Pound to Dollar Rate Recovery Gains Traction

- Written by: Sam Coventry

Image © Adobe Images

The British Pound's recovery against the Dollar gained traction following the Bank of England's November policy update.

The Pound to Dollar exchange rate (GBP/USD) has pared at least half of the slump it endured following the release of the U.S. election result on Wednesday.

The recovery accelerated after the Bank of England cut interest rates by 25 basis points but gave few clues about whether it would cut them again in December.

Instead, the Bank was content to signal that its approach to lowering interest rates would be cautious, particularly given that it raised its forecasts for inflation in the near term.

"The pound is pushing higher after the Bank of England cut interest rates for a second time but raised its inflation forecasts, helping to ratify a repricing in gilt yields that followed the government’s recent Autumn Budget," says Karl Schamotta, Chief Market Strategist at Corpay.

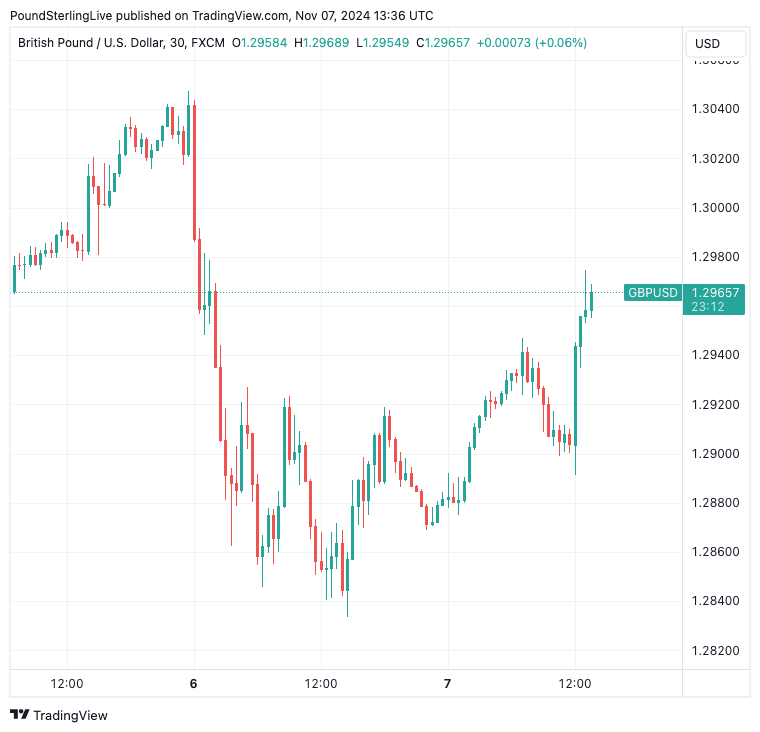

GBP/USD quotes at 1.2963 at the time of writing, which amounts to a 1.0% recovery from the lows registered on Wednesday when it became clear that Donald Trump and his Republicans had stormed to victory.

Above: GBP/USD at 30m intervals.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"The bank maintained a gradual approach to the removal of policy restraint. Given that we expect the bank to maintain a patient easing bias we anticipate that for now the bank is set to maintain a once a quarter policy strategy," says Jeremy Stretch, Chief International Strategist at CIBC Capital Markets.

"Today’s BoE update is supportive for the pound. Unlike the ECB and Fed, the BoE remains comfortable for now to stick to plans for gradual rate cuts. With yields in the UK set to remain at relatively higher levels at least until early next year, the pound is set to remain attractive as a G10 carry currency," says Lee Hardman, an analyst at CIBC Capital Markets.

Although the Pound's recovery against the Dollar is picking up some traction, CIBC's Stretch says he is hesitant to fade near-term GBP/USD rallies.

For those watching levels, he says a close below and strong support at 1.2799 would open the way for an extension towards 1.2733, as this level represents the 38.2% Fibonacci retracement of the year-to-date range (1.2300-1.3434).

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

The big dollar is meanwhile in retreat as investors are some of the previous day's exuberance.

Sure, Trump remains a pro-Dollar trade; however, markets will enter a wait-and-see mode as campaign rhetoric might not quite match reality.

Would Trump really want to risk boosting inflation by diving headfirst into a policy of blanket import tariffs? He might not.

This uncertainty is enough to cool some near-term enthusiasm for the Dollar and allow other currencies to reclaim some lost value.