The South African Rand Rises After Reserve Bank Keeps Rates Unchanged

In an extremely close vote the South African Reserve Bank (SARB) policy committee decided to keep rates unchanged at 6.75% at its meeting today.

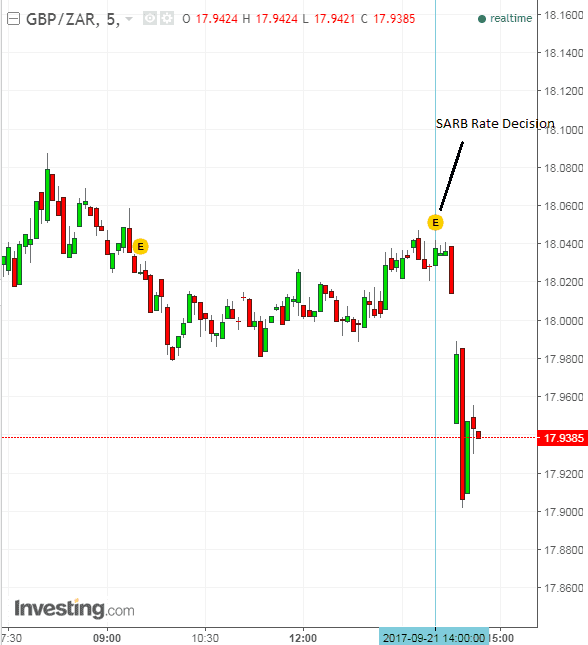

The South African rand rose on the news reaching GBP/ZAR 17.91 to the Pound, from a pre-meeting level of 18.04 (the exchange moves lower when ZAR strengthens).

Governor of the SARB, Lesetja Kganyago, said three members voted to keep rates unchanged whilst three voted to reduce rates by 0.25% - in the end his casting vote swayed the decision to no-change.

Kganyago said the South African economy recorded positive growth during the second quarter of 2017 following two consecutive quarters of contraction.

However, these positives were offset by the country’s poorer medium and long-term growth prospects due to falling domestic investment from low business confidence.

A news report on fin24.com said because of heightened uncertainties in the economy, the governing council felt it would be more appropriate to maintain rates at their current level, and reassess the data and the balance of risks at the next meeting.

The decision came as a surprise to markets who had been expecting the SARB to cut rates by 0.25%.

The central bank revised both their growth and inflation forecasts marginally higher.

The SARB said they expected the SA economy to grow at a rate of 0.60% 2017 - up from a previous forecast of 0.5%.

They expected an acceleration of growth to 1.20% in 2018, with inflation averaging 5.70% in 2017 and 5.80% in 2018.

In relation to the Rand they saw supportive factors from the continued accommodative policies of G10 central banks which meant investors were forced to search for higher yield elsewhere – in emerging market bonds such as South Africa.

“Net purchases by non-residents of South African government bonds have amounted to R(63) billion year to date. The domestic yield curve relative to other peer emerging market economies remains attractive to non-residents despite a decline in the curve across all maturities,” said the statement.

The main risks for the currency came from either the tightening of central bank policies which appears to be currently underway or from the threat of a credit rating downgrade.

“Longer-term bond yields and the rand remain vulnerable to a large non-resident sell-off in the event of further credit ratings downgrades resulting in South Africa falling out of the global bond indices,” said the SARB.

Trade is a supportive factor for the currency whilst political uncertainty an offsetting negative.

Despite the pull-back the GBP/ZAR pair remains in a technical uptrend.

After breaking above a key level of resistance at 18.04 we expect it to continue rising to our next forecast target at 18.62.