Euro-to-Dollar Week Ahead Forecast: Overbought

- Written by: Gary Howes

Image © Adobe Images

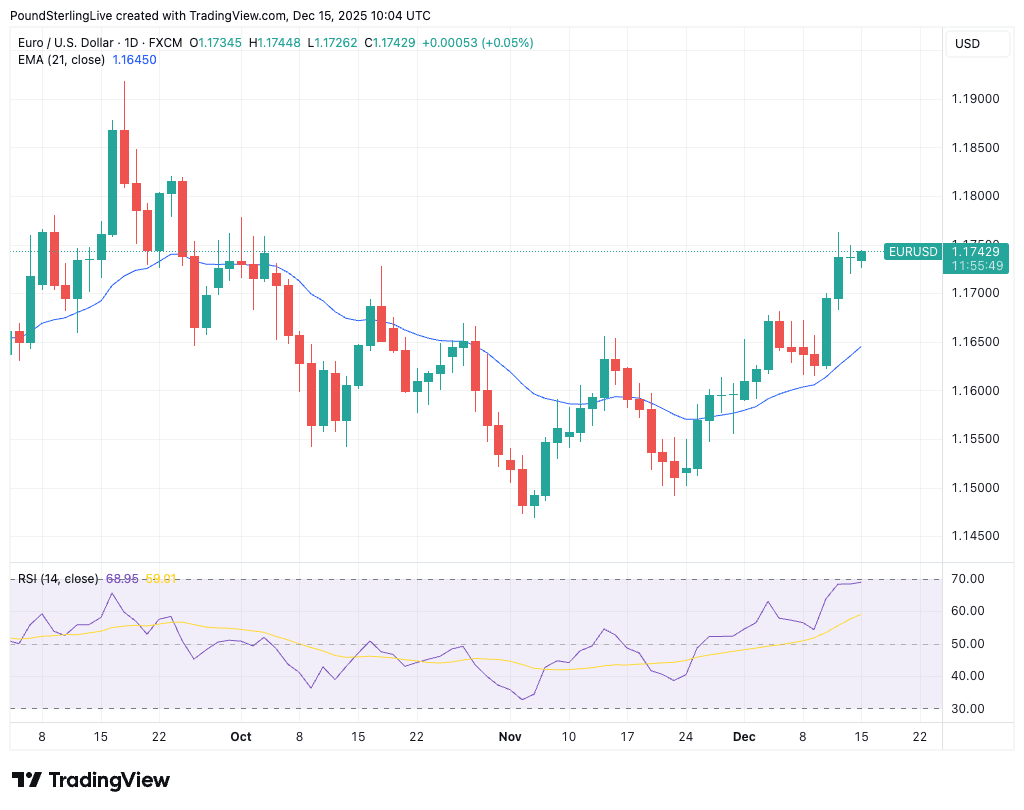

The euro to dollar exchange rate's December rally leaves it looking overbought and due a correction.

The pair is in a renewed uptrend, having raced to 1.1768 on Monday, the highest level since October.

However, the speed of the euro's recent advance takes the Relative Strength Index (RSI) - see lower panel on the daily chart - to 70, meaning EUR/USD is overbought from a technical perspective.

The RSI has mean-reverting tendencies when it reaches overbought conditions, ensuring it will ultimately turn lower again. For this to happen, we would require the euro-dollar exchange rate to enter a sideways pattern or shallow retracement lower.

In short, we think the euro is due to cool down somewhat after a solid run, and we wouldn't be surprised to see a retreat back below 1.17 this week before the next leg higher.

However, the charts can tell us only so much in a week that will be dominated by important data releases.

🔒Lock in today's exchange rate to secure a future payment. You may also book an order to trigger your purchase when your ideal rate is achieved. Learn more.

"EUR/USD has consolidated in the mid-1.17-1.18 range at the start of a week rich in potential catalysts," says Danske Bank. "Near-term risks continue to be skewed toward a modestly stronger USD."

Euro-dollar will react to the outcome of Tuesday's Eurozone PMI figures for December, which are expected to confirm the bloc's economy maintained positive momentum into year-end.

The Eurozone services PMI is expected to come in at 53.3, while manufacturing's recovery is anticipated to be confirmed by another tick higher to 49.9, leaving it on the cusp of returning to growth territory.

Strong data will be consistent with no need for further interest rate cuts at the European Central Bank. In fact, an above-consensus PMI would encourage the steady creep higher in bets that the next move will be a hike.

Yet, it will be the U.S. Dollar that will drive EUR/USD this week; the release of U.S. labour market numbers is the highlight for global financial markets; recall these releases were delayed by the U.S. government shutdown, which means they will fill a notable gap in the data.

The November payrolls data are released Tuesday, where expectations are for an increase in jobs of 50K and a fall in the unemployment rate to 4.4%.

Should the numbers undershoot, the market will ramp up bets for Fed rate cuts in 2026, which will weigh on U.S. yields and on the dollar.

However, should the data beat expectations, those rate cut bets will recede and the dollar can jump and potentially extend gains over the remainder of the week, setting EUR/USD's rally back.

Keep an eye out for U.S. retail sales, also due Tuesday, which should give an indication of how demand in the economy is holding up. Here the figure to beat is 0.2% m/m for October.

Thursday brings U.S. CPI inflation data, where the expectation is for an uptick to 3.1% y/y in November, up from 3.0%.

This is clearly heading in the wrong direction for the Fed, and an above-consensus figure would question market expectations for rate reductions next year, helping the dollar in the process.