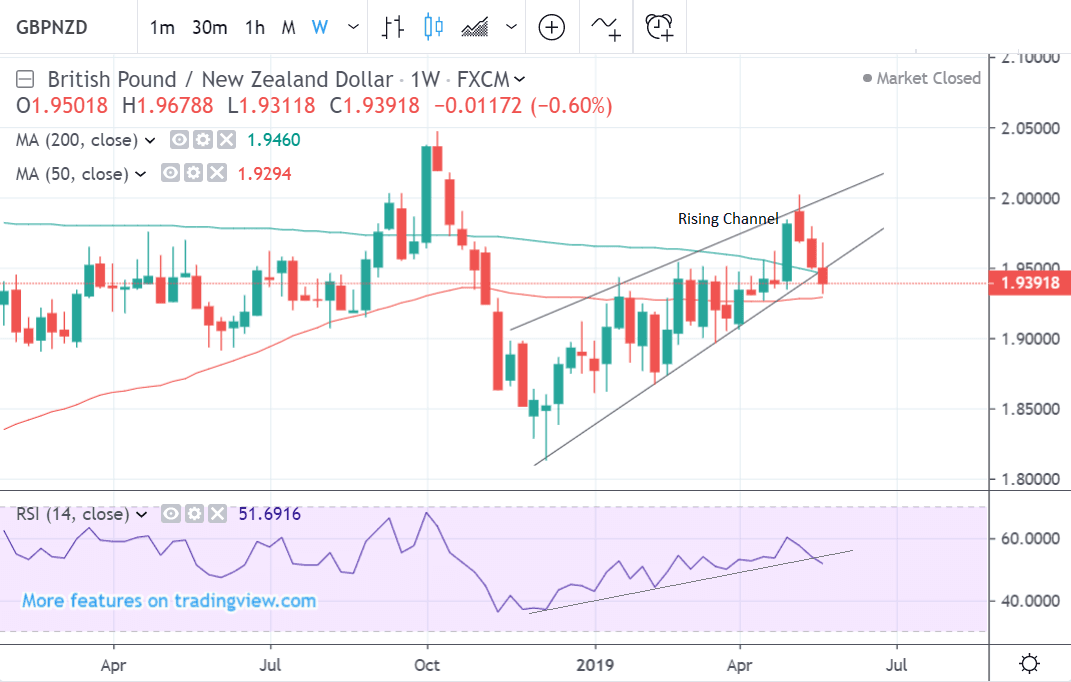

Pound-to-New Zealand Dollar Week Ahead Forecast: Breaking Down Out of Long-Term Rising Channel

Image © Natanael Ginting, Adobe Stock

- GBP/NZD poised to capitulate after channel break

- Large moving averages provide support

- Conservative Party Leadership race to impact Pound

- Global risk trends NZD

The GBP/NZD exchange rate is trading at 1.9428 at the start of the new trading week, about three-quarters of a cent lower than where it was at the same point at the start of the previous week.

From a technical outlook perspective, the pair is now in an established downtrend which started at the beginning of May. Given the old adage that the ‘trend is your friend,’ this downtrend is seen as biased to continue.

