US Dollar Cruises to Fresh 7 Month Best vs. British Pound but Sino-US Trade Spat Can't Last Forever

- Dollar bid as China and US escalate tariff tit-for-tat

- However, China will ultimately run out of US goods to tariff

- Eyes on 1.30 in GBP/USD, Goldman see fair value lower at 1.26

The Pound-to-Dollar exchange rate has raced lower to record its lowest levels since November 2017 with analysts now eyeing support in the 1.30 region to put an end to the sell-off.

At the time of writing the GBP/USD is quoted at 1.3165, having been as high as 1.3470 earlier this month, and technical studies confirm momentum remains firmly pitted against the UK unit.

"It’s still not at all clear that the bottom is in and the uncertain political situation in the UK probably isn’t helping. A close below 1.32 would suggest that the pound was heading back towards the next possible support level, at around 1.3050," says Bill McNamara, a financial exchange analyst who heads up the Technical Trader service.

Goldman Sachs strategist have meanwhile warned they see "fair value" in GBP/USD is around 1.26; therefore if correct the Dollar's move lower will ultimately not respect the technical levels many traders in the market are currently eyeing.

No doubt, the lion's share of the thrust lower in GBP/USD resides with broad-based US Dollar strength, so we will be watching the wide Dollar for guidance.

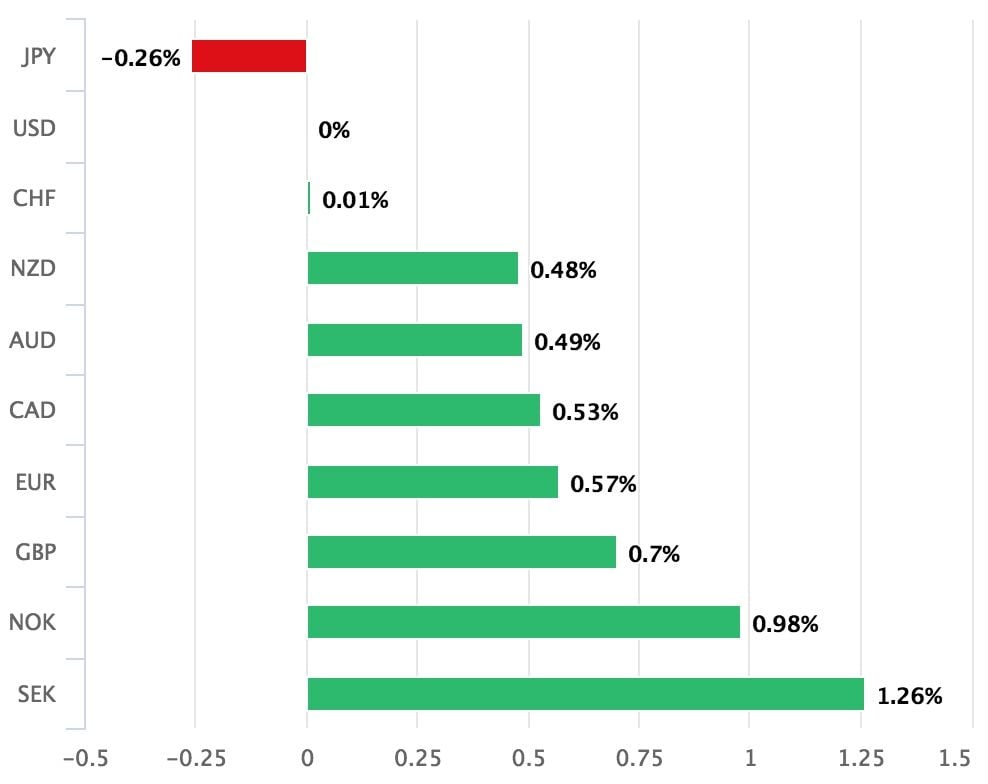

The Dollar joins other 'safe haven' currencies such as the Yen and Switzerland's Franc on the FX leaderboard as investors across the globe liquidate a portion of their investment holdings owing to concerns over the direction of global trade now that the US and China are embedded in a tit-for-tat tariff war.

Above: The Dollar is one of the best-performing global currencies today.

Donald Trump has today proposed an additional $200 billion worth of Chinese products to be targeted with a 10% tariff.

Chris Payne, Managing Director at GWM Investment Management says this is an unexpected move and clearly an escalation in both trade war rhetoric, and downside risk. "European markets have been selling off as automakers and miners - the sectors most at risk of a trade war – have fallen sharply. In addition, Shang-Hai stocks have plunged to two-year lows," says the analyst.

"Sterling got caught up in a global market sell-off that yanked the U.K. unit to 2018 lows against its safer U.S. counterpart," says Joe Manimbo, a foreign exchange analyst with global payments provider Western Union.

Just how low Sterling goes against the Dollar could of course depend on how long these trade jitters will last.

GWM Investment Management's Payne offers an interesting insight that brave speculators might do well to take note of:

"Despite all this tit-for-tat posturing, an all-out trade war is unlikely to ensue because it will not benefit anybody, especially China whose economy is going through a major deleveraging process. It should also be noted that China will soon run out of US goods on which to impose retaliatory tariffs which will move this negotiation to a more sensible and constructive forum.”

The total value of exports from the US to China was recorded at $130bn last year, "meaning a tit-for-tat retaliation would have to cover all imports from the US and more. Any tariff rounds beyond that could be a “disaster” for China economically," says Bo Zhuang, an analyst with consultancy TS Lombard.

Therefore this theme of trade war fears cannot run forever, simply because China will run out of ammunition and if the Dollar is benefiting from this driver there might be limits to its strength. Of course, there are risks that the US might apply the same aggressive tactic to Europe and give markets a whole lot more to worry about.

Those with a particular interest in Sterling-Dollar would do well to remember the highlight of the week for the UK currency is Thursday's Bank of England policy decision where guidance as to the future of UK interest rates will be delivered.

"This week could be nothing short of a roller coaster for Sterling with the Bank of England rendering an interest rate announcement Thursday. No change to the bank’s 0.5% base rate is expected after the British economy barely grew over the opening quarter of the year. Key for Sterling will be whether the BOE intends to raise rates at all this year. A hawkish message that paves the way to a late summer rate hike would tend to be Pound-positive," says Western Union's Manimbo.

And, mid-week Prime Minister Theresa May faces another significant test as the UK parliament decides whether or not to pass her key Brexit legislation, if she fails the future of May's premiership will be called into question, something that would give the Pound a big headache.

"The Dollar's rally on ramped-up US-China trade tensions has hit sterling hard, but cable faces a potentially bigger worry with a showdown in parliament on Wednesday over Brexit policy," says Paul Spirgel on the FX desk at Thomson Reuters.

Spirgel adds the possibility of heightened political turmoil in addition to chronic low UK growth and falling inflation have led to increased GBP selling.

Ladbroke's puts odds of PM May not lasting until the end of June 2018 at 5/1, and 3/1 for Brexit Minister David Davis to be the next cabinet minister to leave.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.