Australian Dollar vs. Pound Week Ahead: Potential Uptrend Beckons

Image © Greg Brave, Adobe Stock

- GBP/AUD in strong rebound

- The pair is now above 1.80 and in a new short-term uptrend

- The main release for the Pound is PMI data and for the Aussie Q2 GDP and a central bank meeting

The Australian Dollar is seen trading higher at the start of the new week but remains vulnerable - indeed over the past month the currency is the worst performer in the G10.

Sentiment concerning the outlook has not been aided by retail sales released on Monday morning showing 0% growth month-on-month in July; markets had forecast a reading of 0.3%.

The numbers will only add to the sense that the Australian economy is cooling and that the incentive for the Reserve Bank of Australia to raise rates anytime soon is limited.

"Some moderation in retail sales is consistent with lower consumer confidence and falling house prices," says Joanne Masters with ANZ. However, Masters cautions against reading too much into one data point in a monthly series. "In trend terms, retail sales continue to improve."

All eyes will now turn to the RBA which will give their latest assessment for the economy at 02:30 B.S.T. on Tuesday, September 03.

Sterling has rebounded strongly against the Aussie Dollar, climbing back above the 1.80 level at the end of last week, after EU and UK negotiators announced progress on a Brexit deal; this in combination with disappointment capital investment and housing figures from Australia saw Pound-Aussie 'rip' higher.

The GBP/AUD exchange rate is currently at 1.7939 on the interbank market with quotes on international transfers at high-street bank accounts being seen between 1.7311 and 1.7437 while independent specialists are offering towards 1.7849.

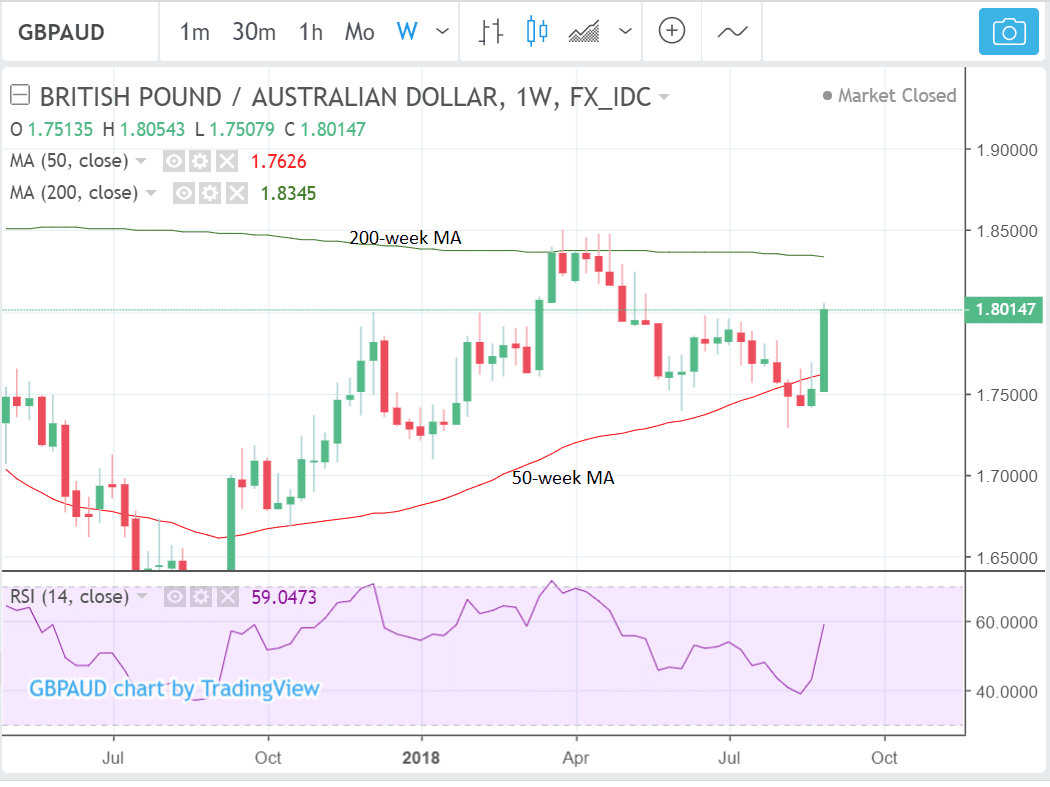

The pair has now recovered back above the 50-week moving average on the weekly chart despite temporarily breaking below the level in August.

The long up week candle is a sign the uptrend is likely to continue.

