Bank of England's Gloomy Economic Forecasts Not Plausible: Berenberg

- Written by: Gary Howes

Image © Adobe Images

The Bank of England is too pessimistic with regards to the UK's economic outlook say economists at Berenberg Bank, who are one of a number of institutions who continue to expect a more robust performance.

"The UK is set for two years of painful stagflation as surging costs erode any hope of real output growth. That is the message the Bank of England sent with its new projections," says Holger Schmieding, Chief Economist at Berenberg Bank.

The Bank of England last week sent Pound Sterling wheeling lower after it released economic forecasts that showed UK GDP would likely fall by 0.25% in 2023 and rise by just 0.25% in 2024.

Expectations for falling growth are based on an assumption inflation would continue to surge and deliver a significant retrenchment in consumer confidence and spending.

Peak CPI inflation is forecast by the Bank to come in at 10.2% in the fourth quarter, up 4.4% on their previous estimates, while the 2023 fourth quarter figure is seen at 3.6%, a revision up of 1.1%.

"The relevant question is whether or not the BoE’s headline-grabbing projections are plausible," queries Schmieding.

"In our view, the answer is that they probably are not," he says in a note to clients following his team's assessment of the new figures and assumptions.

Berenberg's view is the UK's economy either performs really well, or terribly:

"With few exceptions, real GDP performance is either good or bad. But it is seldom as mediocre as the BoE’s latest numbers stipulate. Based on historical experience, the UK economy will likely follow one of two paths: either growth will remain mostly robust despite the serious headwinds, or the UK will fall into a temporary technical or full-blown recession followed by a snap-back in growth thereafter."

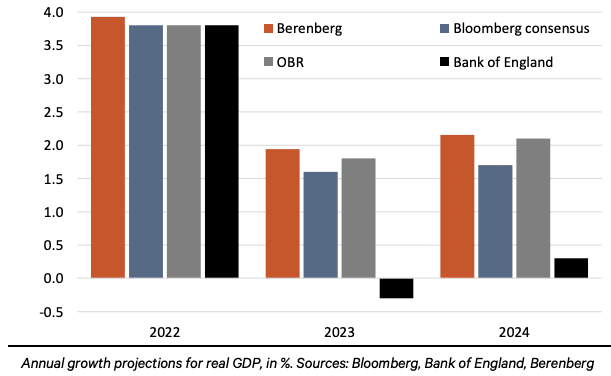

Berenberg, Bloomberg consensus and the UK's Office for Budget Responsibility suggest the balance of probabilities still favours the first scenario in the above, i.e. UK growth will remain robust.

The Bank of England is therefore an outlier:

For now Berenberg assumes inflation peaks at 8.9% in the second quarter and cut their growth forecasts.

But, even after the cuts the projections sit well above those of the Bank of England:

Their third quarter projection for real GDP growth is cut to 0.3% quarter-on-quarter from 0.5%.

They cut fourth quarter growth to 0.4% quarter-on-quarter from 0.7%.

This reduces annual growth projections to 3.9%, 1.9% and 2.2% for 2022-24 from 4.1%, 2.4% and 2.4% previously.

Accordingly, there is no quarter of negative growth assumed, let alone a recession,

"With strong balance sheets, robust labour markets and a high stock of savings, most households should be able to hold their noses and expand consumption in real terms even as inflation outstrips wage growth for a while," says Schmieding.

But Berenberg do acknowledge, "amid darkening clouds, the risks to this call are growing. In our view, markets should consider the risk of a bad outcome".

Berenberg are not alone in assessing the Bank of England is too gloomy and Pound Sterling Live has covered, and will continue to cover, these views.

Capital Economics, the independent research consultancy, says the Bank of England is too gloomy on the outlook.

They say the Bank is underestimating the potential for ongoing strength of the UK labour force, while they anticipate further support to be offered by the government as it grapples for credibility in the face of a 'cost of living crisis'.

A number of economists have picked up on the assumptions on energy, namely that prices are going to flatline at high levels.

The Bank assumes that energy prices are constant after six months, which even a casual observer of financial markets knows is an unlikely outcome.

"If the Bank were to assume that energy prices fall back to the levels implied by futures curves, then GDP growth would be about 0.3 percentage points (ppts) higher in both 2023 and 2024," says Ruth Gregory, Senior UK Economist at Capital Economics.

Another issue picked up by economists is an assumption the government won't offer under-pressure households further assistance.

The Bank assumes that fiscal policy evolves in line with announced government policies and fails to take into account further measures

"It is hard to see the Chancellor holding off on more help for households," says Gregory.

The government will deliver its Autumn budget at around the time the next Ofgem energy cap increase comes into places, placing exceptional pressures on households ahead of the winter.

The budget would almost certainly contain new measures to deal with a tough winter.

"A similar sized fiscal package to that unveiled in March could add up to 0.5% to the level of GDP," says Gregory.