Pound Sterling Sell-off Gathers Pace, But a Turnaround Beckons

- Written by: Gary Howes

Image © Adobe Images

- Market rates at publication:

GBP/EUR: 1.1593 | GBP/USD: 1.3550 - Bank transfer rates:

1.1368 | 1.3270 - Specialist transfer rates:

1.1535 | 1.3482 - Get a bank-beating exchange rate quote, here

- Set an exchange rate alert, here

The British Pound decline gathered pace during the midweek session as an earlier stabilisation proved fleeting and sellers took control for a second day, there are however reasons to expect an imminent turnaround.

Declines come amidst fears the UK is entering a period of surging inflation and slowing economic growth amidst surging energy prices and ongoing supply chain disruptions centred on fuel deliveries.

"Sterling proved to be hit by a combination of risk negativity, rising fuel costs and scepticism as regards the ability of the BoE to follow through with Q4 hikes. Hiking rates in the face of weaker growth assumptions is hardly constructive for Sterling," says Jeremy Stretch, Head of G10 FX Strategy at CIBC Capital Markets.

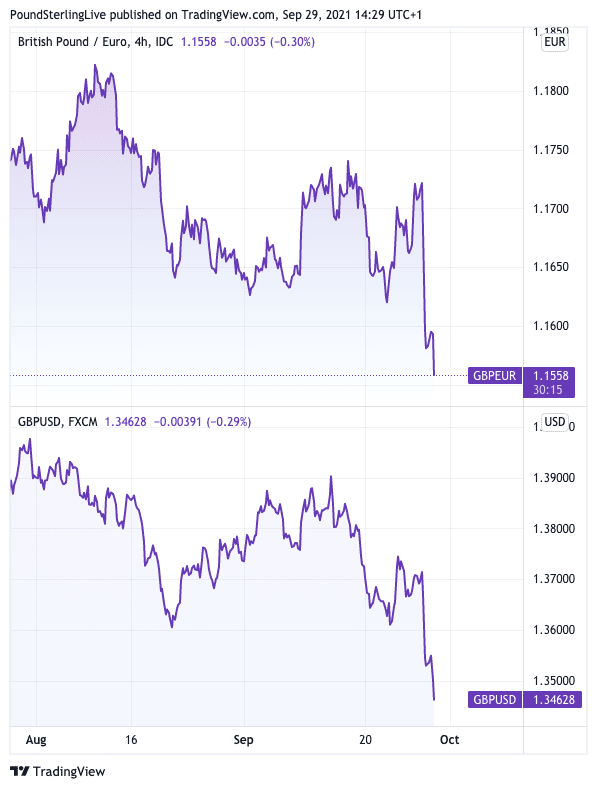

The Pound-to-Euro exchange rate is down by a further quarter of a percent at the time of writing at 1.1558 while the Pound-to-Dollar exchange rate is down 0.60% at 1.3461.

Amongst its G10 peers the Pound is only registering advances against the New Zealand Dollar and Norwegian Krone.

Above: Four hour chart showing GBP/EUR (top) and GBP/USD (bottom).

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Interestingly, the NOK and NZD have both come off strong runs built on the assumption that their central banks would be the first in the G10 to raise interest rates.

The GBP also benefited on this trade as the Bank of England was expected to hike in early 2022, well ahead of most peers.

The market could therefore be unwinding rate hike expectations and punishing those currencies that had benefited from them heading into this week.

"It's positioning (not truck driver shortages) causing sterling weakness," says Viraj Patel at Vanda Research. "Leveraged funds had built-up significant positions in GBP & NZD (on hawkish Central Bank trades). No surprise both have underperformed over the past week... just another risk-off positioning unwind in FX markets".

The queues at some of Britain's fuel stations are nevertheless symptomatic of consumers increasingly wary of supply-side issues in the global and domestic economy and the single greatest risk to the economic recovery is that they retreat further.

The Bank of England released its Money and Credit survey for August on Sept. 29 and it revealed consumers continued Covid crisis era behaviours of forgoing credit and saving money.

Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics, says consumers "need to lose this cautious mindset quickly if the recovery is to progress, given the looming drop in real disposable income in Q4".

But it is hard to see how headlines of surging energy prices and the prospect of goods shortages ahead of Christmas will encourage anything other than caution.

Warning signs over economic growth come alongside an increasingly tetchy Bank of England which fears the current supply-side inflationary pressures might become more entrenched.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Bank of England Governor Andrew Bailey said the prospect of a rate rise as soon as the fourth quarter of 2021 could not be ruled out if the labour market continued to perform well and inflation estimates continued to creep higher.

In normal times such a signal on UK interest rates would support the Pound but market sentiment has flipped to fearing the Bank might be guilty of making a policy mistake.

"UK real yields implied by long‑term inflation‑linked bonds remain historically negative and a drag on GBP because of concerns the current supply‑shock driven price pressures have a longer‑lasting impact on UK inflation," says Elias Haddad, Senior Currency Strategist at Commonwealth Bank of Australia.

But is the Pound's sell-off excessive?

Hints that it might be excessive include a view that inflationary pressures are not unique to the UK; indeed the Eurozone is also facing an energy crunch while the Euronews channel was on Wednesday morning opining a lack of HGV drivers in Europe.

The U.S. is seeing similar issues relating to supply logistics and China is facing outright blackouts for a lack of coal and natural gas.

The Pound might be under pressure now but investor sentiment is febrile and that the UK is materially worse off than anywhere else would need to be blindingly obvious for this to become a longer-term trend.

For now, this is not the case.

"The pound’s weak patch is not expected to last beyond the near term," says Asmara Jamaleh, Economist at Intesa Sanpaolo in a Wednesday briefing to clients.