Euro-Dollar Forecasts Cut at Commerzbank as Italy Poll Looms, Outlook Sours

- Written by: James Skinner

© Stadtratte, Adobe Stock

- EUR advances Friday despite risk of Italy heading for election.

- Dispute over infrasturcture project fractures coalition government.

- Commerzbank downgrades forecasts on mounting headwinds.

- Says a significant ECB easing package is on way in September.

- After souring outlook for China threatens the Eurozone economy.

The Euro was trading with a firm tone Friday but it's at risk from fresh losses in the weeks ahead, according to multiple analysts including those at Commerzbank, who say the European Central Bank (ECB) will send the single currency lower in September as it attempts to rescue the Eurozone economy.

Europe's unified unit has benefited in the second half of the week from speculation suggesting the German government might be on the verge of abandoning its balanced budget policy in order to fund efforts aimed at addressing climate change. It's not clear how much funding would be raised or where such funds would be spent.

September 20 has been floated as the date that any potential package could be unveiled, which is barely more than a week after the ECB's next meeting. Markets have taken the Handelsblatt report as an indication that the German government might abandon its longstanding discipline on the public finances in order to reflate the economy.

"It's important that a lot of the recent discussions surrounding increased fiscal stimulus in Germany are being driven by the rising popularity of the Greens (Bündnis 90/Die Grünen). As such, the main focus of any such stimulus would likely be dominated by increased "green" expenditure compounded with heavy taxation to partially fund it. In short, it wouldn't be the most "business-friendly"," says Stephen Gallo, head of European FX strategy at BMO Capital Markets.

Above: Euro-to-Dollar rate shown at hourly intervals.

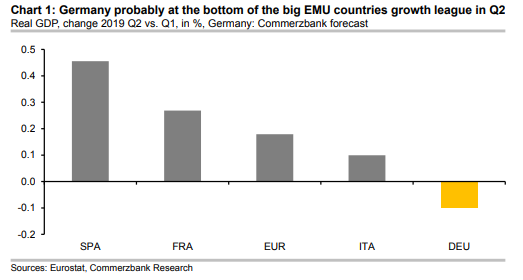

The dire state of the German economy, which some analysts say likely contracted in the second-quarter, and the prospect of a rescue for Europe's largest growth engine overshadowed other negative news emanating from Italy and helped the Euro higher on Friday.

"It should be noted that the recent political turmoil in Italy is far from exceptional. Europe has been characterized by a continuous stream of political struggles and, with Brexit due at the end of October, the abundance of political stress will likely remain in the foreseeable future," says Jeroen Blokland a multi-asset portfolio manager at Robeco.

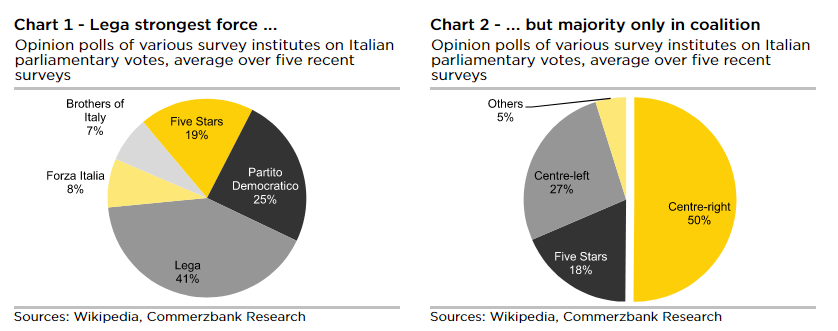

Italy's coalition government is on the brink of collapse and the country on the verge of another general election after a dispute between the ruling League and M5S parties over an infrastructure project came to a head, culminating with Deputy Prime Minister Matteo Salvini requesting the dissolution of parliament and a fresh national ballot. Salvini is the leader of Italy's largest political party and victor from the prior election, with the coalition having appointed a neutral Giuseppe Conte as PM in 2018.

La Republica reported Friday that a procedural vote of no confidence will likely take place of August 15, giving way to a period where President Sergio Mattarella will attempt to resolve the coalition's differences and if necessary, explore the possibility of forming an unelected government to avoid elections. The alternative is another election, which the Italian press says could happen by the end of October.

