Softer South African Rand Helps GBP/ZAR after Energy Woe Stifles SARB

- Written by: James Skinner

"Given deteriorated growth prospects, the risk of currency weakness has increased" - South African Reserve Bank.

Image © SARB

A softening South African Rand helped to lift GBP/ZAR alongside USD/ZAR and others in the penultimate session of the week after the South African Reserve Bank (SARB) downgraded forecasts for the local economy and lifted its cash rate by less than many forecasters were anticipating.

South Africa's economy had been on course to grow by more one percent this year following one of its strongest expansions for more than a decade in 2022 but the constraints imposed by January's severe failures of the local power grid prompted the SARB to slash its forecast on Thursday.

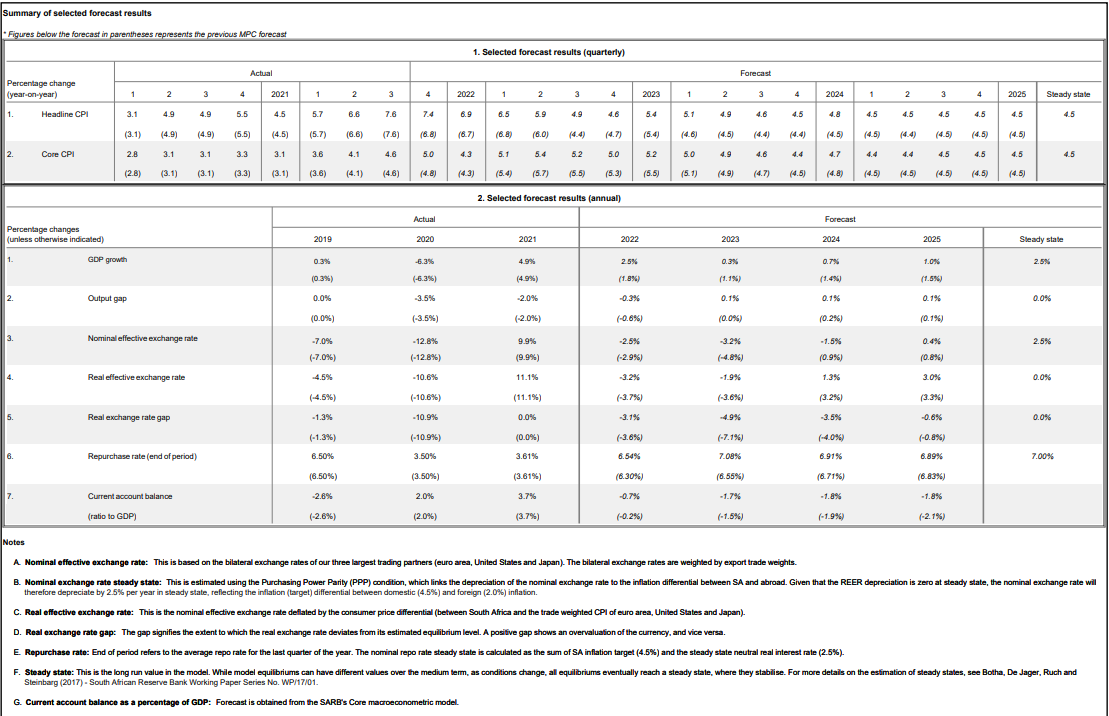

"Extensive load-shedding and other logistical constraints" were cited for a 2023 GDP forecast that now sits at just 0.3%, down from 1.1% previously, and others suggesting similar underperformance of earlier projections for 2024 and 2025.

"While the government has indicated optimism on the ability to end load shedding within the year, Eskom’s comments suggest otherwise and the SARB is clearly not factoring in much chance of improved power supply," says Carmel Nel, an economist and macro strategist at Matrix Fund Managers.

"Electricity constraints, weak global growth, lower commodity prices and depressed sentiment result in a weaker growth outlook. This, in turn, is expected to dampen inflation pressure down the line," she adds.

Above: Pound to Rand rate shown at daily intervals alongside USD/ZAR, Click image for closer inspection.

Above: Pound to Rand rate shown at daily intervals alongside USD/ZAR, Click image for closer inspection.

While many economists had anticipated that South Africa's cash rate would be lifted by half a percentage point to 7.5% on Thursday, the downgraded growth outlook prompted a narrow majority of SARB policymakers to elect in favour of a smaller 0.25% increase to 7.25%.

However, pricing in the forward rate agreement (FRA) market had indicated beforehand that investors were expecting the decision to be a close call between the smaller increase delivered and the larger step that consensus among economists had penciled in.

"In addition, the last round of inflation data releases was on the soft side relative to expectations. While much of the disinflation has been due to lower fuel price inflation, broader segments have shown a turn," Nel says.

"If inflation expectations in the BER’s Q1 survey show a marked decline, then there is a notable chance that this is the end of the hiking cycle. However, we think the numerous risks between now and the March meeting will ensure that a further 25bp hike remains on the cards," she adds.

South African inflation eased in December in both overall and core terms while Thursday's updated forecasts suggest the decline in core inflation is likely to extend throughout the year, taking it back to the 4.5% midpoint of the SARB's three-to-six percent target band.

Above: South African Reserve Bank economic forecasts. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Above: South African Reserve Bank economic forecasts. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Core inflation overlooks prices of items like energy, food and some other goods because of the distorting impact they can have on domestically-driven price trends, although it is sensitive to the overall measure of inflation and some forecasts for the latter were actually lifted on Thursday.

"While core inflation in December came out significantly better than expected, increases in electricity and food price inflation and higher headline inflation for 2022 as a whole keep the headline inflation forecast elevated in the near and medium-term," the SARB says in its statement.

"Risks to the inflation outlook are assessed to the upside. Despite some easing of global producer price and food inflation, global price levels remain elevated and Russia’s war in the Ukraine continues," it adds.

Rand losses were limited on Thursday and with financial markets continuing to speculate that interest rate cuts could be announced by the Federal Reserve as soon as the second half of this year, further downside risk for the South African currency might also be only modest.

However, much depends on the trajectory of the global economy and interest rates elsewhere, while the SARB itself said on Thursday that "Given deteriorated growth prospects, the risk of currency weakness has increased."