates. Get up to 3-5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here