"Mattarella is regarded as a man who puts the stability of the country before political upheaval. He is not likely to dismiss the coalition government lightly. Hence, his first effort will be to reshuffle the cabinet," says Marco Wagner, an economist at Commerzbank. "Italy will remain the weak link in the euro zone. We already expect growth of only 0.5% in 2020. At the same time, the spending policy will keep the budget deficit and public debt high, which should regularly lead to conflicts with the EU Commission."

Above: Commerzbank graph showing opinion polling results from Italy, possible coalitions.

Salvini's gambit comes amid a strong performance for the League party in the polls, which has led many analysts to conclude that the 'populist' leader could win any election held and potentially secure an outright majority in the process that would eliminate the need for a quarrelsome coalition. This is being perceived as almost certain to ensure another clash with the European Commission over Italy's spending.

"In addition to the economic slowdown and the risk of additional tariffs, Europe is also burdened by political imponderables. The Italian government is on the brink of collapse, while Britain's withdrawal from the EU remains an enigma," says Mark Andre-Fongern at MAF Global Forex. "Due to an almost inevitable confrontation with the EU, we expect further political tensions and a sustained depreciation of the euro within the coming months."

The prospect of an even stronger mandate for the controversial League party comes at a bad time for the Eurozone economy, which slowed sharply in the second quarter and is expected to have weakened further in the third quarter. GDP growth was 0.2% in the second quarter, down from 0.4%, while some economists say the German economy itself probably contracted by 0.2% amid the U.S.-China trade war that has done more damage to the Eurozone than either of the world's two largest economies.

"We expect the ECB to take expansionary measures as early as September (including the resumption of QE measures) Accordingly I have to admit that in the current market environment EUR-USD is likely to suffer as a result. We therefore have to assume that until the ECB meeting, and probably beyond that, EUR-USD will remain under pressure," says Ulrich Leuchtmann, head of FX strategy at Commerzbank.

Leuchtmann has cut his forecasts for the Euro-to-Dollar rate all the way out to the end of 2020, with the single currency now projected to fall to 1.10 by the end of September before rising back to only 1.12 in time for year-end. Those are down from 1.14 and 1.16 respectively while marking the second downgrade inside three months. Other lenders have also downgraded their forecasts for the Euro of late as it increasingly dawns on the market that the ECB might have to take radical action soon.

Above: Euro-to-Dollar rate at daily intervals alongside DE-U.S. 2-year yield spread.

"China's economy is not recovering despite the economic stimulus package. We have therefore fundamentally revised our China view and no longer expect the Chinese government to significantly increase its stimulus measures," says Jorg Kramer, chief economist at Commerzbank. "The Chinese economy is unlikely to pick up significantly. As a result, we have markedly lowered our growth forecasts for Germany (2020: from 1.3% to 0.8%) and the euro zone (1.1% to 0.7%). The ECB is likely to introduce a comprehensive easing package in September."

Growth has slowed more in the Eurozone than it has in either the U.S. or China as a result of the trade conflict, with the German industrial sector having fallen in the second half of 2018 into a recession that has only grown deeper as the 2019 year draws on. The U.S.-China trade war is now widely expected to get worse before it gets better, with September 01 marking the next likely escalation.

Data released Wednesday showed German industrial production falling by 1.5% in June, by 1.9% for the second quarter overall and by 5.2% for the year to the end of June. As a result, analysts are Barclays said Wednesday that this number could mean the German economy shrank by 0.2% in the second quarter, which might leave the recent Eurozone figure vulnerable to a downgrade when the second estimate is released on August 14.

All of these economic factors are pushing the ECB's long-elusive inflation target of "close to, but below 2%" further and further from view, which is why the bank said in July that it's tasked staff with devising a "tiered system for reserve remuneration" and considering "options for the size and composition" of a new quantitative easing program.

Changes in rates are normally only made in response to movements in inflation, which is sensitive to growth, but impact currencies because of the push and pull influence they have over capital flows. Those flows tend to move in the direction of the most advantageous or improving returns, with a threat of lower rates normally seeing investors driven out of and deterred away from a currency.

Above: Commerzbank graph showing growth league table for major Eurozone economies.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement