Pound Sterling Plummets to Multi-year Lows against Euro and Dollar

- Written by: Gary Howes

- GBP liquidated by wary investors

- As Bank of England judged to have lost control

- Of inflation and messaging

- Labour market reaches an inflection point

- Uncertainty comes as Sturgeon launches independence drive

- EU set to launch trade sanctions on UK

Above: File photo of Nicola Sturgeon. Image copyright: The SNP, Accessed and Reproduced under CC Licensing Conditions.

The British Pound has been hammered as international investors lose confidence in the UK economy and the Bank of England's ability to control inflation expectations, meanwhile fears of another Scottish independence bid and EU trade sanctions add a negative political dynamic to sentiment.

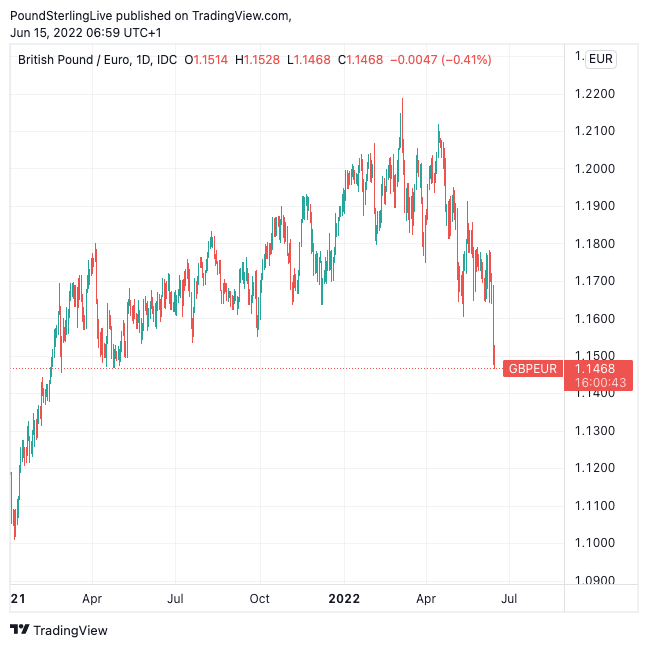

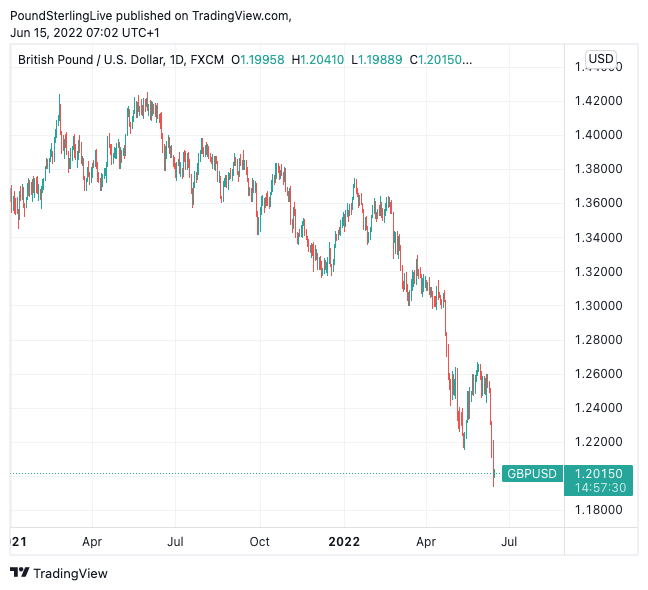

The scale of Sterling's collapse is notable: the Pound to Euro exchange rate collapsed 1.20% on Tuesday to reach 1.1474, its lowest level since April 2021 and the Pound to Dollar exchange rate collapsed a further 1.10% to reach 1.1933, its lowest level since the great Covid panic of March 2020.

GBP/EUR is now down 3.0% in 2022 and GBP/USD is down 11.0%. (You can set your own FX rate alert here).

"GBP/USD broke below the previous low of 1.2108 amid uncertainty surrounding the Brexit deal, while the Bank of England is unlikely to match the Fed in terms of the magnitude of an expected rate hike this week, where the decision appears to be between a 25bp and a 50bp move," says Francis Cheung, Rates Strategist with OCBC Bank.

For a currency there is nothing more detrimental than uncertainty and the Bank of England, UK politics and the economic outlook are providing this in abundance.

"We stay cautious towards the sterling, noting there is no technical support level near current level," adds Cheung.

The outlook for the Pound remains resolutely bleak with a combination of factors conspiring to bring the currency down, all of which won't be resolved in the near-term:

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Bank of England Has Lost Control

Most importantly the collapse in the value of Pound Sterling reflects a loss in confidence in the Bank of England's ability to control inflation and communicate clearly, creating unnecessary confusion for investors.

The Bank meets on Thursday and is expected to deliver another tepid 25 basis point hike, a move markets view as inadequate given the searing heat of UK inflation.

The Bank will look particularly limp in the face of the more determined U.S. Federal Reserve which will on Wednesday night raise interest rates 75 basis points and offer solid yield support to the U.S. Dollar.

But even the European Central Bank is now sending a clear signal of intent: it will raise interest rates in July and again in September as part of a determined sea-change in policy aimed at getting on top of rising inflation and this is tipped to help the Euro.

Above: GBP/EUR daily chart showing the decline to levels last seen in 2021.

The Bank of England ultimately suffers a communication problem: May's Monetary Policy Report was downbeat and confusing given it suggested the Bank might soon quit its rate hiking policy in light of projections for a significant economic slowdown.

This raises the question of whether the Bank targets growth or inflation?

A reading of the Bank's recent communication doesn't offer clear answers. The Bank's stated mandate is to ensure inflation stays at 2.0% over the longer term but policy makers now appear more concerned with managing economic growth, thereby deviating from their stated objective.

The Bank could therefore remain unwilling to raise interest rates to the levels required to squash domestic inflation expectations.

This matters for Sterling given other central banks are hiking with intent and offering a clear path for investors to follow, even if it is an uncomfortable one.

As mentioned already, for a currency there is nothing more detrimental than uncertainty and the Bank of England is providing it in abundance.

For the Pound to recover the Bank must on Thursday deliver a clear and decisive message that includes a 50 basis point rate hike and an unambiguous message that more hikes are coming as it seeks to deliver on its inflation target.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The Economy

UK labour market developments are a key determinant of inflation expectations.

The UK continues to have record job vacancies and a limited labour force, which places upward pressure on wages, which in turn fuels domestic inflation.

The consistent message from the labour market in 2022 is that conditions remain tight as unemployment falls and job vacancies print fresh record highs month after month.

But April's job market statistics confirm a turning point might have been reached as a run of strength looks to be coming to an end.

"An inflection point has been reached. This is consistent with our view of gradually loosening labour market conditions over 2022 as the economy faces the cost of living crisis," says economist Abbas Khan at Barclays.

Above: GBP/USD daily chart showing a relentless sell-off.

UK labour market data were mixed with 177K jobs being added in the three months to April says the ONS, more than the 105K increase the market was looking for. But the unemployment rate rose a touch to 3.8% in April from 3.7%, markets were anticipating 3.6%.

This suggests the labour pool might have increased as more people re-entered the labour market.

A 'dovish' Bank of England might leap on this development to argue against the need to raise rates by any more than 25 basis points, continuing down a path of mixed intent on the economy and inflation.

Beyond the labour market all other data prints negative: inflation is burning hot as CPI rose by 9.0% in the 12 months to April 2022, up from 7.0% in March.

Sentiment is at record lows and fuel prices at record highs, developments that batter the all-important engine of the economy: the consumer.

Scottish Independence

Scottish First Minister Nicola Sturgeon on Tuesday unveiled what she says was a "refreshed" case for independence.

Key to the independence push was the wish for Scotland to break away from the UK and rejoin the EU, as per Sturgeon's paper "Independence in the Modern World. Wealthier, Happier, Fairer: Why Not Scotland".

The paper makes comparisons between Scotland and other European countries, all of which Sturgeon says are independent, wealthier and fairer than the UK.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

She acknowledged this would mean a hard border for goods being created between Scotland and the UK.

The UK government responded by saying now is not the time for another independence referendum.

If the government does not grant a referendum any subsequent vote would be considered illegal.

The developments add a fresh layer of political uncertainty to the UK outlook, which only weighs further on Sterling.

"The First Minister of Scotland has announced her intention to call a new referendum on Scottish independence by 2023. As a result, the pound depreciated visibly also against the euro," says Asmara Jamaleh, Economist at Intesa Sanpaolo.

Northern Ireland Protocol and EU Trade Sanctions

The UK meanwhile looks set to be sanctioned by the EU in response to intentions to set aside parts of the Northern Ireland protocol.

"The collision course of the UK government with the EU over the NI protocol is another headwind for sterling," says Kit Juckes, who heads FX strategy at Société Générale.

The UK this week laid out legislation to facilitate trade between Great Britain and the UK province of Northern Ireland, but the EU has said this breaks international law.

They are expected to deliver a legal response as early as midweek, that could include fresh trade restrictions on UK exports.

Media talk of a trade war is over exaggerated however, given the UK does not actually apply similar customs checks to inbound EU imports.

The UK government is unlikely to do anything in the event of any fresh measures announced by the EU meaning UK exporters will bear the brunt of any EU measures, potentially resulting in a further deterioration in the UK's trade balance.

"A trade war between the EU and the UK would bring clear downside risks for the pound. Additionally, any breach of international law could sour investor sentiment even further. The UK carries a significant current account deficit. Arguably this increases the importance of the government’s reputation on the international stage," says Jane Foley, Senior FX Strategist at Rabobank.

Global Risk Sentiment is Dire

The global financial market is in a bear market: a period defined by an ongoing loss in value.

The Pound is a pro-cyclical currency that follows the fortunes of the broader market and it tends to decline during periods of market turmoil.

Therefore, removing all other domestic issues the Pound already finds itself in an unhelpful landscape.

"For some time sterling has been a bellwether of risk appetite which, given the small, open nature of the economy and the prominence of the UK's financial sector, is understandable," says Thomas Flury, a Strategist at UBS' Chief Investment Office.

"US equities tumbled yesterday with S&P 500 down by 3.9%. Nasdaq fell by 4.7%. The S&P 500 has thus fallen by 21.3% YTD and thus entered a bear market," says Kyrre Aamdal, analyst at DNB Markets.

"The main reason seems to be a fear that the Fed will raise the policy rate much faster to unwind its stimulus policy, and a 75bp rise has been discussed in the markets," he explains.

Market fears of more-than-expected rate hikes from the Fed were ignited again on Friday when U.S. inflation for April surprised to the upside coming in at 8.6% year-on-year.

That was after the month-on-month pace of inflation rose from 0.3% to a whopping 1% in May.

Markets now see an increased likelihood that the Fed hikes by 75 basis points on Wednesday, meaning U.S. financial conditions tighten faster than expected.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes