The South African Rand Already Has Many Positives Priced In

Whilst it is undoubted that the major driver of the Rand has been political risk the longer-term trend is still dictated by macro-economic factors.

The Rand’s strong appreciation over the last twelve months has been driven by two main fundamental catalysts, according to HSBC Global Research.

Then first of these has been the improving trade balance and the second the Rand’s previous extreme undervaluation.

The big question now is will these sources of strength continue to drive the currency higher or are they exhausted?

“Scope for trade improvement is limited,” says HSBC’s Murat Toprak in relation to the first driver.

Whilst global trade has improved on the back of the reflation upcycle and South Africa’s trade surpluses may continue growing, the stronger currency is now an impediment in itself to sustaining that strong rate of growth.

South African manufacturers also struggle to compete effectively for market share with other countries, says the analyst.

On the question of valuation, there is some value left in ZAR, says Toprak, but not enough to be, “constructive over the medium-term.”

Overall the “undervaluation signal is very weak,” says the HSBC analyst.

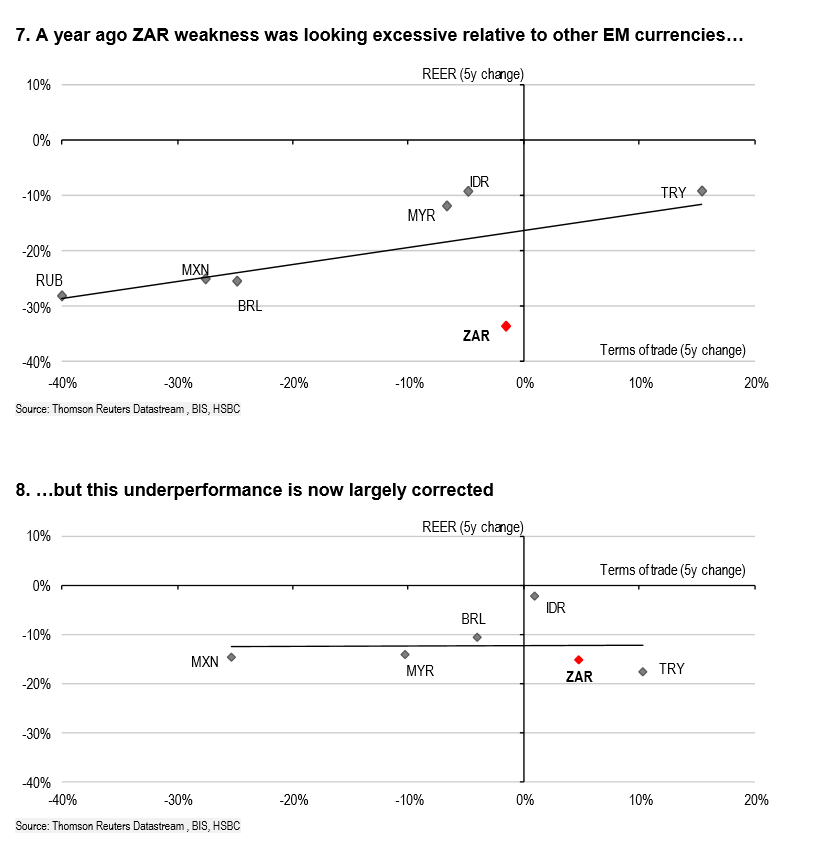

The change in the ZAR’s circumstances is clearly illustrated by comparison with other emerging market currencies when valued against their terms of trade.

Terms of trade is the price of exports as a ratio to the price of imports.

Currencies gain when the terms of trade rise because it shows the same quantity of exports will buy more imports and because buyers have to purchase exports in the host’s currency it is indicative of a strengthening currency.

A year ago, ZAR was undervalued when compared to its quite high terms of trade, as shown in chart 7 below.

It was also lower when compared to other EM currencies.

Chart 8, however, shows this situation has to a large degree corrected.

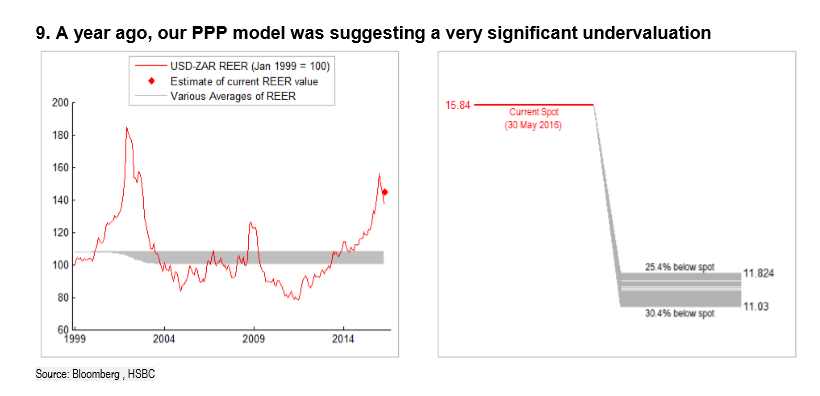

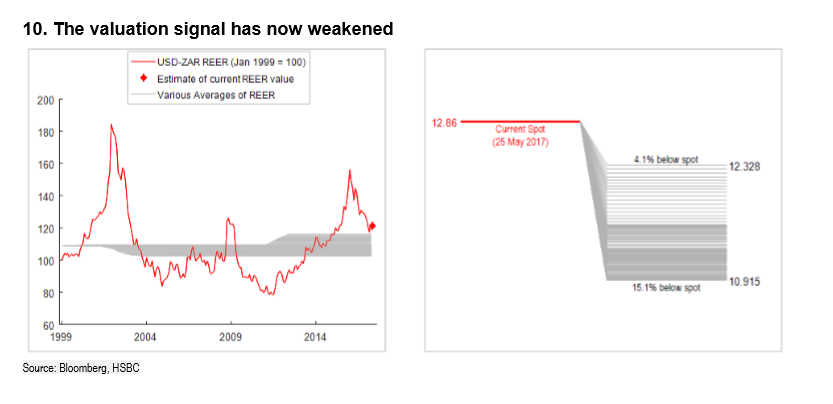

The same goes for comparisons based on the Purchasing Power Parity (PPP).

Previously the currency was grossly undervalued, but the rally over the last 12 months has now compressed the ‘valuation gap’.

The grey area on the charts is the ‘fair value’ range – i.e the value the currency ought to be at.

As can be seen, the currency is now a lot closer to fair value than it was a year ago.