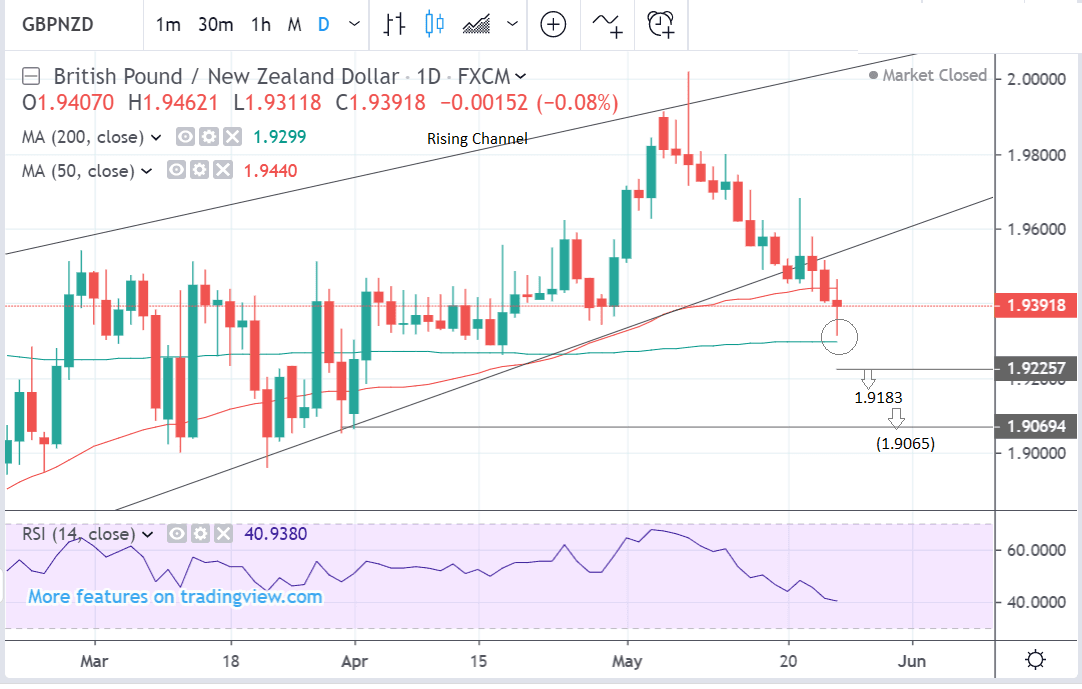

The pair has now broken below the lower borderline of the multi-month trend channel, which is a bearish sign.

A probable decline of at least 61.8% of the height of the channel extrapolated lower can be read, which in this case would indicate a target to aim for at 1.9183.

However, a formidable hard floor of support lies just below the current level of the exchange rate, composed of the 200-day moving average (MA) at 1.9391 and the 50-week MA at 1.9294, and these could prove difficult to break below.

It could therefore be the case that downside momentum is therefore halted, albeit temporarily.

The pair has also formed an indecisive doji candlestick on the daily chart (on Friday) suggesting a possible reversal in the short-term trend.

Nevertheless, the RSI momentum indicator is not oversold on either the daily or weekly chart, and on the weekly is has broken below a trendline, suggesting probably more bearish momentum to come.

Ideally, we would like to see a clear break on a closing basis below these MAs or a move below 1.9225 on a non-closing basis for confirmation of more downside.

The next target would then be 1.9183 as calculated from the channel breakout, followed by the March/April lows at 1.9065.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The New Zealand Dollar: What to Watch this Week

The main driver of the New Zealand Dollar remains global risk trends with the Kiwi is especially sensitive to trade dynamics with China, which is its largest trading partner.

The state of the Chinese economy and trade tensions with the U.S. can impact on the Kiwi as it affects likely Chinese demand for NZ exports: a Chinese economy firing on all cylinders is more like to display a greater demand for exports than an economy hampered by a trade-induced slowdown.

Chinese manufacturing PMI data out on Friday, therefore, could impact on the Kiwi if it comes out surprisingly lower than expected, as some economists fear. Currently the consensus forecast is for a slight decline to 49.9 from 50.1 in May, however, the impact of the trade war could be greater-than-expected.

A more general tone of risk aversion is permeating markets, and expected to continue with negative implications for NZD.

“It’s been a ‘risk-off’ session for global markets overnight, with equity markets a sea of red and bond yields sharply lower as markets anticipate another round of central bank easing. The US-China trade stand-off continues to hang over market sentiment, with no signs either the US or China are willing to take steps to de-escalate the dispute,” said Nick Smyth, an analyst at BNZ Bank, on Friday.

The decline in global growth expectations is reflected in the fall in New Zealand interest rates, which bodes negatively for the currency.

“NZ rates continued falling yesterday amidst growing global risks and the 10 year swap will break 2% today for the first time on record,” adds Smyth.

