New Zealand Dollar’s Vulnerability On Charts Poses Upside Risk for GBP/NZD

- Written by: James Skinner

- NZD/USD testing major support near 0.62 on charts

- Supporting GBP/NZD & tilting directional risk higher

- GBP/NZD could top 1.9625 if NZD/USD cedes 0.62

Image © Adobe Stock

The Pound to New Zealand Dollar rate has been contained within a well defined and relatively narrow range over the recent month but with the influential NZD/USD pair testing a major level of support on the charts, it’s possible that the breakout risk for GBP/NZD is on the upside.

New Zealand’s Dollar was one of the top performing major currencies in Thursday’s European session when the NZD/USD pair appeared to be drawing dip-buyers from the market after testing an important level of technical support located around 0.6250 on the charts in Asia Pacific trading.

This saw the Kiwi feature as one of only four currencies within the G10 contingent to rise against the U.S. Dollar, which strengthened broadly as government bond yields fell across the globe while stock and commodity prices remained on the back foot following a Wednesday sell-off.

“Risk sentiment is still fickle and fragile. Our buy-on-dip strategy remains intact, but with much lower levels and later timing in mind,” says Imre Speizer, head of NZ strategy at Westpac, in reference to NZD/USD.

“Global risk sentiment and Fed pricing remain the main drivers, with local fundamentals taking a back seat for now. That said, the Q2 NZ consumer confidence update was eye-catching,” Speizer and colleagues said on Thursday.

Above: NZD/USD shown at hourly intervals alongside GBP/NZD.

Above: NZD/USD shown at hourly intervals alongside GBP/NZD.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The New Zealand Dollar had fallen widely in the Wednesday session when investor risk appetite and many financial markets faltered following congressional testimony from Federal Reserve (Fed) Chairman Jerome Powell.

Wednesday’s weakness prompted the Pound to New Zealand Dollar rate to rally briefly above the 1.96 handle, leading it to test an important level of technical resistance around 1.9625 on the charts before dip-buying in NZD/USD pulled the Sterling pair back to earth on Thursday.

The 1.9625 level has scuppered repeated recovery attempts by Sterling since the early days of March but would likely give way, resulting in a breakout to the upside from a multi-month range, in any event where NZD/USD breaks below the important set of support levels tested this week.

“NZD/USD has established decent support around 0.6200 over the past month, and a period of ranging between there and 0.6600 is expected over the next few weeks,” Westpac’s Speizer said in a note to clients this week.

Whether the Kiwi can hold above the 0.62 handle has implications for GBP/NZD because the latter tends to closely reflect the performance of Sterling and the Kiwi when each is measured against the U.S. Dollar.

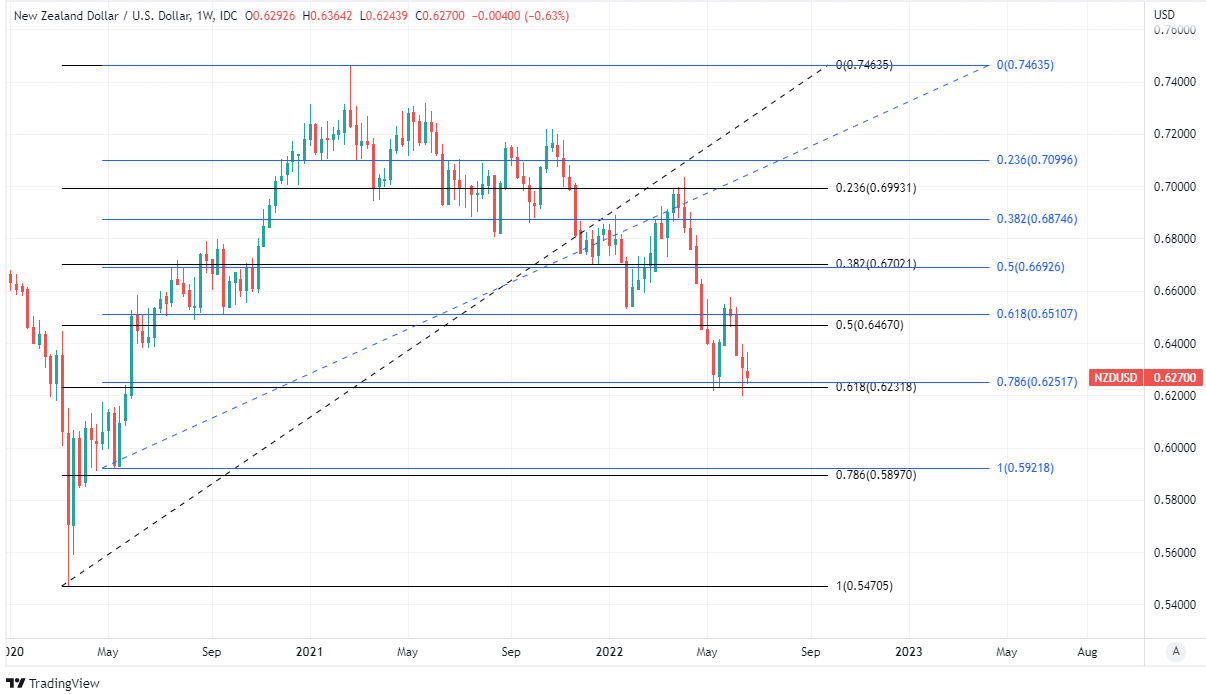

Above: NZD/USD shown at weekly intervals with Fibonacci retracements of March 2020 and May 2020 recovery rallies indicating medium-term areas of support for the New Zealand Dollar.

Above: NZD/USD shown at weekly intervals with Fibonacci retracements of March 2020 and May 2020 recovery rallies indicating medium-term areas of support for the New Zealand Dollar.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

This is in turn something that is likely to be determined in part by the data emerging from the New Zealand economy and its possible implications for Reserve Bank of New Zealand (RBNZ) interest rate policy in the months ahead.

“New Zealand’s housing market is weakening because of the Reserve Bank of New Zealand’s 175bp of tightening (with much more to come). House prices have eased by 5-6%, with another 6% fall likely,” says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

“Cost pressures remain intense. The RBNZ will need to keep increasing its policy interest rate. But our ASB colleagues do not expect the amount of tightening priced by the market,” Capurso and colleagues said this week after downgrading their New Zealand Dollar forecasts.

Capurso and the CBA team lifted their forecasts for the U.S. Dollar and cut projections for other currencies this week with the effect that the important NZD/USD exchange rate is now expected to end the year at 0.59, its lowest level since the first half of 2020.

This implies that GBP/NZD is likely to trade up to 1.9830 by year-end, which is roughly the level at which it entered 2022, although CBA’s new forecasts suggest this is more of a medium-term possibility and that GBP/NZD will trade at or below current levels throughout the third quarter.

Above: Pound to New Zealand Dollar rate shown at daily intervals with Fibonacci retracements of 2022 decline indicating areas of likely technical resistance for Sterling and support for the Kiwi. Click image for closer inspection.

Above: Pound to New Zealand Dollar rate shown at daily intervals with Fibonacci retracements of 2022 decline indicating areas of likely technical resistance for Sterling and support for the Kiwi. Click image for closer inspection.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes