South African Rand's Break Higher Sees GBP/ZAR and USD/ZAR Facing Further Losse

- Written by: James Skinner

- USD/ZAR & GBP/ZAR breaking beneath key averages

- As USD’s retreat refloats commodity & EM currencies

- ZAR bolstered by improving domestic fundamentals

Image © Pound Sterling Live.

- GBP/ZAR reference rates at publication:

- Spot: 20.10

- Bank transfer rates (indicative guide): 19.39-19.53

- Transfer specialist rates (indicative): 19.91-19.95

- Get a specialist rate quote, here

- Set up an exchange rate alert, here

The Rand rallied as the U.S. Dollar beat a hasty and widespread retreat at the opening of a holiday-shortened week, pushing USD/ZAR and GBP/ZAR beneath key levels on the charts while opening the door in the process to the prospect of further gains ahead for the South African currency.

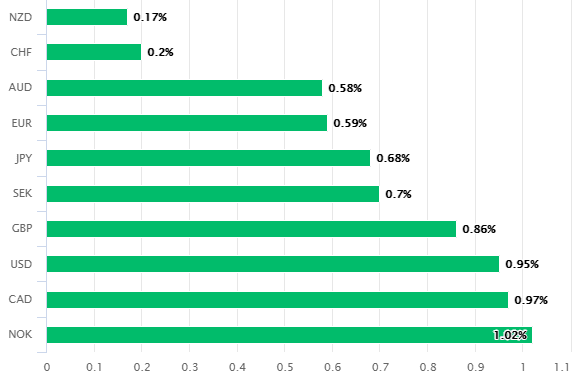

U.S. Dollar declines lifted all currencies but those with a commodity connection or a high yield appeal were out in front on Tuesday and the South African Rand ticked both boxes to advance smartly on the day, as well as ahead of a busy period for the U.S. economic calendar.

Multiple important figures are due out of the U.S. this week but there’s uncertainty over whether they’ll provide the same degree of support to the Dollar as they have done recently following Friday’s address from Federal Reserve Chairman Jerome Powell.

Above: South African Rand on Tuesday measured against G10 major currencies. Source: Pound Sterling Live.

“US data is likely to be mixed, but markets are expected to continue to focus heavily on the labour market data, as this is perceived to be the key area where a reduction in the FOMC’s dovish tone could come from,” says Annabel Bishop, chief economist at Investec.

Chairman Powell confirmed last Friday that the Fed is likely to begin winding down its quantitative easing programme before year-end but ruffled the Dollar’s feathers when saying the economy will have to pass “a different and substantially more stringent test” before the bank would be willing to lift its own interest rates, evidently disheartening some traders and later reducing the market-implied probability of a Fed rate rise before the end of 2022.

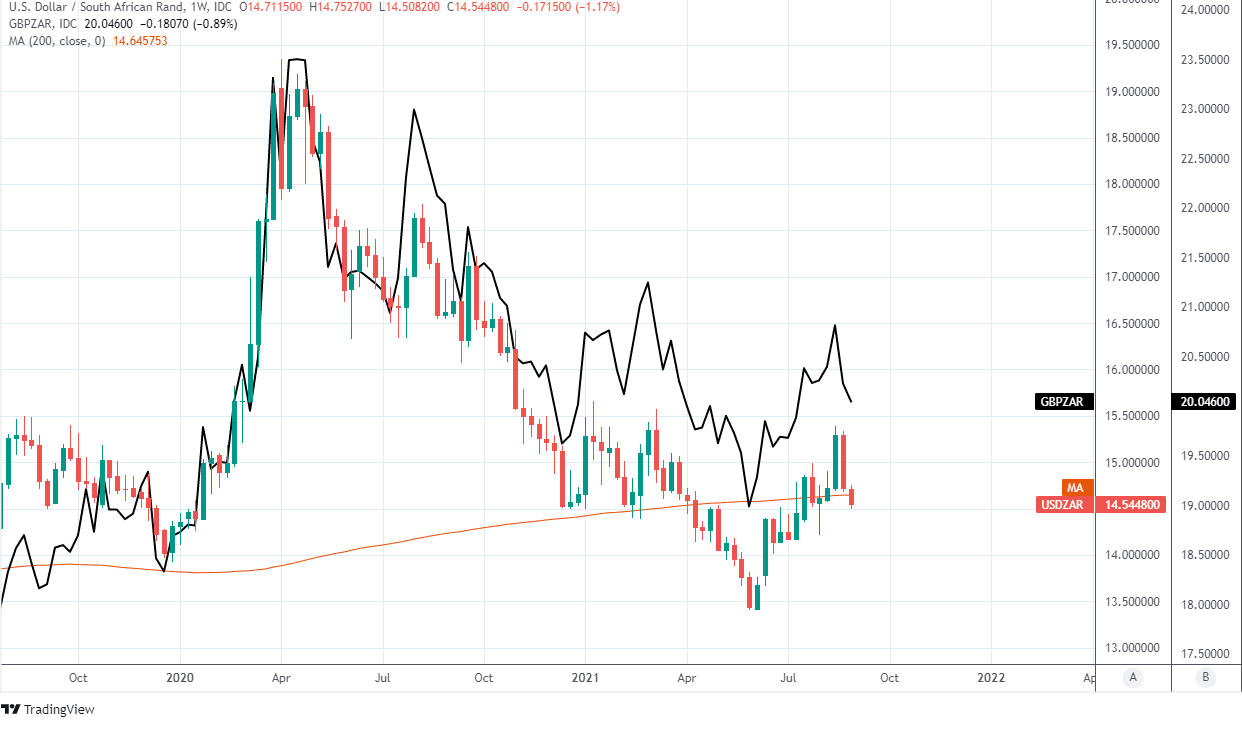

This has been a boon for non-Dollar currencies including the Rand, which pushed a retreating greenback below both 200-day and 200-week moving-averages on the charts this Tuesday in price action that weighed heavily the Pound-to-Rand rate after Sterling proved unable to keep up with its South African counterpart.

“The appreciatory trend remains fundamentally supported by the elevated rand basis, oversized SA trade surpluses and a receding political risk premium. Fiscal risks are still being priced into the fair value assumptions on local bond yields, however, the GDP revision has reduced anxieties around the magnitude of SA’s debt burden,” says Nema Ramkhelawan-Bhana, head of research at Rand Merchant Bank.

