Pound Sterling Higher on Bailey & Saunders Interest Rate Signals

- Written by: Gary Howes

- Bailey signals need for higher rates

- As inflation risks becoming embedded

- GBP/EUR hits 1.18

- GBP/USD at 1.3650

- Saunders says early rate rise appropriate

File image of Andrew Bailey, image © FCA, changed from original by Pound Sterling Live.

- Market rates at publication:

GBP/EUR: 1.1801 | GBP/USD: 1.3670 - Bank transfer rates:

1.1570 | 1.3388 - Specialist transfer rates:

1.1740 | 1.3600 - Get a bank-beating exchange rate quote, here

- Set an exchange rate alert, here

The British Pound advanced against the majority of its peers at the start of the new week, fuelled by weekend comments from members of the Bank of England's Monetary Policy Committee (MPC).

Governor Andrew Bailey issued another strong signal that the time to raise interest rates was approaching, a message echoed by MPC member Michael Saunders.

Bailey said he was "concerned" about above target inflation and that the Bank had "got to prevent the thing from becoming permanently embedded".

By raising interest rates the Bank would cool any domestically generated inflation, thereby protecting savings and putting a lid on inflation expectations.

The comments were the latest expression of concern by Bailey that inflation that starts off in the supply chain morphs into a self sustaining beast as consumer and business behaviours adapt.

Bailey said in late September that interest rates can rise while quantitative easing is still ongoing, a message that introduces the prospect of a rate rise before the end of the year.

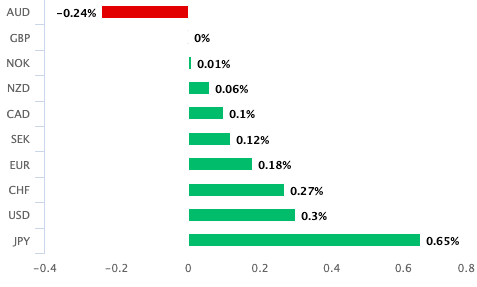

Above: the Pound outperformed the majority of G10 peers on Monday Oct. 11.

The concern is that if consumers anticipate higher inflation in the future they are potentially more inclined to push for higher wages, particularly in a jobs market such as the UK where there are over 1.2M job vacancies.

Indeed, while Saunders acknowledged surging gas prices he said widespread labour shortages posed a bigger risk of inflation by feeding into higher pay demands.

"It looks to me as if the labour market is tight across many sectors. And that's likely to push up pay growth, and indeed already seems to be," said Saunders.

Businesses in turn react to higher wages and more generalised inflation expectations by lifting their charges for goods or services.

Bailey said he sees "big and unwanted price changes" which "still have a way to go".

Jussi Hiljanen, an economist at SEB says markets now price a high probability (around 90%) for a Bank of England rate hike from 0.10% to 0.25% before the end of the year.

Signs the Bank was readying for interest rate rises acts to push up the return offered by UK financial assets, in turn attracting foreign investor capital and bidding the Pound higher in the process.