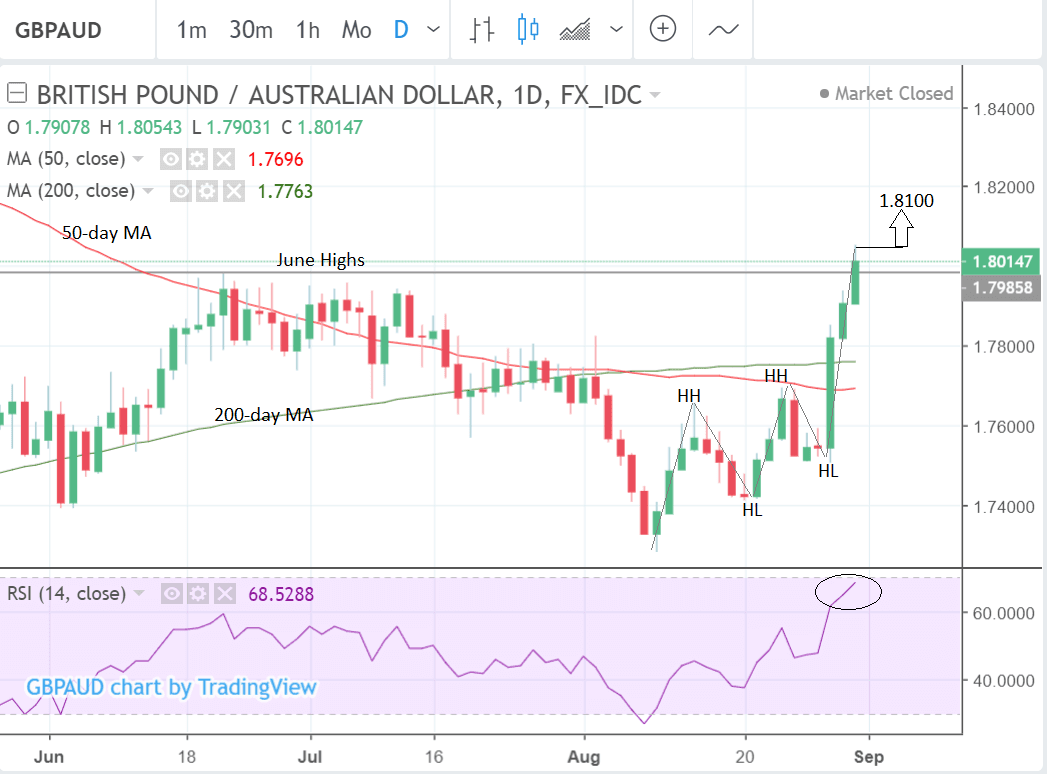

The daily chart shows how the short-term trend has probably reversed after the young uptrend formed two consecutive higher highs (HH) and higher lows (HL) and broke above both the 50 and 200-day moving averages (MA), which are usually tough obstacles on charts.

Now that the pair has established a new short-term uptrend from a technical perspective it is more likely to extend that trend than not, so we are biased to forecasting higher prices.

A break above the 1.8054 would probably confirm such an extension to the next target at 1.8150.

The pair has broken above the key June highs further supporting a bullish case, however, it is looking increasingly overbought, with RSI momentum at 68, just 2 points below the overbought zone above 70.

If RSI goes into overbought it will be a signal not to open any more longs, and suggests the possibility the pair may consolidate for a while, quite possibly at around the level of the June highs at 1.8000 or thereabouts, before any further gains.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The Australian Dollar: What to Watch

The Australian Dollar has several very important data releases in the week ahead which could impact on its value; these include Q2 GDP growth, the Reserve Bank of Australia (RBA) monetary policy meeting, retail sales and the current account balance.

Q2 GDP is forecast to have risen by 0.8% in Q2 compared to Q1, which saw a rise on 1.0% in growth, when it is released on Wednesday September 5 at 2.30 B.S.T.

Compared to a year ago. GDP is expected to have risen by 2.8% in Q2. A higher than expected result would support the Aussie and vice versa for a lower result because a strong economy attracts more outside investment supporting demand for the currency.

The RBA is not expected to change its official cash rate when it meets for its September monetary policy meeting on Tuesday, at 5.30, and the meeting may just be another non-event for the currency as has been the case at countless other meetings. The RBA has maintained a neutral stance for a long-time and there seems no reason why it should change that now.

If anything geopolitical risks, which have been a major factor against the RBA raising rates, have re-emerged with China-US trade talks disintegrating again and Trump threatening further tariffs.

