Pound Sterling May Outlook: Bank of England 'Taper' Decision to Set the Tone against Euro & Dollar

- Written by: Gary Howes

- May 06 brings key BoE decision

- As well as Scottish vote

- Outcomes could awaken GBP volatility

Image source: Bank of England. Credit Laura Bell.

- Market rates at publication: GBP/EUR: 1.1506 | GBP/USD: 1.3939

- Bank transfer rates: 1.1280 | 1.3650

- Specialist transfer rates: 1.1420 | 1.3840

- Get a bank-beating exchange rate quote, here

- Set an exchange rate alert, here

The British Pound has flatlined against the Euro as the end of the month approaches while continuing to churn familiar territory against the U.S. Dollar, but early May could bring with it a welcome dose of volatility.

May 06 will see a major Bank of England (BoE) decision as well as the Scottish election that might result in a majority for pro-independence parties.

The BoE will deliver its monthly monetary policy decision as well as its quarterly Monetary Policy Report, which makes this meeting a candidate for any notable shifts in policy.

For the British Pound, this is the highlight of the near-term event calendar and could therefore set the tone for the currency in May.

Shaun Osborne, FX Strategist at Scotiabank says with regards to the GBP outlook, "the BoE’s meeting a week from now comes into focus with economists mixed over whether the bank will tee up a reduction in its rate of asset purchases - with some even expecting such a move to be announced next week."

Ahead of the event we have noted a number of institutions have said the BoE will take the opportunity to 'taper' its quantitative easing programme by reducing the amount of assets it purchases as part of its policy to provide liquidity to the economy.

Tapering is meanwhile seen as a necessary first step towards ultimately raising interest rates.

Such a move by the BoE would come as something of a surprise to markets given that it was only three months ago that the debate centred on whether or not the BoE would cut interest rates to 0% or below.

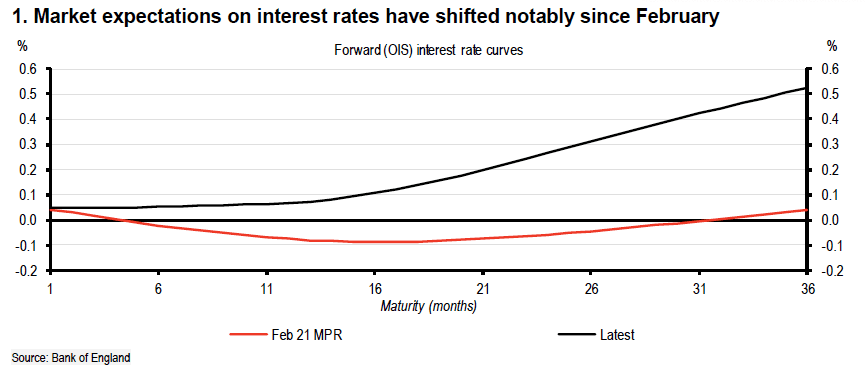

The shift from a central bank that was potentially considering cutting rates to one that is embarking on a journey to raising rates again has been credited by analysts as being one source of support for the British Pound.

The Pound-to-Euro exchange rate rallied from 1.11 to 1.18 in the first three months of the year on this BoE shift, the Pound-to-Dollar exchange rate rallied to 1.42 from 1.35.

But Sterling has fallen into something of a rut this April and therefore the BoE's looming decision could offer fresh impetus either higher, or lower.

Analysts at Standard Chartered say the BoE won't act anytime soon, even though the economy is witnessing a strong rebound and is on course to only raise interest rates at the end of 2022.

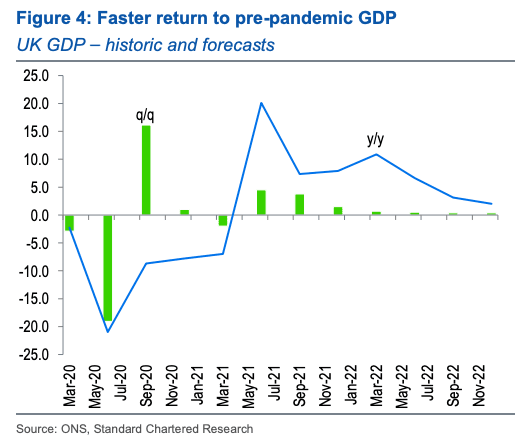

Above: Standard Chartered this week raised their UK GDP forecast to 6.4% for 2021, up from 4.8%.

