GBP/EUR Week Ahead Forecast: Running Short of Road Above 1.13

- Written by: James Skinner

- GBP/EUR support near 1.1164 but little upside ahead

- Recoveries may fade around & above 1.13 short-term

- Market pricing of BoE & ECB rate outlook a headwind

- Economic data key for GBP/EUR direction short-term

- PMI surveys the highlights; BoE speeches also eyed

Image © Adobe Stock

The Pound to Euro exchange rate reversed much of its February rebound last week as market pricing of the future bilateral interest rate differential shifted further against Pound Sterling, which could now have difficulty sustaining any further attempted recoveries once near and above the 1.13 level.

Sterling was a middling performer among major currencies last week while the single currency notched up gains over all G10 counterparts barring a resurgent U.S. Dollar as economic data and commentary from central bankers turned the market tide against the Pound to Euro rate.

Sharper-than-expected falls in UK inflation rates for January were instrumental in pulling the rug out from under a GBP/EUR pair that had risen for seven successive days of gains over the Euro prior to the Office for National Statistics announcement.

However, losses for Sterling were compounded by gains for the Euro when Isabel Schnabel, an executive board member at the European Central Bank, warned that ECB interest rates may ultimately have to be lifted further this year than many had given credit for.

"A few statements by Isabel Schnabel in an interview today finally convinced markets to raise the terminal rate to 3.7% – more in line with hawks' wishes and our own expectations," says Davide Oneglia, a director of European macro research at TS Lombard.

Above: Pound to Euro rate shown at daily intervals with selected moving averages. Click image for closer inspection.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"In addition, judging from this weeks' speech by Fabio Panetta, ECB doves appear to be less dovish than some investors might have expected," Oneglia writes in a Friday research briefing.

Shifting market expectations for the ECB deposit rate are suggesting the interest rate differential with the Bank of England (BoE) is likely to be squeezed to what would be its narrowest level since 2018 by the time this year is out, which is a headwind for the Pound to Euro rate.

The ECB's hawkish stance is hardening at a point when some members of the BoE's Monetary Policy Committee are adopting a more non-committal position on the outlook for Bank Rate, which was raised to 4% this month.

"The easing in core services inflation suggests that interest rates won't rise much further, perhaps from 4.00% now to a peak of 4.25% or 4.50%," says Ruth Gregory, deputy chief economist at Capital Economics.

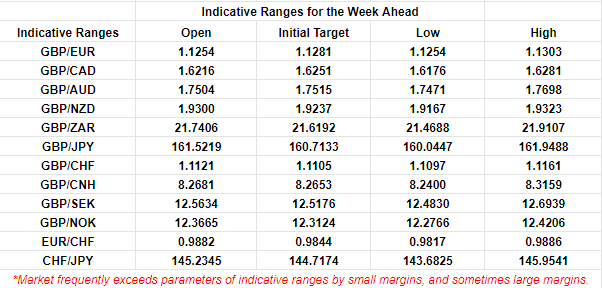

Above: Financial model-derived estimates of probable trading ranges for selected currency pairs this week. Source Pound Sterling Live. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

"But we suspect the Bank of England will need to see more convincing signs of slower pay growth before it can judge that inflation is firmly under control. That's why we continue to expect rates to stay at their peak level until early next year," Gregory writes in a Friday research note.

Chief economist Huw Pill has been one of the more 'hawkish' rate setters at the BoE in recent times and his remarks last Thursday suggested a March increase in Bank Rate can no longer be taken for granted and that a smaller 0.25% uplift is potentially the most that should be expected.

This week the market is likely to pay close attention to Thursday speech from Catherine Mann when she addresses "The results of rising rates: Expectations, lags and the transmission of monetary policy" at the Resolution Foundation.

It would likely come as another headwind for the Pound to Euro rate if Mann, the most hawkish rate setter of them all at the BoE, also indicates a preference for smaller increases in Bank Rate up ahead or otherwise for an imminent pause in the interest rate cycle.