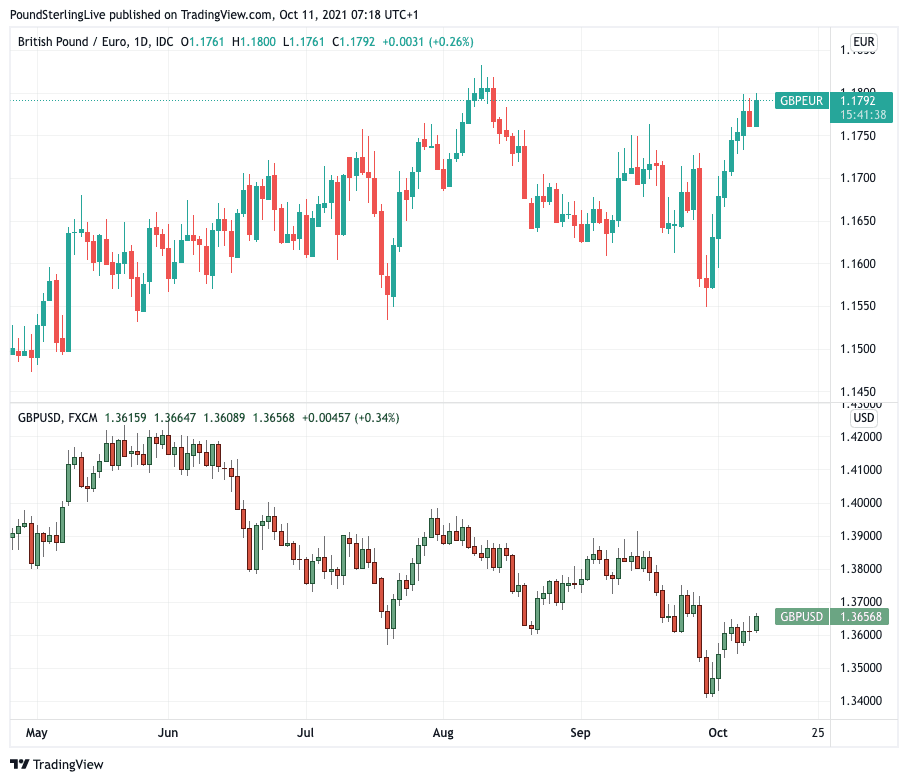

The Pound-to-Euro exchange rate rose to a high of 1.18 on Monday while the Pound-to-Dollar exchange rate rose to a high of 1.3665.

Above: GBP/EUR daily chart (top) and GBP/USD daily (bottom).

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

But a higher Bank Rate also pushes up the cost of lending in the economy which could slow economic activity and there are some economists who warn the Bank could be about to commit a monetary policy mistake by raising interest rates.

However one noted economists view the Bank's evolving stance as appropriate.

"Among the major central banks, the Bank Of England has been by far the most analytically-sound and transparent about the prospects for inflation and its risks. This continues to be the case judging from this weekend’s interview with its Governor," says Mohamed A. El-Erian, President, Queens' College, Cambridge University and Advisor to Allianz and Gramercy.

Also propping up expectations for a rate rise was the Bank of England's Michael Saunders who told the Telegraph at the weekend that "it is appropriate that the markets have moved to pricing a significantly earlier path of tightening".

He added consumers in the UK must prepare for "significantly earlier" interest rate rises than might have been previously expected, hinting a rate rise could occur before year-end.

"You can be aggressive in providing stimulus when it's needed. But the flip side of that is to be willing to take away some of that stimulus when inflation risks are no longer to the downside but more to the upside," said Saunders.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Saunders and Sir Dave Ramsden were the two members on the MPC who voted to end quantitative easing ahead of its planned December expiry, although they both voted to keep interest rates unchanged.

"I'm not in favour of using code words or stating our intentions in advance of the meeting too precisely, the decisions get taken at the proper time. But markets have priced in over the last few months an earlier rise in Bank rate than previously and I think that's appropriate," said Saunders.

"“The February one is fully priced in and for December, it's half priced in. I'm not trying to give a commentary on exactly which one, but I think it is appropriate that the markets have moved to pricing a significantly earlier path of tightening than they did previously," he added.

Last week the Bank of England's new Chief Economist Huw Pill said he feared a "more long-lasting" inflation threat to the UK.

The "balance of risks is currently shifting towards great concerns over the inflation outlook," he said.

Can the Economy Handle Higher Interest Rates?

Raising interest rates at a fragile moment for the economy - i.e. where growth is at risk of slowing - could exacerbate weakness say a number of economists we follow who are wary that the Bank might be about to committ a policy mistake.

"We’re more worried about inflation than stagnation for now, but central banks are tempted to do what the ECB did in 2008 – hike when growth is slowing. That ended badly for Europe. The UK MPC seems to have itchier fingers than most despite also facing more growth hurdles than most," says Kit Juckes at Société Générale.

However independent economist Julian Jessop says it now looks increasingly likely that the Bank will raise interest rates much sooner than most anticipated and on the topic of whether it is about to make a mistake he says "don’t panic".

He says a Bank Rate hike from 0.1% to 0.25% (or even 0.5%) would still leave nominal rates near historic lows and still lower than the pre-Covid level of 0.75%.

"Context is important," says Jessop. "The economic backdrop and fiscal choices will have a far bigger impact on the public finances than any likely changes in short-term rates (note the numbers below assume a full 1pp hike)."

Furthermore, higher inflation keeps real rates low, taking the sting out of a hike for borrowers.

For the Bank's MPC, "credibility is important too," says Jessop.

He says other central banks are already raising rates, or reducing asset purchases.

Some on the MPC may be happy just to let the current Quantitive Easing programme expire and not announce any more for 2022, "but a small rate hike on top would send a stronger message," says Jessop.

Andrew Sentance, Senior Adviser at Cambridge Econometrics, has long advocated for higher interest rates at the Bank, saying, "a gradual rise in interest rates is needed to combat rising inflation - sooner rather than later".

"Financial markets seem sanguine about prospect of higher interest rates. That is good news. Inflation is bad news for business, so if Central Banks take action to curb it, that should be positive for the economy over the longer term," he adds.