"We think the BoE will still lean towards caution and fall short of any announcements – such as a slowing of quantitative easing (QE) purchases – which could be construed as overly hawkish by the markets," says Christopher Graham, Economist at Standard Chartered.

Should Standard Chartered be correct, and the market was expecting a more 'hawkish' announcement on tapering, then the Pound could come under pressure.

The problem for foreign exchange market participants is it is quite difficult to ascertain where the market stands on the matter.

We know the market is unanimous in expecting interest rates to be kept unchanged and for economic growth forecasts to be upgraded, but on the matter of reducing quantitative easing there is no clear signal.

Standard Chartered says the BoE will opt to look through rising inflationary pressures, instead opting to maintain caution given concerns over the outlook for the labour market.

"Given the size of the UK’s output gap, the likelihood that unemployment still heads higher later this year as government employment support is withdrawn, and risks associated with new COVID-19 variants, we still expect the BoE to be largely focused on a return to full employment," says Graham.

The U.S. Federal Reserve (Fed) on Wednesday said it was not considering tapering its own asset purchase programme given that millions of Americans are still without work.

The U.S. central bank will therefore readily accept the heat of rising prices if it helps jobs rebound.

The example set by the Fed could therefore be one the BoE seeks to emulate if it is intent on maintaining a cautious approach.

The BoE could however emulate the example of the Bank of Canada (BoC) which last week said it would begin tapering its quantitative easing programme, a decision that enabled the Canadian Dollar to maintain its 2021 outperformance.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The BoC said the economy was recovering at a rate consistent with the removal of some of the extraordinary support it had provided; does the BoE share a similar view on the UK?

Economists at Credit Suisse say the BoE is indeed likely to follow the Canadians, saying they will likely taper bond purchases by reducing the weekly pace of bond buying from £4.4BN a week to £3.0BN a week.

"This should allow the Bank of England to complete its current QE program of £150bn and reach its Asset Purchase Facility (APF) target of £895bn by the end of 2021," says Sonali Punhani, Chief UK Economist at Credit Suisse.

HSBC also predict the BoE will begin the process of tightening UK monetary conditions at its May policy meeting, an expectation their strategists say has helped the Pound higher over the first three months of 2021.

Economists at HSBC tell clients in a new research note that the BoE will announce it is to start tapering its quantitative easing programme, by cutting the pace it acquires bonds from the open market.

"The May meeting could well be the time the MPC starts a gradual tapering of asset purchases," says Elizabeth Martins, Senior Economist at HSBC.

HSBC expect the BoE might announce a reduced purchase pace for its quantitative easing programme, while raising its growth forecasts and nudging down its near-term inflation forecast.

Daragh Maher, Head of Research, U.S., at HSBC says this shift in expectations "justifies the strong performance of GBP for much of 2021 so far".

Above: The markets are now pricing in a 15bp rate rise by the end of next year, and more than 50bps of tightening over the next three years. Image courtesy of HSBC.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Economists at NatWest Markets are telling their clients that the BoE is likely to announce a tapering at its May 06 meeting.

"While the Bank of Canada kicked off taper season, I expect the Bank of England in May will turn investor attention more fully on the issue," says John Briggs, Global Head of Strategy at NatWest Markets.

Briggs says in a weekly client research briefing he expects the BoE in May will announce a reduction in Quantitative Easing from ~£18BN a month to ~£14BN a month.

Scotland will vote for the next Holyrood parliament on May 06 and political commentators say a strong result for pro-independence parties will raise pressure on the UK government to grant another independence referendum.

Paul Robson, Head of G10 FX Strategy at NatWest Markets says his team have cut exposure to the Pound ahead of the vote owing to the risk that it results in a strong mandate for another referendum.

“It’s about event risk and long Sterling positioning," he says in a recently published strategy note.

Polls show the pro-referendum SNP party of Nicola Sturgeon is on course to win the vote, but, of late the question of whether the party can secure a majority has grown.

The SNP's high-water mark in the polls appears to have occurred towards the end of 2020 but have since faded while the Conservatives and Labour have seen their share of the polls increase.

Should Sturgeon fail to secure a convincing majority a release of anxieties that might have built up in the currency market could help Sterling find some upside.