USD Strength v GBP on Hold for Now as Speculators Turn Shy

The recent recovery story in the pound to dollar exchange rate (GBP-USD) has caught the attention of traders with many wondering whether a break above the 1.51 level is now a possibility.

“However having rallied sharply already this year additional sideways activity may well prove necessary before this incomplete bull trend continues.” - Lucy Lillicrap on the broader USD complex.

At the very least the range on either side of 1.5 should is predicted to be maintained as general USD softness continues to dominate the mood on FX markets.

As we walk into the new week we see the pound to dollar exchange rate (GBP-USD) converting at 1.4936.

This is slightly lower than recent levels, but as we can see nothing out of the ordinary is being experienced:

“The latest price action for this pair is starting to give the impression that a bottom has taken shape at just above 1.46 and the rally off the lows was given extra (technical) impetus by the bullish divergence now evident of the 14-day RSI,” says analyst Bill McNamara at Charles Stanley in London.

McNamara says the medium-term downtrend is still dominant but a test of that line, at 1.52 or so (which seemed pretty unlikely a week ago) is starting to look like a realistic expectation in the short to medium term.

Please note that all currency quotes mentioned here refer to the wholesale market. Your bank will affix a discretionary spread when transferring money internationally. However, an independent provider will seek to undercut your bank's offer, thereby delivering up to 5% more currency in some instances. Please learn more.

Dollar Strength on Hold… for the Time Being

We get the sense that it remains the dollar that is the driving force of the GBP-USD pairing and it is softness in the Greenback that is really allowing the currency relief.

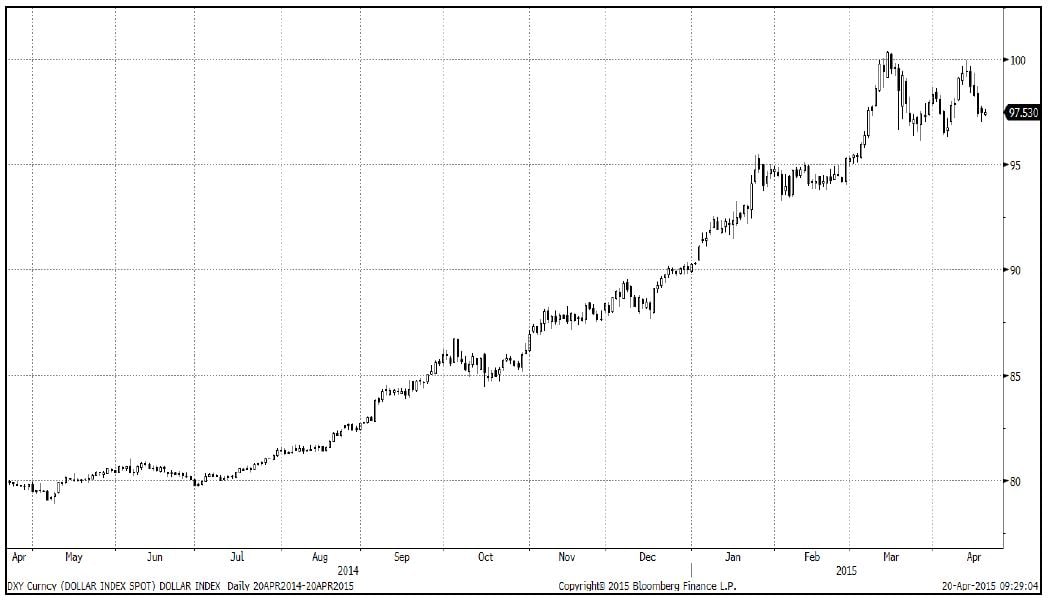

Dollar Index strength is on hold as prices consolidate below the psychological 100.00 level, this coincides with CFTC data that shows traders are ditching their once broad based bullish USD view. The net long USD positioning of the currency market narrowed again and now sits at $39bn.

This is compared to the November position of $49.4 i.e. markets are 20% less bullish on the dollar.

Underlying momentum indicators remain positive and many in the market tell us they are expecting weakness to be corrective only.

According to risk management strategist Lucy Lillicrap at brokerage AFEX, long-term potential is still apparent towards 105.00 if not 110.00 (looking into 2016) and any fresh dips beforehand are thus viewed as untenable.

Such moves could prompt a more sustained move lower in the British pound.

“However having rallied sharply already this year additional sideways activity may well prove necessary before this incomplete bull trend continues,” says Lillicrap.

Negative scope in the meantime looks restricted much under 96.00 and only an extension below the distant and key 93.25 level will damage this macro bullish environment.

With regards to GBP-USD, while re-emergent strength should prove untenable as well the market could potentially hurdle this pivot point next even if any such gains prove to be unsustainable.

This AFEX viewpoint differs to that held by McNamara who, if we recall, reckons 1.52 remains a possible target.

“Broader technical readings remain negative and without additional basing evidence no direct path yet exists toward even previous 1.5550 reactive peaks,” says Lillicrap.

Instead with selling pressure likely to firm up around 1.5150 initially rallies should prove relatively short-lived.

Should a sustained sell-off of the pound sterling commence once more 1.4300 is seen as the first target ahead of a deterioration towards 1.4050.

This level should attract before more substantial buying interest starts to become apparent.

So while further gains in the pound dollar exchange rate remains possible, we would take a caution approach and expect the outlook to remain broadly negative.