Pound Sterling Forecast to see Further Upside against Euro: BMO Capital

- Buy GBP/EUR on the dip

- 1.1764 seen as solid support

- Govt. spending plans seen as key to GBP outlook

Image © Adobe Images

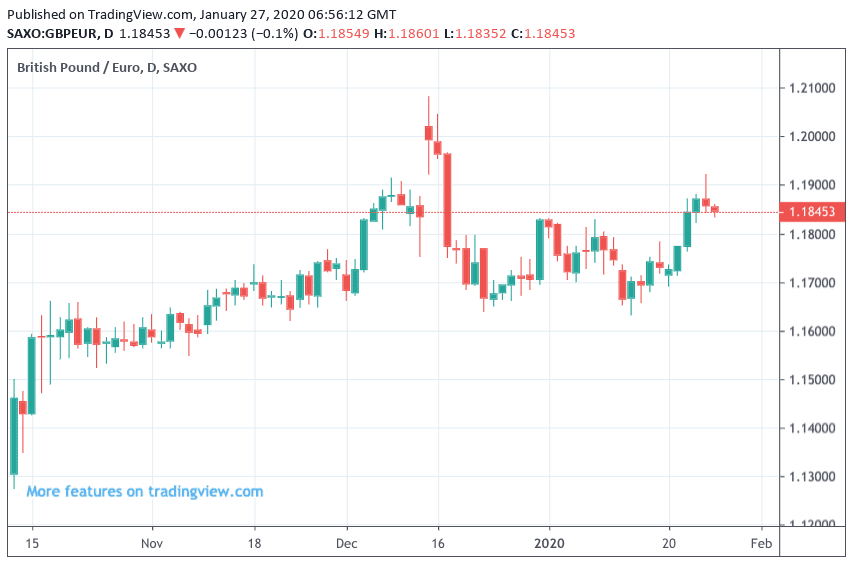

- GBP/EUR Spot rate: 1.1844, down 0.03%

- Indicative bank rates for transfers: 1.1529-1.1612

- Indicative transfer specialist rates: 1.1670-1.1737 >> Get your quote now

Stephen Gallo, European Head of FX Strategy at BMO Capital Markets, says the British Pound is likely to remain well supported for the foreseeable future as a combination of Bank of England policy and increased Government spending provide a positive fundamental backdrop for the currency.

Gallo says there is more upside in store for the Sterling-Euro pair in particular, and that any weakness below 1.1764 should offer new buying opportunities.

The Pound-to-Euro exchange rate rallied to 1.1920 last week in the wake of a data release that showed the UK economy was potentially experiencing a post-election pick up in activity. The flash Composite PMI from IHS Markit read at 52.4, well ahead of the 50.5 expected by markets and suggested the economy is back into expansionary territory following a soft end to 2019.

The data "highlighted a decisive change of direction for the private sector economy at the start of 2020. Business activity expanded for the first time in five months, driven by the sharpest increase in new work since September 2018," said IHS Markit.

The GBP/EUR exchange rate spiked above 1.19 on the news, but the gains above this psychologically significant level were ultimately short-lived in nature, betraying a hesitant market.

For Sterling, the pickup in economic activity reflected by the PMIs must continue over coming months for the Pound to gain any meaningful traction if it is to test the 1.20 levels.

From Gallo's perspective, the Pound should however ultimately remain supported. In a note to clients, he says he finds the market's current approach towards Sterling to be potentially flawed, saying "a portion of the FX market's narrative is incorrect."

"It's not that the GBP can rally unless the UK and EU reach a FTA that involves tariff-free trade. It's about what the government can do with domestic policy to support the economy with or without an EU FTA," says Gallo.

How the Government prepares for a post-Brexit economy will become clearer on March 11 when the Chancellor of the Exchequer Sajid Javid delivers the budget, which is expected to include a host of spending commitments.

The increase in spending - particularly on infrastructure - could boost economic activity which is ultimately supportive of further strength in the Pound.

Analyst Shahab Jalinoos at Credit Suisse in Zurich says the big ticket event for the Pound in the first three months of 2020 will come in the form of the government's budget announcement.

In a note to clients issued earlier this month, Jalinoos says the first quarter of the year does not present opportunities to gauge how well UK–EU trade talks are proceeding, "limiting scope for a major move" in the Pound.

But, "what is on the table in Q1 is the government's budget date of 11 March... The government has promised to continue targeting a balanced current budget within 2020. But it has promised to raise capital spending from 2 to 3% of GDP, allowing an extra GBP 100BN of investment over 5 years, of which GBP 80BN has yet to be allocated," says Jalinoos.

Jalinoos says that the kind of spending envisaged by the Government would take public sector gross investment to levels not seen on a sustained basis since the early 1980s, "and is expected to be concentrated on "levelling up" growth between the high-performance south-east and the rest of the country".

"While this news in not entirely new, we suspect the anticipation of this budget will keep GBP supported, especially as there will likely be a drip feed of likely proposals released on a regular basis in the weeks ahead," says Jalinoos.

The immediate outlook for Sterling will meanwhile rest on the Bank of England's decision on whether or not to cut interest rates. 2020 has seen the market's focus return to economic fundamentals and the Pound has tended to follow the waxing and waning of the market's expectation for a January 30 interest rate cut.

The Pound traded softer heading into mid-January as expectations for a cut peaked at 70% following a slew of poor data releases (albeit they covered the November-December period) and speeches from various Bank of England policy makers who warned they were becoming increasingly inclined to view a rate cut as favourable.

But, data since the December election has been decidedly more upbeat, suggesting the provision of political certainty could unlock investment that has been shelved in recent years.

BMO Capital thinks any decision by the Bank of England's Monetary Policy Committee (MPC) to cut interest rates heading into a shift in economic and fiscal policies will simply add to the bullish case for the GBP.

"On a reward-for-risk basis, though, the better opportunities in the GBP and short-term rates are probably best expressed by positioning for a 'hold' next week," says Gallo, referencing an expectation that the Bank will opt to keep interest rates unchanged at their January 30 meeting.

Thursday’s policy update from the Bank of England is certainly the key event for Sterling this week.

Despite last week’s stronger-than-expected data out last week, money market pricing suggests investors still see the outcome a close call with the probability of a cut being in the 55-60% region.

"If the BOE does cut rates, given the slide in inflation and lacklustre GDP growth, we can expect to see the pound sold off. Consequently, GBP/EUR could slip back towards €1.16 while GBP/USD could fall back towards $1.29," says George Vessey - Currency Strategist at Western Union .