Sell the Pound, Buy Australian Dollar: TD Securities

- GBP/AUD to break lower says investment bank

- GBP/AUD currently attempting to rebound

- Aussie employment data on Thurs said to be key

Image © Adobe Images

- GBP/AUD rate at publication: 1.8050

- Bank transfer rates (indicative guide): 1.7417-1.7544

- Money transfer specialist rates (indicative): 1.7600-1.7920

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

Foreign exchange strategists at TD Securities are entering a "short GBPAUD position" in order to capture value in a falling Pound Sterling against the Australian Dollar, which is tipped to benefit from a stronger-than-expected labour market report on Thursday.

The Canada-based international lender and financial services provider tell clients they aim to "fade the latest uptick in GBP that comes as the UK has taken further steps to reduce lockdown restrictions".

The British Pound was one of the best performing major currencies in the first three months of 2021, with analysts saying the country's rapid vaccination rollout offered the economy a chance of outperformance.

However, vaccination programmes are beginning to accelerate elsewhere, particularly the EU, leading to the view that the UK's vaccination advantage might soon fade and deprive Sterling of its recent source of outperformance.

"The UK has outperformed on the vaccine front, but this advantage has started to narrow. At the same time, however, the domestic economy continues to lag many of its peers," says Ned Rumpeltin, European Head of FX Strategy at TD Securities.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

Concerning the Australian side of the GBP/AUD equation, TD Securities warn of significant upside risks to Australia's March employment report.

"If confirmed, we think this could help break the AUD out of its recent torpor, but we think an AUD rebound is best pursued on the crosses. In line with our less-positive stance on GBP, we think GBPAUD downside is starting to look increasingly attractive," says Rumpeltin.

Australia is due to release employment data on Thursday, with consensus looking for a release of +35.0K.

The call comes as a regular monthly survey by National Australia Bank Ltd. showed Australia’s economic recovery was intensifying.

NAB's Business Conditions report - which measures hiring, sales and profits - reached a record high in March even as the government was withdrawing its JobKeeper wage subsidy.

The employment index component of the report climbed to 16 points from 9, pointing to ongoing strength in hiring, despite the survey being conducted from March 19-31 that includes the end of JobKeeper.

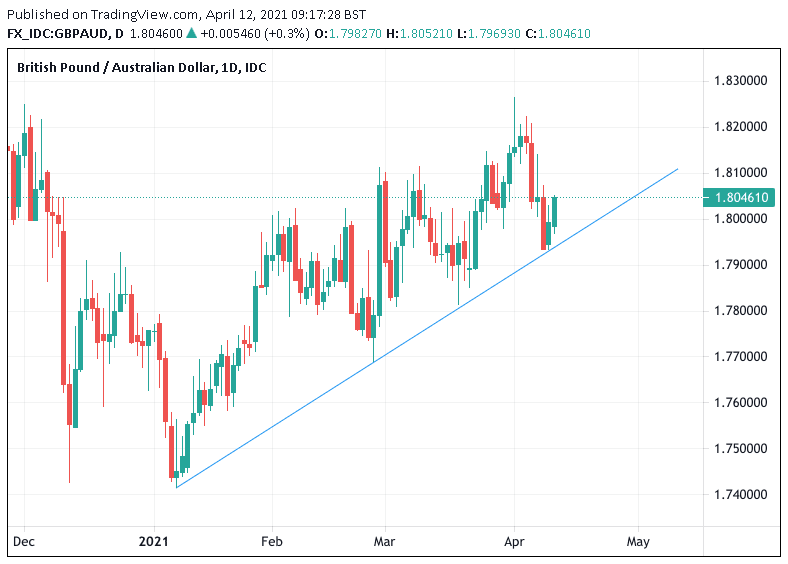

The Pound-to-Australian Dollar exchange rate (GBP/AUD) is meanwhile looking to record a third consecutive day of advances on Tuesday, but gains must accelerate if Sterling is to recapture the value it lost in the previous week.

GBP/AUD opened April at 1.8144 but was quoted back down at 1.7991 by the time markets closed on April 08.

It is at 1.8060 at the time of publication and TD Securities are targeting a move down to test support around 1.7595.

We reported at the start of the new week that the Pound's 2021 uptrend against the Australian Dollar still remains intact with an under-pressure UK currency picking up support at a critical support level in the previous week.

As can be seen in the above, a supportive rising trend-line is located at a series of lows formed in the broader rise of GBP/AUD.

If recent price action confirms the 2021 uptrend is indeed intact then GBP/AUD can engage in a recovery pattern over coming days, although a test of fresh 2021 highs remains unlikely this week and could be a prospect over a multi-week timeframe.