Pound-to-Dollar: Technical Forecast and Events to Watch in the Coming Week

Despite a strong start to the week, the Pound-to-Dollar exchange rate is forecast to continue declining as analysts hold a bullish view of the Dollar following recent strong wage and service sector activity data.

The British Pound opens the new week against the Dollar on the front-foot with the exchange rate rallying to 1.3110 having opened the week at 1.3063. Sterling is outperforming its competitors as traders see political risks in the UK fading amidst signs Prime Minister Theresa May remains secure in her job.

Yet, the charts are telling a bearish story and whether or not the politically-inspired gains can last is questionable.

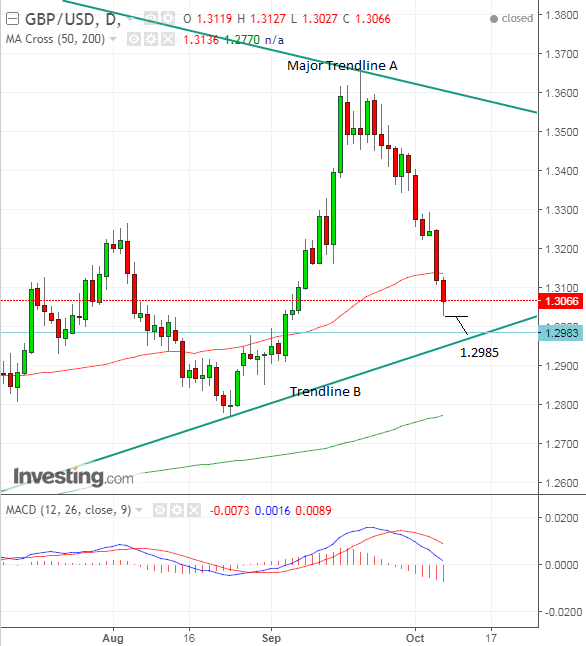

Pound Sterling Live's technical analyst Joaquin Monfort notes the Pound-to-Dollar exchange raet rose up to the mid-1.36s in September, touched a major trendline, and then rotated and started a steep descent.

The pair's concerted, short-term, downtrend is expected to continue, in the absence of any signs of reversal, although its scope for further extension is severely curtailed by some major obstacles not far below the current market level.

The next target lower is 1.2985 where very strong support from the major trendline drawn from the October lows as well as the S1 monthly pivot are likely to act as a formidable obstacle to further downside.

Monthly pivots are levels used by traders to fade the dominant trend and prices often stall, bounce or even reverse at those levels.

A break below last week's 1.3027 lows would probably confirm an extension down to the next downside target at 1.2985.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

News and Data for the Dollar

The release of the last FOMC (Federal Open Market Comittee Meeting) minutes will be the most important event for the Dollar, followed by inflation and retail sales data, the preliminary reading of Michigan Consumer Sentiment (Friday 15.00 BST) , and JOLTs job openings (Wednesday 15.00).

The Federal Reserve meeting minutes released at 7.00 on Wednesday October 11, should reflect the current hawkish tone of the meeting statement, the dot plots and the commentary of most Fed speakers .

"The FOMC minutes scheduled for release on Wednesday should be hawkish and with gas prices rising and wage growth increasing, economists are also looking for a very sharp recovery in retail sales that should take USD/JPY back to its highs near 113.50," Said BK Asset Management's, Managing Director, Kathy Lien.

Commenting on the strong wage growth reflected in the Labour Bureau report last Friday, Lien expects the dollar to continue trading strongly:

"With manufacturing- and service-sector activity accelerating and wage growth rising, we expect the dollar to extend its gains in the coming week."

Inflation data for September, out at 13.30 on Friday, will be a key release for the Dollar, as it will need to come out strongly to support the Federal Reserve's hawkish rhetoric.

The market clearly thinks it will with a consensus forecast of a rise in headline Inflation of 2.3% compared to the 1.9% of the previous month.

Core Inflation is forecast to come out at 1.8% from 1.7% previously.

Retail Sales and Core Retail Sales are also out at the same time as inflation.

The former is expected to rise by 1.6% in September, bouncing back from -0.3% in August.

Core Sales are expected to show a 0.3% increase from 0.2% in the previous month.

"We see a 1.7% jump in retail sales, reflecting a hurricane-induced surge in demand concentrated in autos," say TD Securities in a note on up-and-coming releases.

The see risks from a less-hawkish than expected Fed minutes as markets have fully-priced in a hawkish comment.

Events and Data for the Pound

Politics was the main driver of Sterling in the previous week and it will probably once again be the main driver in the week ahead.

Sterling lost ground as a result of Prime Minister May's leadership coming under criticism, and whilst there are no signs she will resign the flak has weakened her position.

Over the weekend we have noted that the Conservative Party has rallied around May and her position looks to be secure once more and as noted by Viraj Patel at ING Bank N.V. this might offer Sterling some upside.

The coming week is a key time for Brexit negotiations as it will be the last week of talks before the EU summit to determine whether sufficient progress has been made to move onto phase two.

The consensus expectation is that progress will not be judged sufficient to move on.

"Barring any surprising breakthroughs, the EU27 is almost certain to vote that insufficient progress has been made to move onto the 2nd stage of negotiations," said Canadian investment bank TD Securities.

The most important had data to be released is Manufacturing and Construction Output data for August at 9.30 BST on Tuesday, October 10.

TD Securities, again, think there is a substantial chance of a deeper decline than the markets are expecting.

They say that although Manufacturing rose in June for the first time in 2017 they expect the gains to be at least partially retraced in August due to a fall in car sales.

They are also skeptical about the Construction Output result for August, saying that despite their model indicating an uplift due to a delayed effect from strong mortgage and house price data before, more recent Construction PMI's point to a decline.

Other releases to keep an eye on in the coming week are the Royal Institute of Chartered Surveyors (RICS) house price monitor at 00.01 on October 12; the Trade Balance at 9.30 on Tuesday, October 10 and the British Retail Consortium's (BRC's) Retail Sales Monitor on Tuesday at 00.01.