Surging Iron Ore Prices to Keep Pound-to-Australian Dollar Exchange Rate Under Pressure

- AUD in strong start to new week

- Iron ore market dynamics to underpin AUD further

- GBP/AUD will struggle to extend recent gains

Image © Adobe Images

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

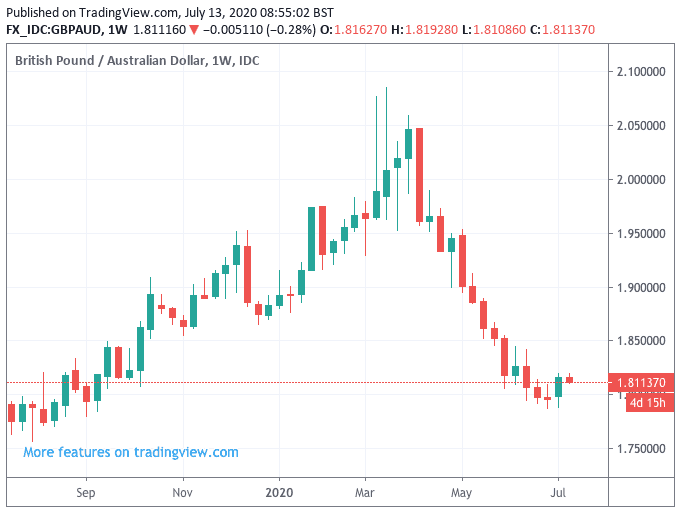

The Pound advanced 1.18% against the Australian Dollar last week, which made for the first weekly advance in a month and offer a rare spot of relief for Sterling sellers considering the trend has been resolutely lower since April.

Indeed, such is the strength of the downtrend the pair has not enjoyed two consecutive weekly advances since March 30 and this leaves us expecting the potential for some softness to emerge over coming days, particularly given the firm fundamental dynamics underpinning the Aussie Dollar's April-July advance.

Indeed, the Aussie Dollar is off to a flyer on Monday courtesy of a broad-based rally in global stock and commodity markets, with traders opting to look through the near-term noise of rising U.S. covid-19 infections and focus on the evolving recovery story.

"Currencies are still playing to the tune that has dominated over the past few weeks, i.e. a continued struggle between global risk aversion and global risk appetite. The latter prevails in the end over risk-off sentiment, but this is not a straight road. Concerns about the COVID-19 pandemic – new cases are steadily rising in the US; Melbourne has just announced another six-week lockdown – are still preventing risk-on sentiment from spreading much more across markets and currencies," says Roberto Mialich, FX Strategist at UniCredit Bank in Milan.

The Australian Dollar maintains perhaps the highest correlation with risk of its developed market peers, tending to rise in tandem with rising stock markets, and fall when they are in decline.

With markets up at the start of the new week, so too is the Aussie Dollar: The Australian-U.S. Dollar exchange rate is a third of a percent higher at 0.6973, the Pound-to-Australian Dollar exchange rate is a quarter of a percent lower at 1.8117.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Despite Melbourne being put into another lockdown, the fundamental backdrop behind the Aussie Dollar's strong run since March remains intact as the commodities the country exports continues to enjoy favourable dynamics which should ensure the balance of risks in GBP/AUD are pointed lower.

It has been confirmed that the country enjoyed record shipments of iron ore to China in June which lifted prices and the Australian Dollar according to John Meyer, Head of Research at brokerage SP Angel in London.

Iron ore shipments from Port Hedland in Western Australia rose to 7% mom and 19% year-on-year to 46mt in June from 43mt in May.

"The strong performance is driven by supply issues in Brazil due to problems with Dams at a number of iron ore mines and other disruption caused by COVID-19," says Meyer. "Disruption to Scrap supplies may have also driven smelters to produce more steel through blast furnaces."

According to Australia's Department of Foreign Affairs and Trade, iron ore exports accounted for 16.4% of Australia's exports in the 2018-2019 period following 25% growth on the previous year, with the trend only looking to continue in the current year, despite the covid-19 pandemic.

Port Hedline is the main export gateway for iron ore miners, and June’s outflow was higher than the previous record month set in 2019 says Meyer.

Year-to-date shipments have risen more than 6% to 271mt according to Bloomberg and China iron ore stockpiles rose 0.6% to 108.8mt last week, according Mysteel.

SP Angel expects Chinese ferro-vanadium prices to continue to rise on higher use of Australian iron ore as high-grade Australian iron ores contain less vanadium than iron ores from many other parts of the world.

"This requires more ferro-vanadium to be fed into smelters to meet stricter regulations for structural rebar and other structural steels," says Meyer. "Major flooding along the Yangtze will be met with massive new work on flood defences."