Pound-New Zealand Dollar Rate Ascendant as Kiwi Looks Past RBNZ Lift Off

- Written by: James Skinner

- GBP/NZD at month highs after RBNZ lifts cash rate

- GBP advances as profit-taking pushes NZD into losses

- But hiking cycle underway, supports NZD medium term

Above: File image of Governor Orr. Image © Pound Sterling Live, Still Courtesy of RBNZ.

- GBP/NZD reference rates at publication:

- Spot: 1.9668

- Bank transfers (indicative guide): 1.8980-1.9117

- Money transfer specialist rates (indicative): 1.9490-1.9570

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Pound-to-New Zealand Dollar rate entered the mid-week session at one-month highs after the Kiwi drew no obvious benefit from a widely anticipated Reserve Bank of New Zealand (RBNZ) decision to begin reversing its crisis-inspired interest rate cuts this month.

New Zealand’s Dollar drew no immediate benefit from Wednesday morning’s RBNZ decision to lift New Zealand’s main interest rate from 0.25% to 0.50%, in line with market expectations, as part of its plan to keep inflation in check over the coming years.

Wednesday’s decision makes the RBNZ only the second central bank within the G10 economies to lift its interest rate since the onset of the coronavirus crisis after the Norges Bank began to raise its benchmark for borrowing costs last week.

“The Committee noted that further removal of monetary policy stimulus is expected over time, with future moves contingent on the medium-term outlook for inflation and employment,” the RBNZ said in its October monetary policy decision.

The RBNZ also said New Zealand’s main inflation rate is likely to exceed 4% later this year before returning towards the 2 percent midpoint of the bank’s one-to-three percent target band over the coming years.

Returning inflation to the target is predicated however, on the bank more-than reversing the interest rate cuts announced in 2020, which took the cash rate down from one percent to 0.25%.

“The RBNZ has made it clear that the focus for policy-making is the medium-term outlook and there are both demand and supply side aspects to consider. That outlook points to the OCR heading up over time,” says Nick Tuffley, chief economist at ASB Bank in Auckland.

