GBP/USD Rate: Still Well Supported says Technical Pro

- Written by: Gary Howes

Image © Adobe Images

The Pound to Dollar exchange rate (GBP/USD) has seen a setback over recent hours but technical analysts say it is too early to capitulate and call an end to the multi-week uptrend.

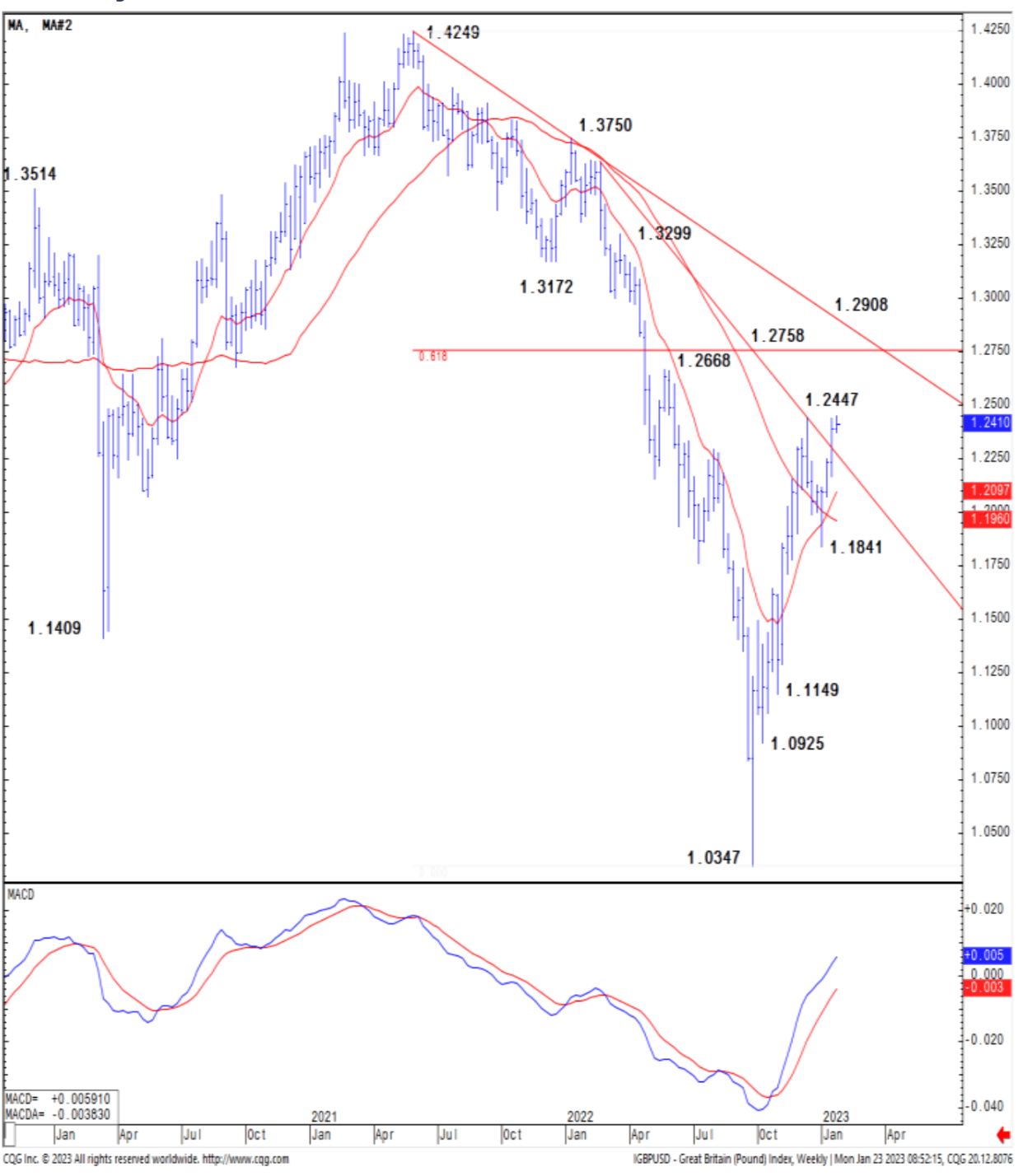

David Sneddon, a technical analyst at Credit Suisse, says an eventual break above the 1.2445/47 December highs should see resistance next at 1.2668 come into play.

"GBPUSD remains well supported above its rising 13-day exponential average and with a small bullish 'outside day' in place and the downtrend from February last year broken the spotlight remains on the 1.2245/47 December highs," says Sneddon.

"Whilst we may continue to see this cap for now, we are biased to an eventual sustained break higher emerging," he adds.

GBP/USD has risen since lows in September proved a broader turning point for a heavily-sold Pound and the broader multi-month Dollar rally.

The 2023 high stands at 1.2448, reached on Monday, but the pair has since fallen back following the release of disappointing domestic data.

Above: GBP/USD at weekly intervals, image: Credit Suisse. Consider setting a free FX rate alert here to better time your payment requirements.

UK PMIs showed a further slowdown in economic activity in January and emboldened expectations for a UK economic recession to take hold in the first half of 2023.

Nevertheless, the Dollar remains an important player in GBP/USD and an extension of recent weakness could pip concerns over the UK economic outlook and assist the exchange rate higher.

"This should then clear the way for strength to extend to next key resistance at 1.2668/1.2758 – the May 2022 high and 61.8% retracement of the 2021/22 fall," says Sneddon.

Attainment of these levels would potentially usher in a fresh phase of consolidation, says Sneddon.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"Support is seen at 1.2335/25 initially, below which can see a test of the 13-day exponential average and price support at 1.2265/55, but with this ideally holding. Below here though would warn of a more concerted correction with support next at 1.2169," he adds.

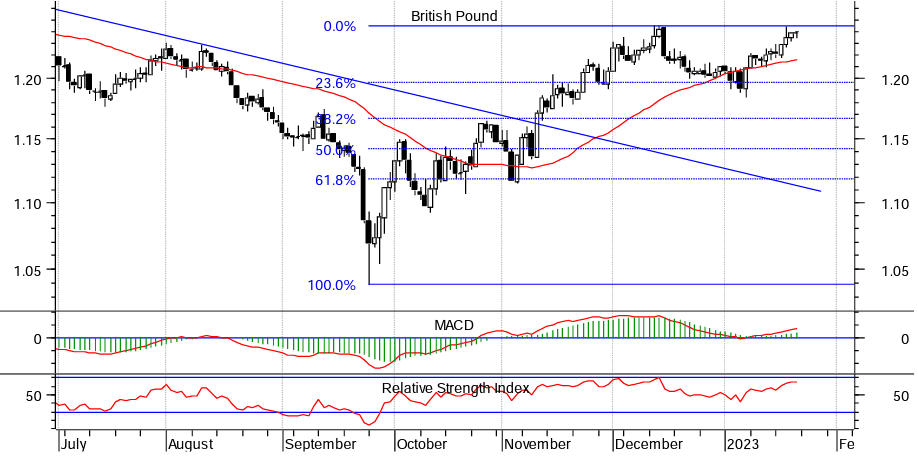

Bill McNamara, technical analyst and founder of The Technical Trader says GBP/USD warrants a closer look following recent price action.

"Thanks in no small measure to the ongoing weakness in the US currency, sterling has pushed back up to the upper end of its recent range and is now within striking distance of December’s six-month peak, at 1.2421," he notes.

"Although it looks somewhat overbought on the 14-day RSI the MACD implies that upward momentum is still building," says McNamara.

A close above $1.25 would look short-term bullish on the charts, he adds, and the next upside target would then be last May’s peak, at ~1.265.