New Zealand Dollar to Rise Over Coming Weeks say CBA as Strategists Label Kiwi a "Buy"

- Written by: James Skinner

-NZD declines in risk-off trading Friday but better days are ahead.

-CBA forecast the NZD will recover against USD in coming weeks.

-TD Securities say Buy the NZD relative to CAD, targetting 4% upside.

© kasto, Adobe Stock

The New Zealand Dollar slipped Friday as traders' appetite for risk faltered across the globe, drawing a close to what has been a volatile week for the currency, although strategists at Commonwealth Bank of Australia have forecast the Kiwi will rise steadily during the weeks ahead.

A likely petering out of the US Dollar's nascent ascendancy, moderating concerns over geopolitical risks and signs of a renewed upturn in global economic growth all add up to a fertile environment in which the New Zealand Dollar can prosper, potentially reversing much of the steep losses wrought on the currency during April and May.

"The forces pushing NZD/USD down between mid-April and mid-May are fading," says Joseph Capurso, a senior currency strategist at Commonwealth Bank of Australia. "We expect NZD to track higher to $NZ 0.7100 in coming weeks and end 2018 at $NZ 0.7200."

Above: NZD/USD rate shown at daily intervals.

CBA's call comes after an eight week long sell-off drove the Kiwi currency down by more than 6% against the US Dollar, 5% against the Japanese Yen and still-meaningful amounts relative to other developed world currencies.

The Kiwi even fell by around 200 points against Pound Sterling during eight weeks to the end of May, which is noteworthy given renewed pessimism over the UK economy and outlook for the so called Brexit negotiations.

Above: Pound-to-New-Zealand-Dollar rate shown at daily intervals.

The downward move was driven largely by events in the global bond market and a deterioration of risk appetite among traders. US 5, 10 and 30 year bond yields reached mulit-year highs of 2.94%, 3.15% and 3.25% respectively in May, due to concerns over rising inflation, interest rates and debt issuance from the Treasury.

Above: 10 Year US Government Bond Yield.

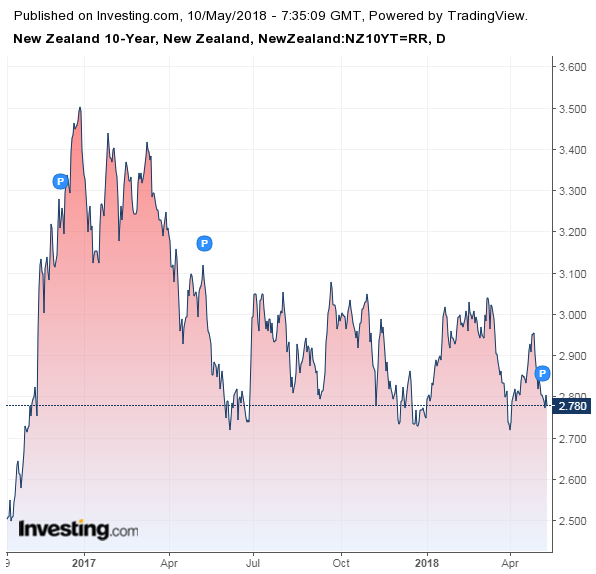

Meanwile, the outlook for New Zealand monetary policy has deteriorated after new Reserve Bank of New Zealand governor Adrian Orr snuffed out the market's last remaining hopes of a 2018 interest rate rise at a press conference after its latest meeting that put Kiwi bond yields under renewed, keeping them anchored beneath those of their US peers.

Above: 10 Year New Zealand Government Bond Yield.

This has incentivised investors to sell Kiwi Dollars and buy the greenback in order to invest in the American bond market rather than vice versa. This is the opposite of how the so called carry trade, which has traditionally propped up the Antipodean currencies relative to their international peers, used to work.

"There is limited upside to FOMC interest rate expectations from current levels in our view," says CBA's Capurso. "Therefore, we do not expect the NZ-US two year bond spread to become much more negative in the remainder of 2018."

The 2018 shift in the so called yield spread has undermined what was a crucial source of support for the Kiwi currency but, in recent days, other strategists have also suggested the bond market sell-off and rise of the US Dollar is nearing an end.

"The global economy’s soft patch will end in our view. While the PMIs have decreased, they remain very strong, particularly in the advanced economies. A strong global economy is very supportive for NZD/USD because of the influence on commodity demand," Capurso explains.

Some are now even betting against the greenback, claiming US rate expectations have moved too far and that yields should soon return to earth, which suggests there is scope for upside in the NZD/USD rate ahead and potential for a reversal in the Dollar index. Others are also beginning to get behind the New Zealand Dollar in selective instances.

Above: NZD/CAD rate shown at daily intervals.

"Since the USD rally began in mid-April, the CAD has outperformed most of its G10 peers quite handily with NZD the major laggard," says Mazen Issa, an FX strategist at TD Securities. "We buy NZDCAD (spot ref of 0.8970) in our FX Model Portfolio. We target a move towards 0.9300, risking 0.8780."

Issa and the TD Securities team say their model suggests the New Zealand Dollar now trades at a 4% discount to "fair value" and "negative data surprises" are at a five year extreme following a five month period where Kiwi economic indicators have persistently disappointed against market expectations.

The Toronto-based investment bank also flags that markets may be too optimistic in their expectations for Bank of Canada interest rates, given that investors appear to expect a total of three rate rises before the end of March 2019, despite an ongoing slowdown in the Canadian economy and a litany of risks to the economic outlook stemming from the North American Free Trade Agreement negotiations.

"This will be too tall of an order for the BoC. Too much implied tightening also suggests that the CAD has more to lose vs. its Dollar-bloc FX peers where the Overnight Index Swap curve is benign. A rate cut by the RBNZ is a low probability event, making NZDCAD topside a cleaner expression of idiosyncratic CAD risks," Issa concludes.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here