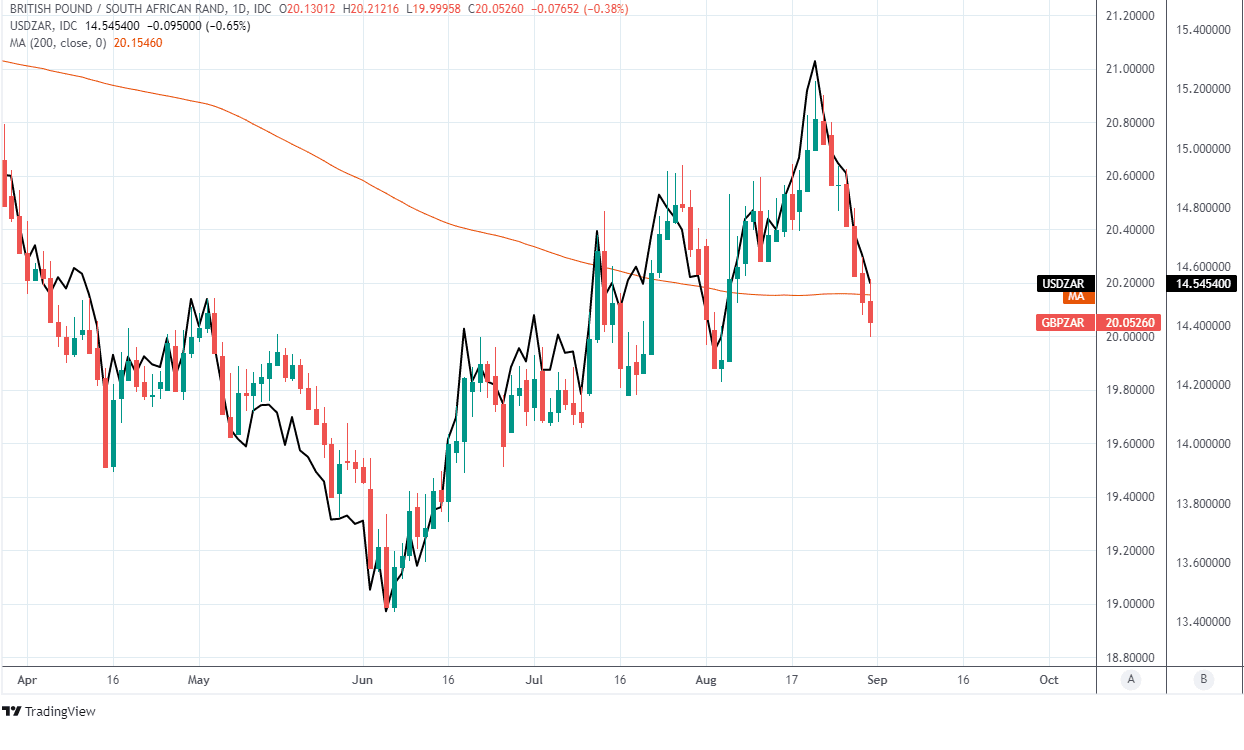

Above: Pound-to-Rand rate shown at daily intervals with USD/ZAR. Heads for fourth consecutive loss when crossing below 200-day moving-average.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Buttressing the Rand in its appreciation this Tuesday and explaining its outperformance over the recent week are previous U.S. Dollar declines as well as last week’s revelation by Statistics South Africa that the country’s economy did not actually shrink as much as was previously feared in 2020.

“The revision to its GDP statistics, with the economy now 11% larger than in June (periodic GDP revisions are normal for economies around the world), sees last year’s debt to GDP ratio around 71% instead of 80%, and a lower trajectory as a ratio of GDP. This has doubtless benefitted the rand as well, although actual planned debt levels have not moderated,” Investec’s Bishop says.

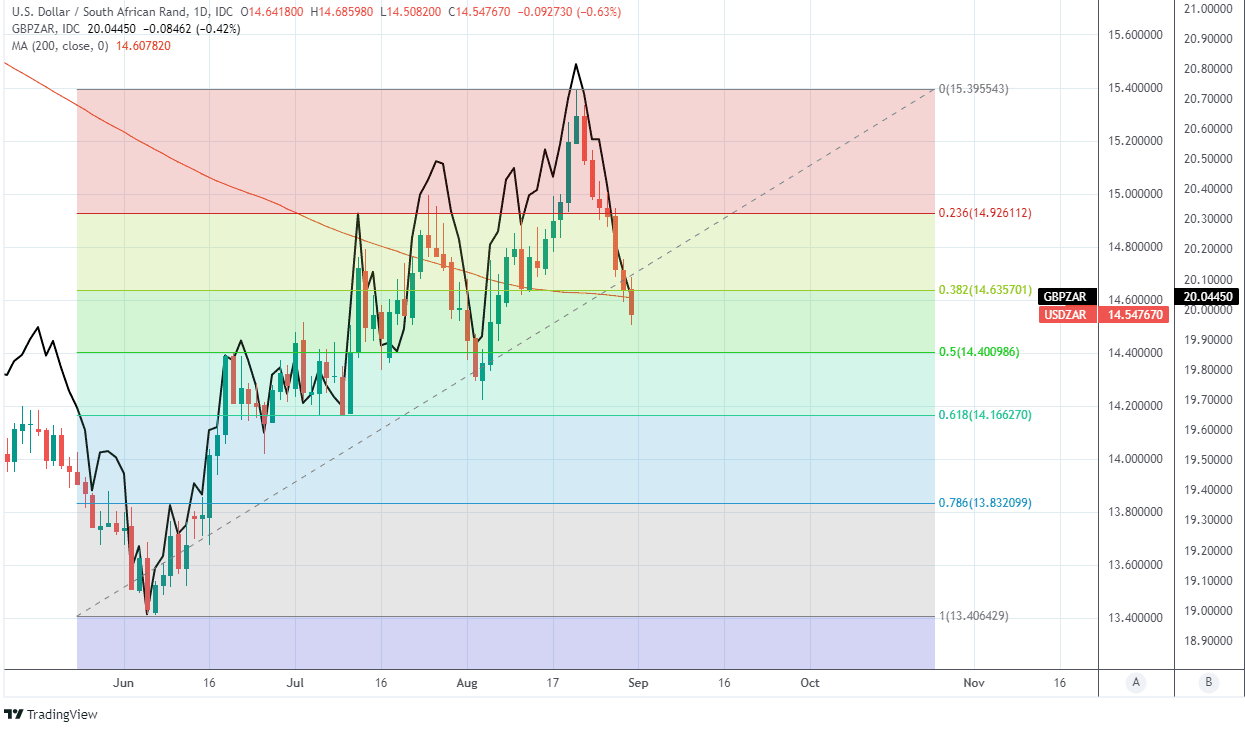

Tuesday’s price action pushed USD/ZAR and GBP/ZAR below key levels on the charts and with the Rand enjoying improved domestic newsflow and the Dollar downturn, the risk is on the upside for the South African currency, which was close to having unwound on Tuesday half of the losses seen since early June when the U.S. Dollar first began to recover in anticipation of a ‘hawkish’ shift in Federal Reserve policy.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“USD/ZAR lost upside momentum below the March peak at 15.5716 and is to slide further still,” says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank. “Minor support is seen along the 200 and 55-day moving averages at 14.6255/14.5568. Further down sits the early August low at 14.2237 and the April low at 14.1413.”

While the charts are flagging further gains as likely, and the Dollar’s nascent declines are positive for the South African currency, some analysts out there have suggested that it’s 2021 inclination toward outperformance could be likely to fade, although mainly when measured against other emerging market currencies that have central banks which have raised interest rates or signalled an intention to do so in the near future.

“Several factors are likely to weigh on Rand and we expect underperformance on a relative basis,” says Sean Kelly, an analyst at J.P. Morgan, who tips USD/ZAR for a fall to 14.0 by the end of September. “We expect ZAR to only underperform on a relative basis vs. better placed currencies such as RUB.”

The Rand’s earlier outperformance was facilitated in substantial part by barnstorming gains for commodity prices that lifted the values of export goods, converting the South African current account deficit into a surplus in the process and while boosting the perceived ‘fair value’ of the currency in the eyes of investors along the way.

But commodity prices have since cooled and South Africa’s inflation rates have meanwhile been dampened by a host of factors, which have seen market expectations for the South African Reserve Bank interest rates tempered, which has been a favourable development for National Treasury but less of a supportive outcome for the Rand moving forward.

“We maintain a benign view of underlying inflation dynamics (despite supply factors that should push headline inflation higher in 2021), and forecast a persistent undershoot of the 3%-6% inflation target mid-point, which we think will prompt the SARB to maintain its dovish stance. Our views on inflation and monetary policy are more dovish than market pricing,” says Clemens Grafe, co-head of CEEMEA economics at Goldman Sachs.

The Reserve Bank cited this tamer inflation outlook alongside ongoing risks posed by the coronavirus and South Africa’s own economic vulnerabilities in July for accepting the advice of its quarterly-projection-model that an initial increase in the country’s 3.5% cash rate be delayed until the final quarter.

Kelly and the J.P. Morgan team tipped USD/ZAR for a fall to 14.0 by the end of September in their latest review of the bank’s forecast last week but anticipate that will be the peak for the South African currency, which is seen being followed by a climb back to 14.25 into year-end.

Meanwhile, Grafe and the Goldman Sachs team see USD/ZAR falling to 13.30 over the next three-months before declining further to 13.0 over a six month horizon, with the dominant difference between the two banks’ forecasts being opposing views on the outlook for the U.S. Dollar.

Above: USD/ZAR shown at weekly intervals with 55 and 200-day moving-averages, Fibonacci retracements of June’s rally indicating possible areas of additional support for the Dollar and GBP/ZAR.