Current British Pound Strength an 'Aberration' Warn Standard Chartered

Yes, Pound Sterling is oversold at current levels, but it can still get cheaper.

This is the house-view at global financial services giant Standard Chartered who have briefed clients on where they see the UK currency going as we move thorough Brexit negotiations.

In a client briefing dated March 23, the London-based bank are of the opinion that any strength in Pound Sterling is likely to be temporary and they recommend selling the currency.

The call comes amidst a relatively positive period for Sterling - it is has advanced against the majority of its competitors over the course of the past week and only the Yen and South Africa’s Rand have managed to eke out an advantage.

The Pound's Current Strength an Abberation

There are two distinct and opposing views held by the analyst community with regards to the Pound's recent strength:

1) This is a corrective bounce

2) This is the start of a sustained recovery

We have covered in detail of late point 2 noting a number of big-name analysts who believe Sterling has absorbed the lion’s share of bad news pertaining to upcoming Brexit negotiations.

Those who believe worse is to come are the opinion that markets have miscalculated just how rough the European Union will be when it comes to agreeing a future trading relationship with the UK.

Indeed, analyst Nick Verdi a Senior FX Strategist at Standard Chartered bank has gone as far as describing Sterling’s recent strength as an “aberration”.

“The UK-specific risks of Brexit negotiations suggest that short squeezes in GBP will prove to be aberrations on a downward trajectory,” says Verdi in a note to clients dated March 23.

Standard Chartered have emphasised that the GBP-USD rally over the past week does not diminish their bearishness noting that higher-than-expected UK CPI inflation and an incrementally less dovish Bank of England in the context of stretched short GBP positioning have driven the move.

i.e. the move higher is technical in nature - the market is in a one-way directional bet that can be prone to violent and sudden reversals as some participants are periodically thrown out or opt to take profit.

“While we remain bearish on GBP-USD, upside surprises to UK economic data or encouraging noises on the UK’s Brexit negotiations with the EU could drive an outsized and violent short squeeze,” says Verdi.

Such moves can be triggered by better-than-expected data releases, for instance we are seeing Sterling rally nicely following the release of UK retail sales data for February.

For Standard Chartered, even the positive data pulse of March (inflation and better-than-expected retail sales) are not enough to remove the uncertainties posed by upcoming Brexit negotiations.

“We expect these drivers to be more than offset by the negative economic fall-out from UK-EU Brexit negotiations,” says Verdi.

Expectations for a bumpy ride abound.

Commonwealth Bank of Australia’s Peter Kinsella reflects on the fact that the EU have to satisfy the competing interests of 27 EU members; the French want to take as much business as possible from the City of London, the Germans want to ensure that the UK is not better off post-Brexit - preserving the attractiveness of the EU as an entity - while the Irish want to keep the closest possible trading relationship with the UK.

“The possibility for a malign outcome is significant,” says Kinsella. “This is another reason to hold a negative view towards GBP prospects in the short term.”

The Pound is Oversold ... But it Can Still Get Cheaper

Assessing the kind of deal that will be struck is a key unknown for investors, and the GBP’s fortunes will be closely tied to the success of UK-EU negotiations, which have already undermined the GBP to a significant degree.

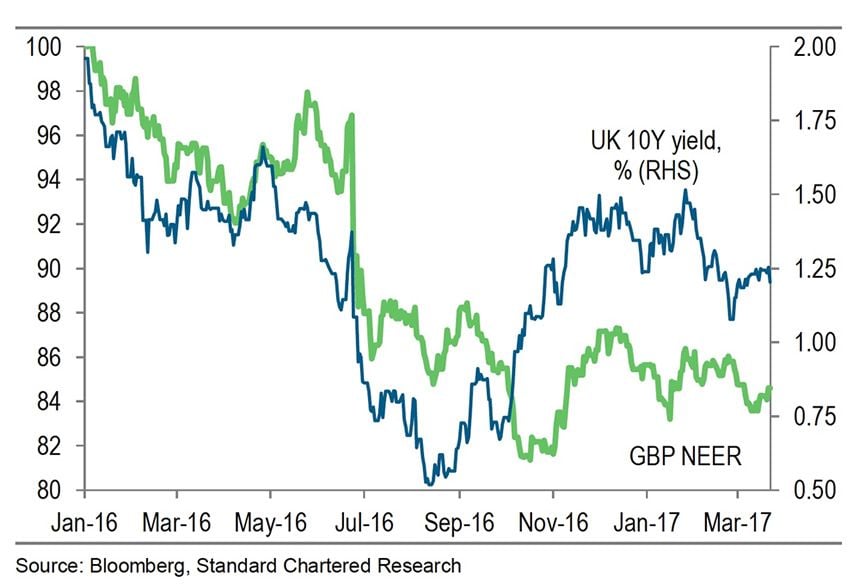

Indeed, the GBP trades at a significant discount to the 10Y yield on a nominal effective exchange rate (NEER) basis.

However, a two-year deadline to agree a deal is ambitious and fraught with risks that suggest this discount could become greater still.

Strategy ... Keep Selling the Pound

Standard Chartered remain bearish on the British Pound and recommend maintaining a bet against GBP-USD for now.

Strategists at the bank recently lowered their stop-loss level on the short GBP-USD recommendation to 1.2510.

With the exchange rate currently trading close to their stop-loss level they would look to re-enter shorts if their recommendation were stopped out.

Standard Chartered are forecasting GBP/USD to fall to 1.19.