SA Rand Won’t be Pushed Above Key 17.35 Level by Sterling

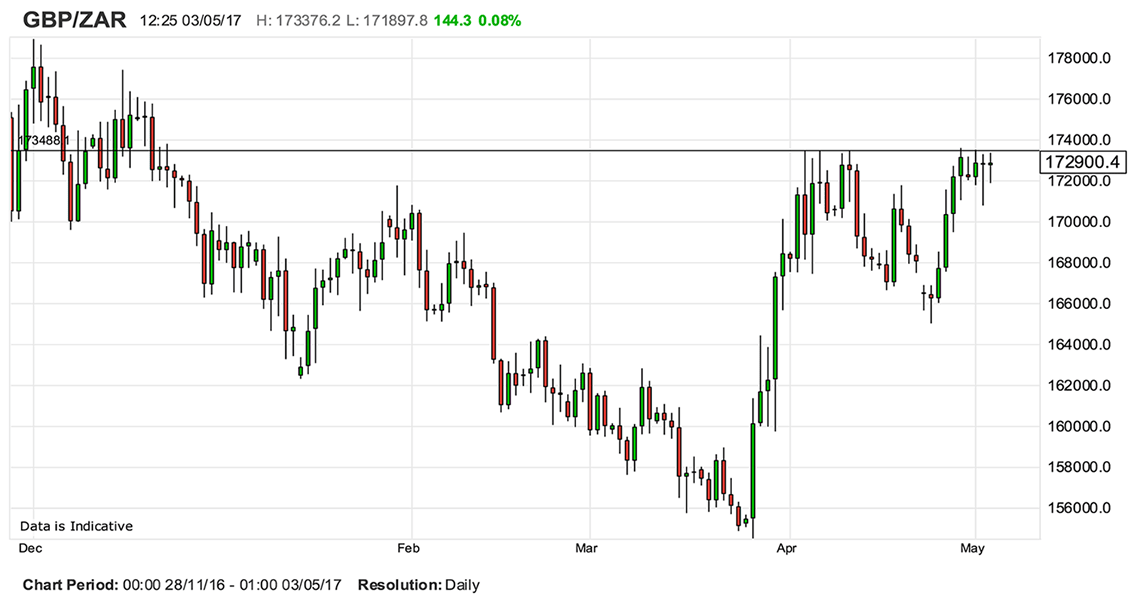

A titanic struggle in underway between the Pound and Rand over the 17.35 level where the exchange rate is seen to still be banging its head.

The last time a pound bought more than R17.35 was back in December 2016.

Having rallied off a floor towards 15.60 since mid-March it would appear that there is a good supply of Sterling whenever the ceiling is tested.

There are two distinct options those with an interest in this market should be aware of: Either the exchange rate breaks this resistance and makes a quick run higher or it is rejected and forced back into the mid-16.00’s.

Right now it is hard to see a catalyst but Sterling has been outperforming its major competitors for a few weeks now and there is little to suggest we would doubt the currency’s trend higher.

Meanwhile, “emerging Markets, especially South Africa, have not shrugged off the political cloud that hangs over its head,” say TreasuryOne - a Johannesburg-based foreign exchange brokerage.

While recent trade data showed a balance that came in with a decent surplus of R11.4bn, the market hardly took note as they wait for the first real action by newly appointed finance minister Gigaba.

“This seems to be the status quo in the short term - with politics the main decider on the local direction of the Rand, but can change should numbers start to dwindle in the next few months in relation to the downgrade and ancillary factors,” say TreasuryOne.

One key number the brokerage is watching are portfolio inflows, as that has tapered off in the last week and they say the Rand will weaken if that flow becomes more sparse.