Domestically there are also problems as household debt is still too high, preventing the RBA from raising or lower rates for fear it could either cause a credit crunch with the former or increase borrowing and indebtedness with the latter.

The most recent data showed threats to growth with capital investment falling more-than-expected and housing data suggested less projects coming online.

If anything the RBA may strike a dovish tone - meaning in favour of lower interest rates - rather than a hawkish tone, and this could weigh on the Aussie.

Other key data includes retail sales data which is expected to show a 0.3% gain in July compared to the previous month when released on Monday, at 2.30.

The current account which measures a country's gross balance of trade as well as other cash inflows and outflows is forecast to show a deeper -11.1bn deficit in Q2, on Tuesday when it is released at 2.30. This would constitute a decline from the -10.5bn of Q1. A deeper-than-expected current account deficit is negative as it shows less aggregate demand for the Aussie Dollar and vice versa for a surplus.

British Pound this Week: The Calendar Heats up Again

Beware, politicians return to work from their summer holidays; cue the inevitable bickering on what Brexit should look like.

Therefore headline risks rise again and Sterling might prove sensitive to any notable developments. Of course, politics is impossible to call so we will be watching for the unexpected.

Rehashing our #Brexit scenario analysis. We're edging to a world where there are solid signs of progress (upper left quadrant). There are near-term UK political hurdles to still overcome - which may keep $GBP upside in check. But growing confidence that short $GBP not attractive pic.twitter.com/UJfkCo9Ar4

— Viraj Patel (@VPatelFX) August 29, 2018

The calendar does however have some economic releases to watch as the new month commences.

The main releases to watch in the week ahead are manufacturing, construction and services Purchasing Manager Indices (PMI) data for August.

PMI's provide relevant, timely, data which often provides a reliable guide to future, broader, economic trends.

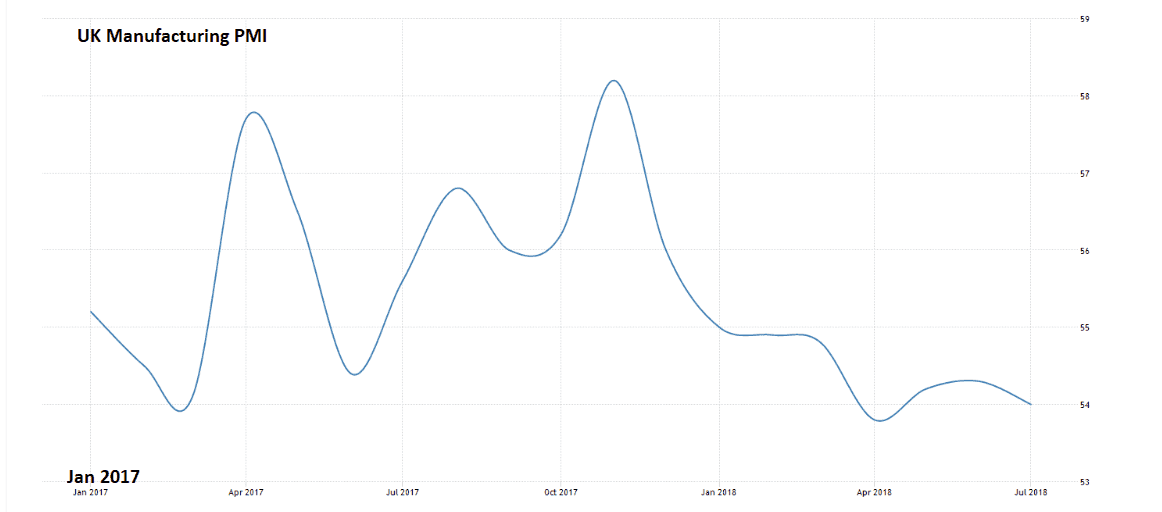

Manufacturing PMI is expected to slip from a 3-month low of 54.0 in July down to 53.8 in August when it is released at 9.30 B.S.T on Monday, September 3.

Manufacturing PMI has been in decline recently and further greater-than-expected weakness could weigh on Sterling, but as long as it remains above 50 - the level which differentiates expansion from contraction - it is unlikely to heavily influence the exchange rate.

