New Zealand Dollar Forecasts Face Downside Risks at Wells Fargo, Despite Aggressive RBNZ Rate Hikes in 2022

- Written by: Gary Howes

- NZD underperformance extends

- GBP/NZD looks to hold 2.0

- Wells Fargo warn NZD outlook now uncertain

- But still see multiple rate hikes at RBNZ

Image © Adobe Stock

- GBP/NZD reference rates at publication:

- Spot: 2.0057

- Bank transfers (indicative guide): 1.9355-1.9495

- Money transfer specialist rates (indicative): 1.9876-1.9917

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

New Zealand Dollar forecasts held at international financial services provider and investment bank Wells Fargo are pointed lower, despite them expecting an aggressive series of interest rate hikes being lined up by New Zealand's central bank for 2022.

The call comes amidst another day of New Zealand Dollar selling pressures amidst investor concerns over an outbreak of Covid cases in New Zealand that has resulted in a nationwide lockdown, a stark reminder that the RBNZ's plans count for nothing in the event of the Delta variant gaining a foothold in the fortress state.

And, this is duly reflected in the views of Wells Fargo in their latest assessment; yes the economy is firing on all cylinders and the Reserve Bank of New Zealand (RBNZ) has reason to hike rates, but uncertainty over Covid is the limiting factor.

The New Zealand Dollar forecast targets at Wells Fargo face "downside risks" owing to "the fluid and uncertain situation locally" concerning the Covid pandemic, even though multiple rate hikes are expected from November 2021 onwards.

For now, the market is discounting an aggressive interest rate hiking cycle and focusing on the current Covid outbreak in the country, assessing whether it can once again be successfully contained.

New Zealand reported 11 more cases in the community in the past 24 hours, which brings the total confirmed in this current outbreak to 21.

The government says the outbreak originated in a single passenger arriving from Australia.

"The New Zealand Dollar has suffered significantly in response, and was down 0.47% against the US Dollar yesterday as it became the worst-performing G10 currency for a second day running," says Jim Reid, a strategist at Deutsche Bank.

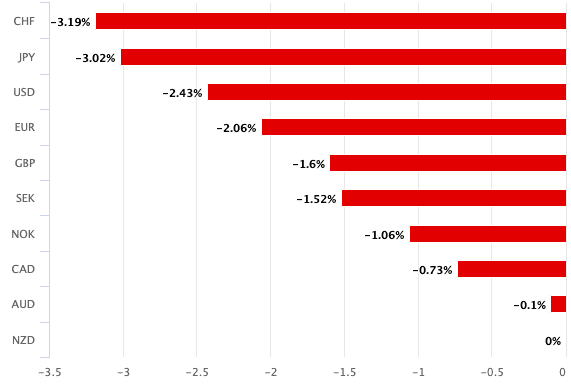

Above: Screened on a one week timeframe the New Zealand Dollar is the worst performer amongst the majors.

"With the RBNZ taking a punt on a hike - at least until later this fall - the NZD has underperformed on crosses. Tying the bank's reaction function to draconian government measures and COVID makes trading the NZD less predictable and even unfavorable," says a foreign exchange strategy note from TD Securities.

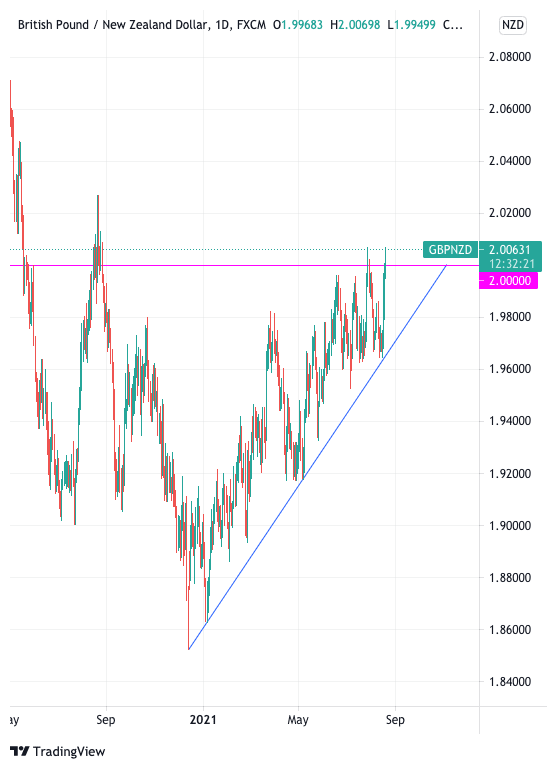

The Pound-to-New Zealand Dollar exchange rate meanwhile punched through the 2.0 ceiling in the wake of the August 18 decision by the RBNZ to delay raising interest rates from their current all-time low of 0.25%.

The pair has however not yet held a daily close above 2.0 since August of 2020, and even back then rates above here were held for a mere two days confirming the importance of this area from a technical perspective.

Above: GBP/NZD daily showing 2.0 resistance level.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

There is hefty selling interest at these levels and whether or not GBP/NZD can hold 2.0 likely depends on how soon the Covid situation in New Zealand is put under control, thereby allowing the market to once again focus on the compelling interest rate narrative.

RBNZ Governor Orr gave a post-policy decision testimony to Parliament on Thursday, saying it was "highly likely" the RBNZ would have raised rates were it not for the lockdown, and that there are upside risks to inflation pressures.

He ruled out raising interest rates before the next RBNZ meeting, saying markets understood that the next move is mostly likely up so they can afford to wait until the next opportunity to act in October.

He said a return of the RBNZ's basic interest rate - the OCR - back to 2.0% would effectively take it to a natural level whereby it is neither stimulatory or restrictive to economic activity

Markets had bet that the RBNZ would raise interest rates by 0.25% - or even 0.50% - just 48 hours prior to the RBNZ's August meeting, given a strong economic rebound and evidence that employment was running at full potential.

Wells Fargo economist Nick Bennenbroek says the outbreak clearly played a large part in the central bank's decision to hold policy steady but that the market's reaction was noteworthy.

"There is of course much uncertainty," says Bennenbroek, "our base case envisages that the COVID situation will be noticeably better by November... in part because the government will have made progress in containing the current outbreak, as well as making more noticeable progress in vaccinating the NZ population against COVID."

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Wells Fargo now forecast an initial rate policy rate hike in November of 25 basis points, to 0.50%, and expect multiple further rate hikes in 2022 of a cumulative 75 to 100 basis points.

They suspect the RBNZ's still hawkish bias may help limit the extent of New Zealand dollar downside, "though the NZ currency may also struggle to gain meaningfully for the time being," says Bennenbroek.

"The current fluid and uncertain situation locally could be a restraining factor for the NZ currency while, somewhat distinctly and perhaps as importantly, any jitters surrounding the global outlook that offer safe-haven support to the U.S. currency could also be a restraining factor for the New Zealand dollar," he adds.

Against this backdrop, Wells Fargo give notice they see moderate downside risk to their medium-term NZD/USD exchange rate forecast target of $0.7600 by end-2022.