British Pound Jumps Against Euro and Dollar as UK Inflation Surges Above 2% Target

- Written by: Gary Howes

- Pound to Euro exchange rate: 1.1540, up 0.3%, the day's best: 1.1555

- Pound to Dollar exchange rate: 1.2470, up 0.88%, the day's best: 1.2475

The Pound is the best-performing major currency following news that UK prices increases are running hot.

The ONS has reported that UK inflation is running well ahead of analyst expectations which could well put pressure on the Bank of England to look at raising interest rates over coming months.

And, the prospect of higher interest rates makes for a stronger Pound as global investors are expected to seek out the higher returns that UK money markets will offer at such a point.

Headline inflation for January read at 2.3%, well ahead of the 2.1% figure analysts had been expecting.

This confirms that inflation has breached the Bank of England’s inflation target for the first time since 2013.

The Pound leapt higher on the result as markets rushed to bet that the Bank will now have to consider raising interest rates.

At their March meeting it was shown that there were some members of the Bank's Monetary Policy Committee who felt the time had come to start considering raising interest rates.

News that inflation is pushing higher will only embolden this view.

"February’s CPI figures will have done little to reassure those MPC members who have recently become more concerned about higher inflation," says Ruth Gregory, UK Economist at Capital Economics.

We would normally argue the Bank will ignore that element of inflation that has been brought about by the decline in Sterling and global fuel prices as it would ultimately prove to be temporary 'one-off' hit.

BUT, much of the inflationary pressures reported today are being generated by economic activity that the Bank would likely consider acting on - core inflation rose by more than had been expected, from 1.6% to 2.0%.

This is that 'organic' inflation that is generated by a growing economy and wage growth which the Bank can control.

"As a result, the future path of inflation could be a little higher than both we and, more importantly, the MPC expected," says Gregory.

On all counts then the Bank's inflation target has been met.

"Given the uncertainty around the Brexit negotiations and the fact that there has been little sign of rising domestic cost pressures, the MPC will stand pat for the foreseeable future. Nonetheless, if the economy continues to hold up well as we expect, interest rates could be rising rather sooner than the markets have been anticipating," says Gregory.

However, a number of commentators believe the Bank will stand by regardless.

“Many will claim the weak Pound is the catalyst for rising prices in the UK, rather than an overheating economy, and thus the Bank may yet hold fire on raising rates,” says Paul Sirani, Chief Market Analyst at Xtrade.

Dennis de Jong, Managing Director at UFX.com agrees with this assessment which suggests to us that the Pound's jump might be premature if he is correct:

"Although there have been rumbles that inflationary pressures may lead to a sooner-than-expected interest rate hike, the BoE still seems a long way from taking the plunge. There is far too much uncertainty at the moment to press the button, so expect Mark Carney and his colleagues to hold fire for the foreseeable future."

The Pound Benefits

While the data is being debated by financial commentators, the market has made up its mind - the rising prices are positive for the Pound.

"This data has been good news for the Pound, which has surged to fresh highs at 1.2460, which is the highest level since late February," says Kathleen Brooks at City Index.

"Today’s data has also boosted UK Gilt yields, which is further helping the recovery in the UK-US 10-year yield spread, which is also at its highest level for a month, and is a key support for GBP/USD," notes Brooks.

EUR/GBP is also under pressure, while GBP/AUD is also picking up after reaching four-month lows late last week, as weaker commodity prices weigh on the Aussie.

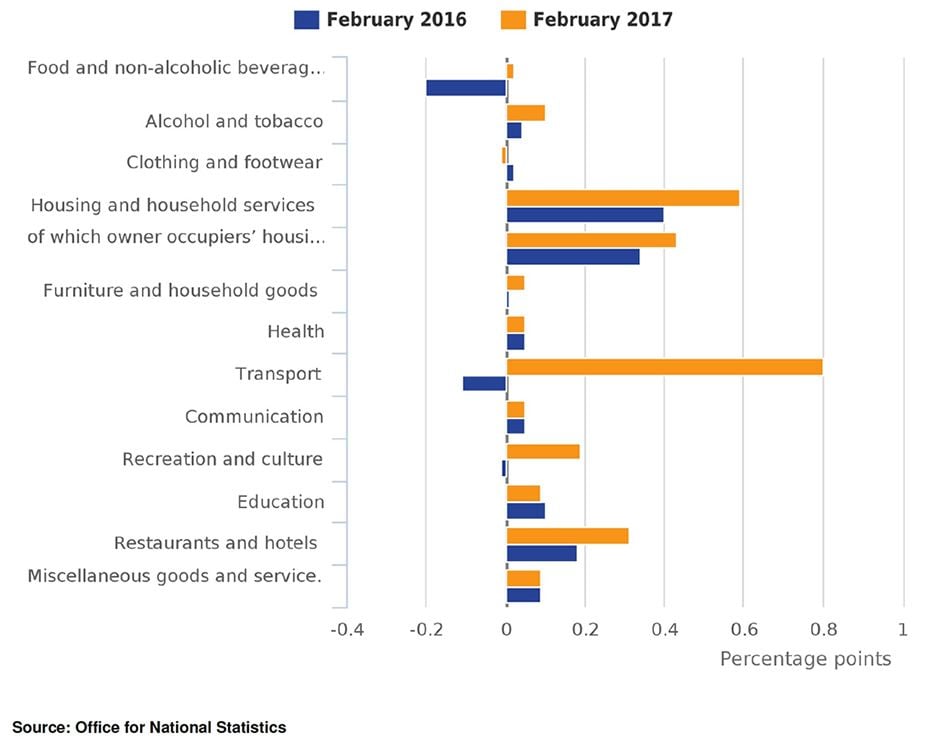

Transport Costs Prompt Surge in Inflation

Fuel prices appear to be the main culprit behind the latest jump in prices.

"The largest upward effect came from transport. Within this category, prices for motor fuels made the largest contribution, with prices increasing by 1.2% between January and February 2017. Fuel prices tend to reflect movements in global oil prices and part of the increase in oil prices during 2016 to date can be explained by depreciation of sterling against the US dollar," say the ONS.

This time last year fuel prices actually fell by 1.0% which also explains why today's number is so significant.

However, there are suggestions that the rate of increase in inflation could start to subside.

"In the next few months the base effect from motor fuel prices turns negative as crude oil prices started to recover this time last year. Crude oil prices are also down around 8% in the last couple of weeks," says Daniel Vernazza, Lead UK Economist at UniCredit Research.

Vernazza believes it means CPI inflation is likely to flat-line over the next few months before rising further to around 2.7% at the end of the year as the past fall in sterling continues to be passed through into higher consumer prices.