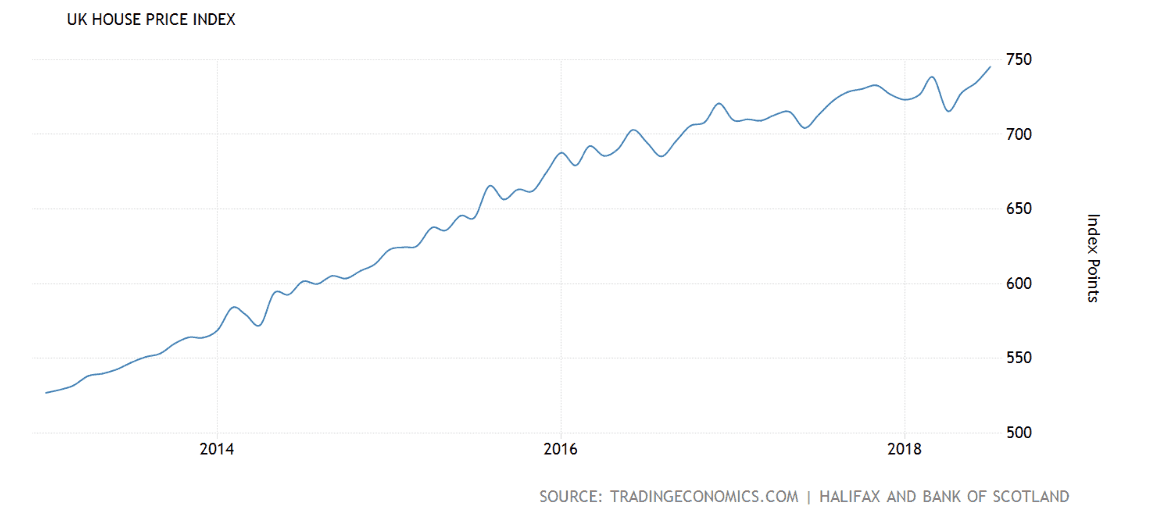

Image courtesy of tradingeconomics

The construction PMI is less significant than the other two but it is released at the same time on Tuesday and is forecast to fall to 54.9 in August from 55.8 in July.

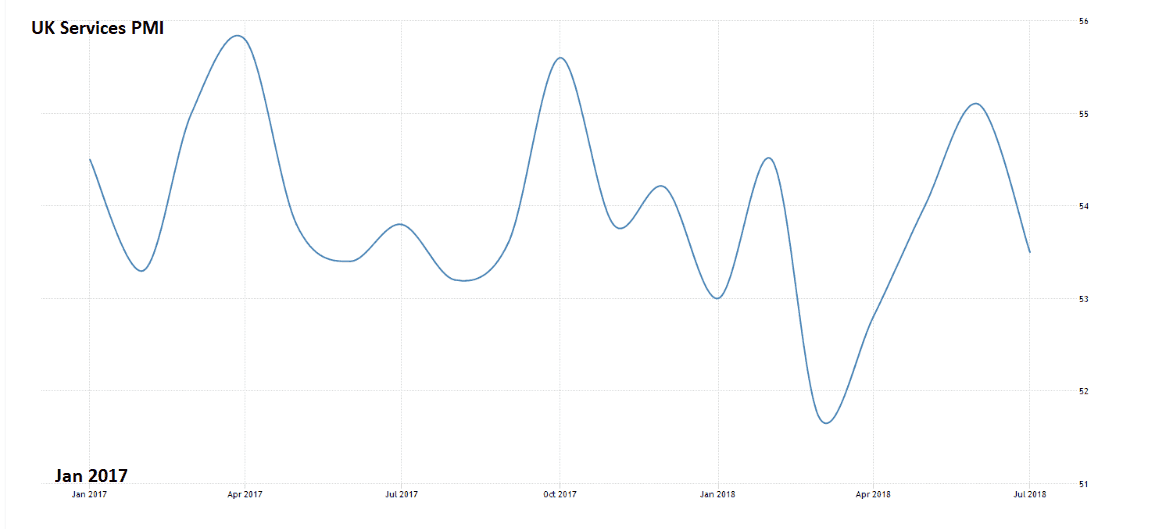

Services PMI is the most important release of the three as this sector accounts for over 80% of the UK's economy - economists are forecast a rise to 53.8 in August from 53.5 previously, when it is out at 9.30 on Wednesday. It is showing a more resilient if volatile progression.

Image courtesy of tradingeconomics.

Another key release for the Pound in the week ahead is the British Retail Consortium (BRC) retail sales monitor, which provides a useful leading indicator for broader high-street sales.

Halifax house price data for August is forecast to show a -0.2% fall compared to July but a 3.9% rise compared to August last year, when it is released on Friday at 8.30.

Although fluctuations in house prices can alert economists to the onset of deeper economic malaise with repercussions for Sterling, they have remained resilient of late and continue to rise overall.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Image courtesy of tradingeconomics.