Chinese rhetoric is growing particularly negative towards the U.S. after the recent targeting of Huawei if the escalation continues it could lead to the U.S. imposing wider tariffs.

“Rhetoric from China appears to be hardening, with two commentaries in the state-owned People’s Daily taking aim at the US, with one likening the recent restrictions on Huawei as the US taking steps to start a technology cold war," says Smyth.

In addition, the news that President Trump has promised $16bn to reimburse farmers for the fallout from the trade war suggests he is in this for the long-haul.

Clearly, overall the global sentiment appears to be more negative than positive for the Kiwi.

From a domestic perspective, the main event in the coming week for NZD is the national budget, scheduled for release at 3.00 BST, on Thursday, May 30, although this rarely moves currencies.

So far the only news in relation to the budget is that Grant Robertson, the finance minister, has changed the national debt target to NZ$15-25bn by 2020/21 from $20bn previously. This widening of the target allows the government greater flexibility to increase spending in the event of crises. It could be a sign the government sees a greater chance of a crisis on the horizon.

Adrian Orr, the governor of the Reserve Bank of New Zealand (RBNZ) is scheduled to speak on Wednesday at 00.00 and 02.10 and analysts will be parsing his comments for signs of whether the RBNZ is likely to continue cutting interest rates as it did at the previous meeting, or whether that one cut was enough. If the former the Kiwi could weaken; if the latter the Kiwi could strengthen. Higher interest rates tend to appreciate a currency by attracting greater net foreign capital inflows, and vice versa for lower rates.

The RBNZ financial stability report is released at 22.00 on Tuesday and could provide further insights into the economy.

Building consents are out at 23.45 on Wednesday and ANZ business confidence at 02.00.

The Pound: Data-Light Week, Politics to Dominate

The main focus for the Pound over the coming week will be political, as the European Union election results are published and likely to show the ruling Conservative Party as having suffered a considerable defeat.

Out of 64 MEPs declared so far, Nigel Farage's Brexit Party has won 28, the Liberal Democrats 15, Labour 10, Greens seven, the Conservatives three and Plaid Cymru one.

"With a big, simple message - which is we've been badly let down by two parties who have broken their promises - we have topped the poll in a fairly dramatic style," says Farage on the BBC's Radio 4. "The two party system now serves nothing but itself. I think they are an obstruction to the modernising of politics, and we are going to take them on."

The extent of the defeat suffered by the Conservatives is sizeable and could be important as it may impact decision-making by party members as to who would be the most suitable replacement for Prime Minister Theresa May who resigned last week.

The worse the defeat the more likely the party will choose a potential leader with broad appeal such as Boris Johnson. Johnson is a Brexiteer who has said that if he were PM, we would be leaving the EU on October 31 “with or without a deal”.

The exact line-up of potential candidates will probably be announced within the next week and the selection and their potential impact on Brexit is likely to affect the Pound. Current contenders include Boris Johnson, Andrea Leadsom, Dominic Raab, and Michael Gove, all of which are considered Brexiteers. Jeremy Hunt is the leading remain voting contender, but even he describes himself as a 'born again' Brexiter.

The EU said it has not changed its stance on Brexit after May’s resignation, and that “our position on the withdrawal agreement - there is no change to that,” according to EU spokesperson Mina Andreeva.

A summer of political intrigue lies ahead, and the uncertainty should keep Sterling under pressure.

On the hard data front, the week ahead is expected to be relatively uneventful.

Consumer Confidence is probably the most important release, and is forecast to show a moderation to -12 in May from -13 previously, when it is released at 00.01 B.S.T. on Friday, May 25.

The inflation report hearings on Tuesday morning could also impact the Pound as Mark Carney, the governor of the Bank of England (BOE) and several Monetary Policy Committee members testify on the inflation and economic outlooks before Parliament's Treasury Committee, however, much of what they say will be highly conditional on the outcome of Brexit.

Housing data is highlighted, with mortgage approvals out on Tuesday at 9.30 and the Nationwide house price index is out on Friday at 7.00.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement