Beware the U.S. Dollar's Final Kick

- Written by: Gary Howes

- USD uptrend to end in 2023

- Near-term strength therefore likely

- GBP & EUR at risk of further weakness

Image © Adobe Images

The Dollar could be in the final phase of its multi-month rally according to analysts at Capital Economics, although they warn it is still too soon to prepare for the Greenback to roll over and turn trend.

Analysis from the independent financial and economics research provider finds the Federal Reserve is nearing the end of its tightening cycle, and as a result, there is limited scope for a further widening of expected interest rate differentials in favour of the Dollar.

But the research also suggests the Dollar only turns after the Fed has finished hiking, which offers some clues as to the outlook for the Pound to Dollar exchange rate (GBP/USD) which has been trending lower since mid-2021 in sympathy with the broad-based rally in the U.S. currency.

Expectations for interest rate hikes at the Fed, the war in Ukraine and a post-pandemic equity market drawdown have all conspired to push the Dollar higher.

"The dollar is now around 15% stronger on a trade-weighted basis since the start of 2021, on par with the fastest dollar rallies on record," says Jonas Goltermann, Senior Markets Economist at Capital Economics.

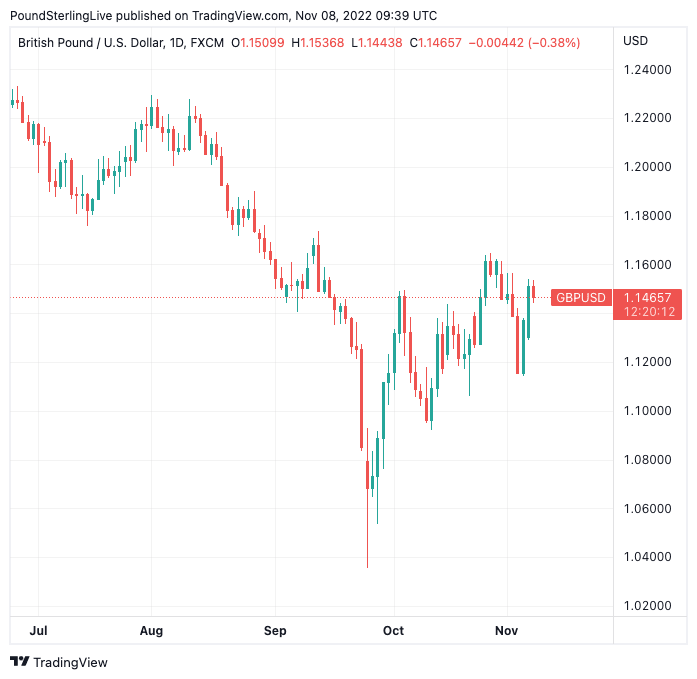

The trend lower in GBP/USD culminated in an all-time low of 1.0354 being reached on September 26, following a sizeable down-move that drew a number of analysts into making predictions for the decline to extend all the way to parity and then beyond.

Above: GBP/USD at daily intervals. To better time your payment requirements, consider setting a free FX rate alert here.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

At the time, analyst Jordan Rochester at Nomura said the slump was a precursor to an eventual move below parity by year-end.

"What we witnessed this morning, with the slight recovery in GBP from the depths of sub-1.04, is likely to be short-term profit taking rather than any material reason for cheer," said Rochester on September 26 following the printing of all-time lows.

The Pound has since recovered against the Dollar, with the 'blowout' seen on September 26 resembling the kind of excessive move that tends to portend the end of a long-running trend.

For the Pound to fall below parity against the Dollar the U.S. currency must resume its trend of appreciation.

Looking at the Dollar index - a broader measure of overall U.S. Dollar performance - shows a peak was reached close to the nadir in GBP/USD:

Above: The Dollar index at daily intervals.

The above chart also shows that while the Dollar has come off recent highs, it is still elevated by long-term measures.

Is the Dollar done appreciating, or is it merely catching its breath ahead of another impulse higher?

"It's still too early to call for a proper trend reversal, and the dollar could still hit new highs if the global outlook deteriorates further, but the scope for further gains seems limited from here. Chasing further dollar strength doesn’t seem attractive from a risk/reward perspective," says Marios Hadjikyriacos, Senior Investment Analyst at XM.com.

The Fed confirmed to markets in its October update that it was not yet done hiking interest rates, disappointing some market participants expecting an imminent 'pivot' in Fed policy.

It is this 'pivot' towards the end of the hiking cycle that would ultimately undermine Dollar strength and potentially result in a turn in trend.

But the Fed is nevertheless likely to slow down its rate hiking cycle with a 50 basis point hike now expected in December, which would signal the end to a period of outsized 75bp hikes.

A further slowdown is almost certain in early 2023 as the economy slows in reaction to the already-delivered rate hikes.

But there is a reason why it would be premature to bet against the Dollar yet, warns Goltermann.

(If you are looking to secure your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

"In most previous Fed policy cycles, the dollar continued to appreciate even after short-term US interest rates peaked as rising safe-haven demand drove the greenback higher," he says.

"With the global economy now clearly slowing and financial market fragilities worsening, we continue to think that a similar scenario will play out this time around and that the dollar will appreciate further against most major currencies over the rest of this year and into the first half of 2023," says Goltermann.

Capital Economics says the U.S. dollar will strengthen further against most other currencies over the coming quarters as the Fed tightens policy aggressively, global growth slows, and risk appetite remains fragile.

"We expect the euro and sterling to fall further as Europe suffers a deeper recession than other major economies and the worsening of the region’s terms of trade continues to feed through to exchange rates," says Goltemann.

Capital Economics says it will likely be after the first half of 2023 before we can confidently call the end of the Dollar's spell of appreciation.

International Transfer Implications: GBP/USD

The Pound has endured a 15.20% loss of purchasing power against the Dollar in 2022, but Dollar buyers would have been at an even greater disadvantage back in late September when the rate fell to an all-time low.

GBP/USD looks to have experienced a counter-trend rebound during October, but there are now signs this is fading.

FX payments are largely about risk management, and the risk right now for those holding Pounds is the Dollar makes another leg higher.

Alternatively, those looking to buy Sterling could wait and see if the USD does in fact offer a final kick; after all, they have the luxury of sitting on multi-year strength.

To position for such a move, you could set an order for your ideal rate when it is achieved, more information can be found here. Alternatively, you could consider securing today's rate for use in the future if you are selling. For spot rates at bank-beating rates, enquire here.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks