New Zealand Dollar Vulnerable post-RBNZ says ANZ

- Written by: Gary Howes

- RBNZ could be forced to slow hiking cycle

- As NZ abandons 'zero Covid' approach

- NZD vulnerable against GBP, USD says ANZ

Image © Adobe Stock

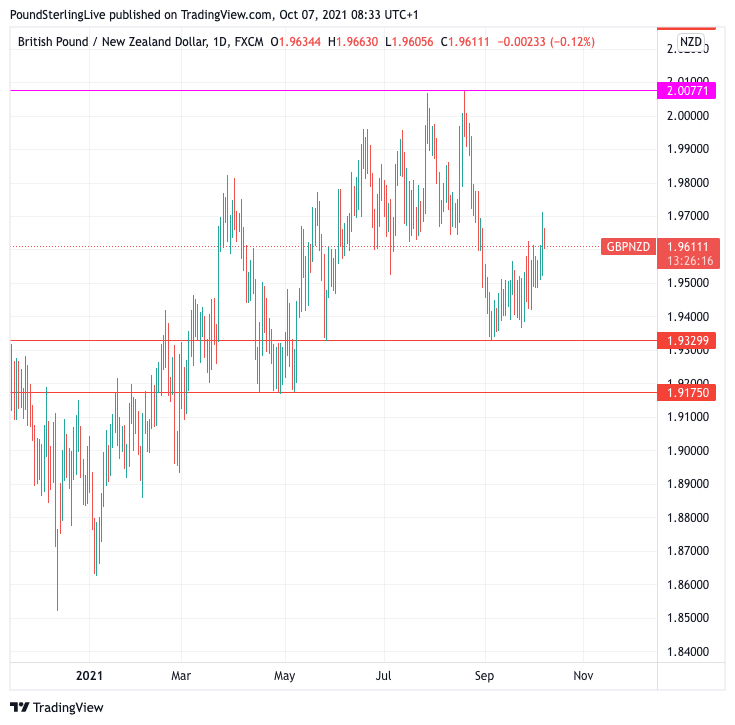

- GBP/NZD reference rates at publication:

- Spot: 1.9611

- Bank transfers (indicative guide): 1.8925-1.90062

- Money transfer specialist rates (indicative): 1.9435-1.9513

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Reserve Bank of New Zealand might have embarked on a journey to higher interest rates, but they are taking off into stormy skies say analysts at ANZ Bank.

"The risks are skewed towards something coming along to derail the RBNZ’s hiking cycle before its completion," says Sharon Zollner, Chief Economist at ANZ.

The New Zealand Dollar has risen in value through the mid part of 2021 as investors anticipated the October 06 interest rate rise which puts the RBNZ at the forefront of central banks looking to normalise policy once again.

But, the New Zealand Dollar actually fell in response to the move, suggesting that the hike is now 'in the price' of the currency.

"The final effect on the New Zealand dollar was not positive, both because the outcome of the meeting was in line with expectations and because the near term picture is any case weakened by the latest pandemic wave tied to the Delta variant," says Asmara Jamaleh, an economist at Intesa Sanpaolo.

This leaves markets looking to the future and buyers will want to see further interest rate rises ahead if they are to bet on the Kiwi.

"The RBNZ’s decision to hike rates by 25bp while Auckland is still in lockdown highlights that New Zealand’s economy is on the brink of overheating. With restrictions likely to ease in the coming months, we expect the Bank to hike rates by another 100bp by the end of next year," says analyst Ben Udy at Capital Economics.

Above: GBP/NZD in 2021.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The RBNZ raised interest rates amidst slowing economic growth related to lockdowns as they judged that the economy remains robust.

The RBNZ said the current Covid-19-related restrictions have not materially changed the medium-term outlook for inflation and employment since the August Statement.

They observed capacity pressures remain evident in the economy, particularly in the labour market.

Despite ongoing restrictions linked to the spread of Covid, the New Zealand government signalled this week that the country would pivot towards a strategy of "learning to live with Covid".

Prime Minister Jacinda Ardern said on Monday "with this outbreak and Delta the return to zero is incredibly difficult."

In response, authorities will commence the easing of restrictions in Auckland this week although a full lifting of restrictions will only be allowed when 90% of the population has been fully vaccinated.

"This is a change in approach we were always going to make over time. Our Delta outbreak has accelerated this transition. Vaccines will support it," said Ardern.

The new approach carries risks in that: 1) there is negligible prior exposure in the population and therefore a substantial pool of the population that can still catch the virus, and 2) less than half the population are fully vaccinated.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

"The COVID outbreak seems likely to get worse before it gets better," says ANZ's Zollner.

If cases explode the government might reconsider the easing condemning the country to an extended period of economically draining lockdown conditions.

The Covid situation in the country is therefore at a precarious point and the RBNZ's tone might well reflect this via a message of caution on the outlook.

"If we do see forward expectations for the OCR adjust lower over coming weeks, that could begin to weigh on the NZD, especially against currencies like the USD and GBP, with the Fed and BoE both inching close to withdrawing stimulus," says Zollner.

The RBNZ acknowledged it was conscious the latest Covid-19 restrictions have "badly affected" some businesses in Auckland and a range of service industries more broadly.

"There will be longer-term implications for economic activity both domestically and internationally from the pandemic," said the RBNZ in a statement.

The risk for the New Zealand Dollar is that the pricing of future interest rates comes off the boil somewhat from here, even as global inflationary pressures threaten to push New Zealand's own inflation rates higher.

"The COVID outbreak must make a follow-up November hike a much less certain proposition than otherwise," says Zollner.

The restrictions put in place to counter Covid "could also have medium-term effects on the economy, probably warranting a gradual pace in hiking rates," says Intesa Sanpaolo's Jamaleh.