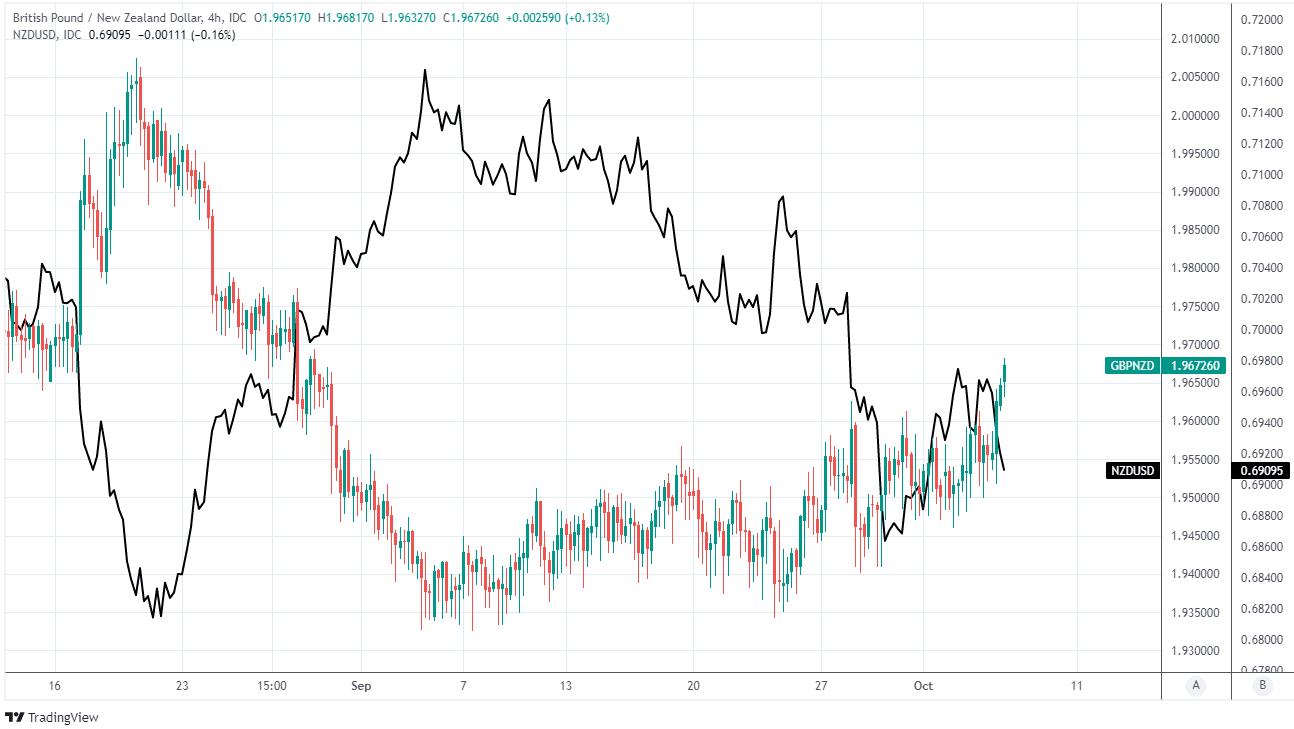

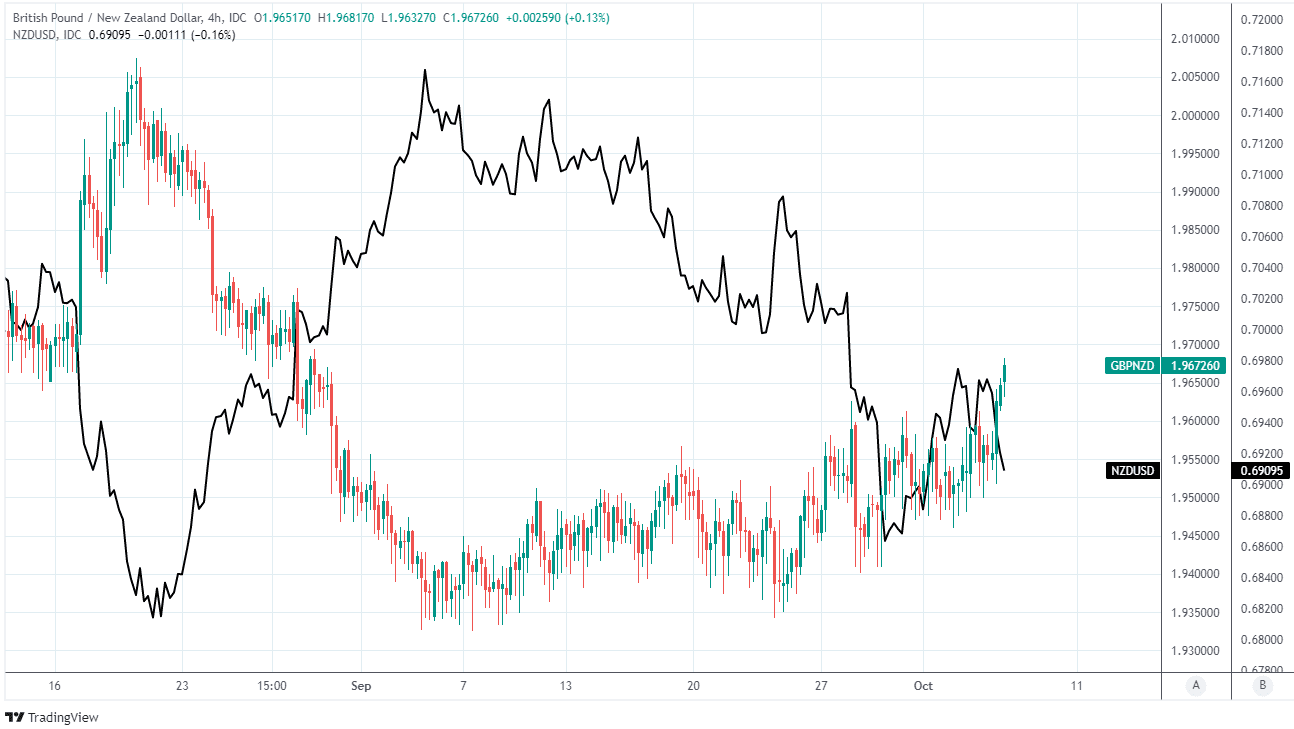

Above: Pound-to-New Zealand Dollar rate shown at 4-hour intervals alongside NZD/USD.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The RBNZ included as assumptions within its August forecasts for inflation the idea that its official cash rate would as far as a little over 2% by the end of 2023 and even then it wasn’t until the end of the forecast horizon in late 2023 that inflation was expected to return to the 2% target.

"The near-term rise in inflation is accentuated by higher oil prices, rising transport costs and the impact of supply shortfalls. These immediate relative price shocks risk leading to more generalised price rises," says Michael Gordon, acting chief economist for NZ at Westpac.

Inflation has risen across the world including in New Zealand in recent months, due mainly to business disruption arising from the various coronavirus containment measures in place around the world, but Kiwi inflations is deemed to have been exacerbated by a range of other factors too.

These include the New Zealand economy’s swift recovery from the travails of 2020, aided by generous taxpayer fiscal support and a strong labour market, which have cultivated upside risks to the RBNZ’s inflation target.

“Our OCR forecast continues to be follow-up hikes in November and February, and then a cautious series of hikes taking the OCR to 1.5% by August next year. As has been the case for some time, the risks are skewed towards something coming along to derail the RBNZ’s hiking cycle before its completion, despite extremely strong inflation pressure,” says Sharon Zollner, chief economist at ANZ.

Medium-term risks to the 2% target have seen the RBNZ grow reluctant to keep its crisis era interest rate settings in place, although the Pound-to-New Zealand Dollar rate rose following the announcement and the Kiwi ceded ground to all other major currencies.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

This was despite the decision being widely perceived as heralding the beginning to a cycle of interest rate rises.

"The RBNZ’s statement may not have been as bullish as some market participants expected: ‘there will be longer‑term implications for economic activity both domestically and internationally from the pandemic," says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

"We expect NZD to weaken further in the London session as market participants digest the RBNZ’s statement," Capurso said early on Wednesday.

The main New Zealand exchange rate NZD/USD was the biggest faller in the G10 contingent of major exchange rates in Europe on Wednesday following what may have been profit-taking by investors, leading the Kiwi to sustain losses against all others in the above grouping.

The Pound-New Zealand Dollar exchange rate rose above 1.96 to trade at levels not seen since late August as a result of the NZD/USD’s declines but could struggle to advance much further in the absence of additional losses for the Kiwi.

"Some recent evidence of a pick-up in COVID infections in New Zealand; the increased downside risks to growth in China; the fuel and power crunch in Europe; and the continued climb in US yields have all played a role in diminishing a positive FX response to today’s RBNZ rate hike,” says Lee Hardman, a currency analyst at MUFG.

Above: Pound-to-New Zealand Dollar rate shown at daily intervals alongside NZD/USD.