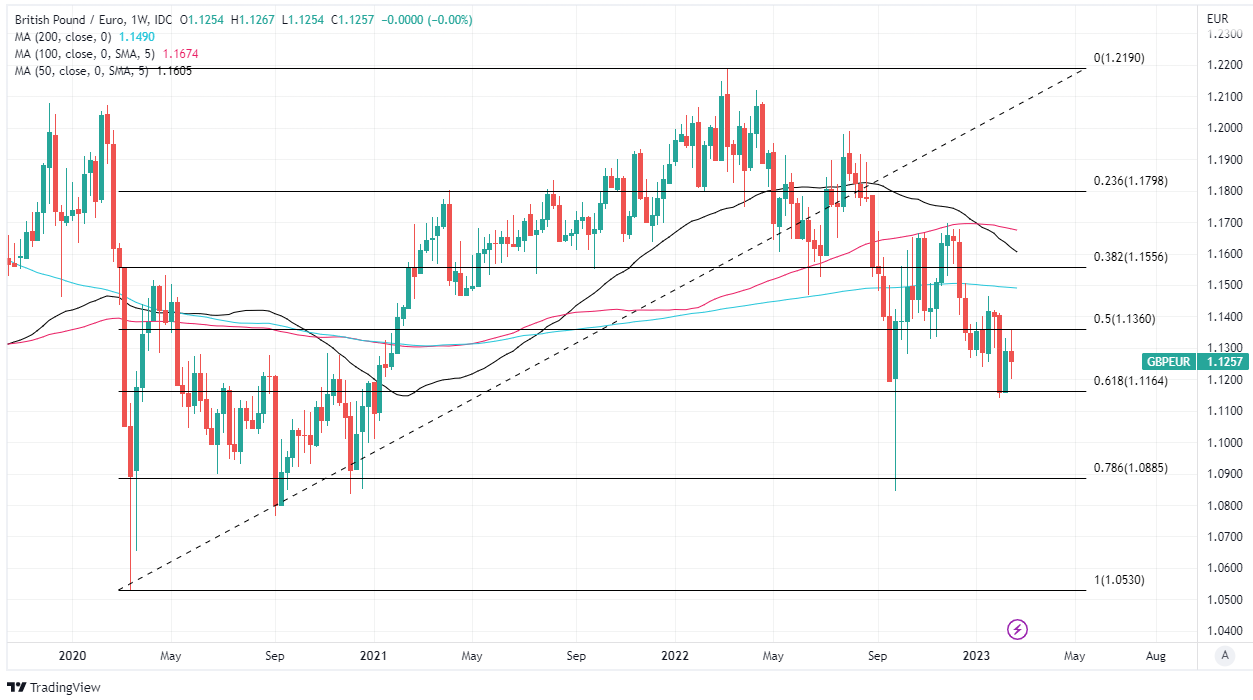

Above: Pound to Euro rate shown at weekly intervals with selected moving average, and Fibonacci retracements of 2020 recovery indicate possible medium-term technical support areas. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

"In contrast to the hawkish Fed rhetoric yesterday, comments from Bank of England chief economist Huw Pill pointed towards the BoE shifting towards a slower pace of tightening," says Chris Turner, global head of markets and regional head of research for UK & CEE at ING.

"We look for one final 25bp BoE hike to 4.25% next month. The comments have seen sterling very marginally underperform – consistent with our preferred view of EUR/GBP drifting into a 0.89/90 [GBP/EUR: 1.1111 to 1.1235] range this year," Turner writes in a Friday briefing.

Other BoE rate-setters are also due to speak publicly this week including Deputy Governor John Cunliffe and Sylvana Tenreyro, who's set to participate in a panel discussion titled "Back to 2% inflation?" at a conference hosted by the Federal Reserve Bank of New York on Friday.

But before then both the Pound and Euro are both likely to be responsive to Tuesday's release of February's S&P Global PMI surveys of the manufacturing and services sectors with any improvement in corporate sentiment likely to be supportive of Sterling.

"These surveys can be influenced by sentiment, and the prospect of better times ahead because of the sustained fall in energy futures prices may have begun to brighten the mood among survey respondents. Therefore, we expect to see a modest improvement in the headline balances, with the manufacturing PMI rising to 48.0, the services PMI edging up to 49.5," says Andrew Goodwin, chief UK economist at Oxford Economics.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes