South African Rand Drivers Are Shifting but Risk of Losses Still Lingers

- Written by: James Skinner

"The stock of South African money invested abroad is now larger than foreign money invested in South Africa (for the first time since the early 2000s)" - Goldman Sachs.

© Lefteris Papaulakis, Adobe Images

The South African Rand was a middle-of-the-road performer for the period in the final session of the week but is said to be at risk of losses in the short term while shifting fundamental drivers might be likely to see the currency trade differently over the medium term too, according to Goldman Sachs research.

South Africa's Rand had fallen more than one percent against a broadly stronger Dollar for the week by Friday, leaving the currency trailing behind many of its most directly comparable counterparts after market-implied expectations of the Federal Reserve (Fed) interest rate rose sharply in earlier trade.

But many currencies in the G10 grouping sustained heavier losses than G20 counterparts in a punishing week for risky assets like stocks, making the Rand a middling performer overall and along the way while giving credence to the research conclusions recently drawn by strategists at Goldman Sachs.

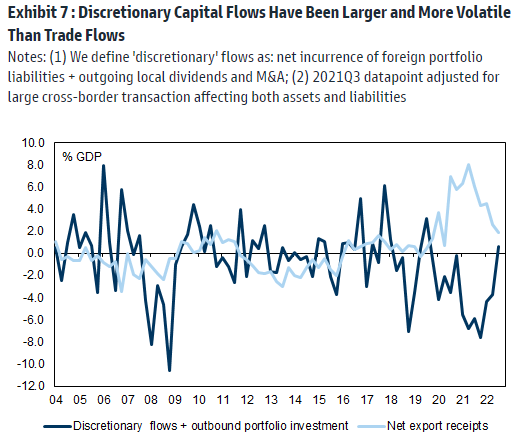

"We recently argued that a combination of structural balance of payments and regulatory changes is likely to alter the behaviour of South Africa's historically volatile and high-beta currency," says Bojosi Morule, a CEEMEA economist at Goldman Sachs.

Source: Goldman Sachs Global Investment Research. Click image for closer inspection.

"More specifically, given the increasing prominence of locally driven capital flows, we see scope for a weaker, more volatile, but potentially lower-beta Rand," she adds in a Thursday research briefing.

One consequence of any "lower-beta Rand" would be a reduced correlation with the up-and-down motion of stocks and commodities, meaning Rand exchange rates might be expected to rise and fall by less than was the case previously.

This results in large part from the balance-of-payment implications of last year's increase in the foreign direct investment limit from 30% to 45%, which has given domestic portfolio flows scope to better offset the effects of foreign capital as it enters and exits the country.

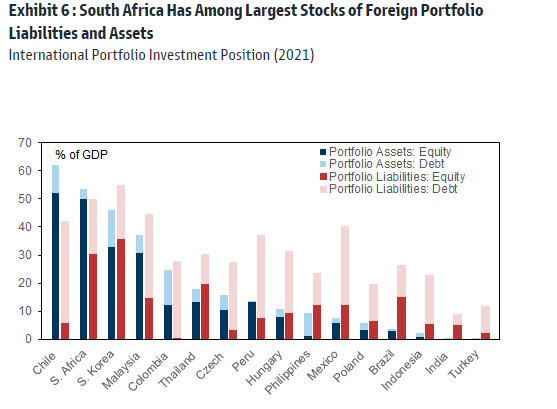

"Foreign portfolio investments in South Africa have historically been more important that local holdings of foreign assets," Morule says.

Source: Goldman Sachs Global Investment Research. Click image for closer inspection.

"This backdrop has changed, however: the stock of South African money invested abroad is now larger than foreign money invested in South Africa (for the first time since the early 2000s)," she adds.

Much still depends on the extent to which the higher outbound investment limit is utilised, however, but Morule and colleagues cite power cuts resulting from increased load-shedding at Eskom for thinking there is a significant risk of larger outflows being seen in the immediate months ahead.

"We see risks that power cuts could intensify to stage 8 or a further incremental 2GW of peak supply removed from the grid (all else equal), with implications for the economy and the Rand," Morule writes, citing the forthcoming winter period.

"In the medium term, our expectation is that significant new generation capacity will come online – consistent with National Treasury’s projections – and this should alleviate the electricity supply constraint considerably next year and imply an end to power cuts by late 2025," she adds.

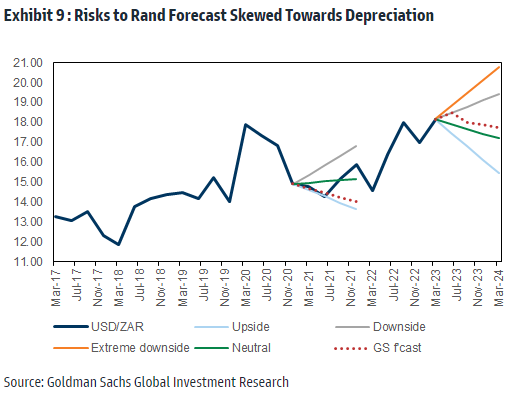

Source: Goldman Sachs Global Investment Research. Click image for closer inspection.

All of this could mean a weaker Rand in the short-term but also a potentially more resilient Rand in periods of losses for global markets.

Goldman Sachs forecasts look for USD/ZAR to edge higher to 18.50 in three months before falling to 17.75 over 12 months, while GBP/ZAR is seen falling to 21.25 in three before edging back up to 21.63 over the coming year.

Risks are said to be on the downside for the Rand in each case, however.

"While our 12m forecast shows some strength vs. the Dollar given our broader Dollar view, the Rand has a lower total return than most other high-yielding currencies, consistent with the more downbeat local view," Morule says.