Respect the Trendline: Why the Pound-to-New Zealand Dollar Exchange Rate is Liable to Further Losses

Image © Pavel Ignatov, Adobe Stock

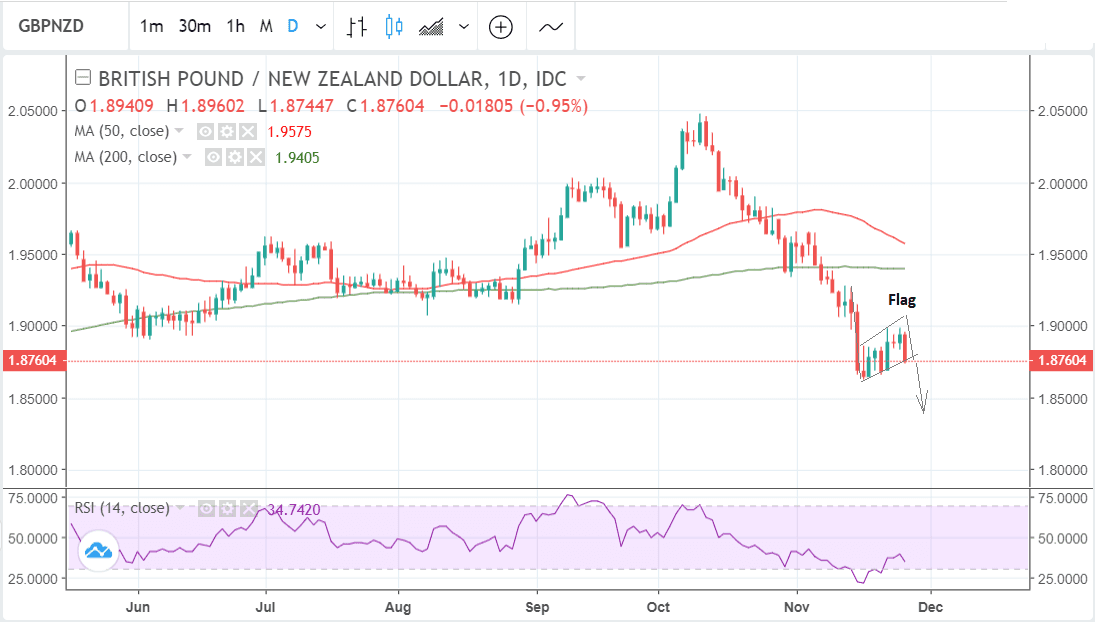

- GBP/NZD looks like it is resuming its downtrend

- Break below key lows could see move down to 1.83s

- RBNZ eases lending conditions

- G20 summit key event ahead for NZD

One Pound buys 1.8770 New Zealand Dollars at the time of writing, a cent below the 1.8880 registered at the close of the previous week.

In the short-term we see a bias to more downside, conditional on the exchange rate breaking below the 1.8630 November 16 lows.

The trend has been down ever since the October highs of 2.04 and given the old Wall Street adage that the “trend is your friend until the bend at the end” the bias lies in a continuation lower rather than a reversal.

More recently the pair has recovered, pulling back up to the major trendline, yet it has failed to break above, capitulating instead, as shown by the long, red, down day which has formed on the daily chart above.

A break below the November 16 lows would probably lead to an extension down to a target at 1.8355, and the level of the fairly important September and October 2017 lows.

Another way to look at recent market activity would be to view it as a technical pattern known as a ‘bear flag’.

These patterns are composed of a steep leg down, known as the ‘pole’, followed by a sideways or slightly ascending consolidation period, known as the flag ‘square’.

At the conclusion of the ‘square’, the market usually starts another steep leg down of an equal or similar length to the ‘pole’. In the example of GBP/NZD this yields a similar target to that already established as the 2017 September-October lows.

As mentioned, at the present time £1 buys NZ$1.8770, but we believe banks are offering rates in the region of between 1.8155 and 1.8286 for the purposes of international payments. Independent providers are offering in the region of between 1.8645 and 1.8681.

New Zealand Dollar Drivers: What to Watch

The New Zealand Dollar appears to be the major beneficiary of the better mood amongst investors today.

The rise in the currency comes following the Reserve Bank of New Zealand's Financial Stability Report released overnight. The RBNZ relaxed mortgage lending limits, as was expected.

The restrictions now specify that no more than 20% (previously 15%) of each bank’s new mortgage lending can be to owner occupiers with deposits less than 20%.

No more than 5% of each bank’s new mortgage lending can be to investors with deposits less than 30% (previously 35%).

The RBNZ’s overall assessment is that New Zealand’s financial system is "sound" and "risks have abated a little over the past six months".

While risks related to the housing market have reduced, high dairy debt and reliance on offshore funding remain vulnerabilities, with global risks seen as having increased since the May Report.

The RBNZ highlights that both farmers and financial firms will need to adapt to manage climate change risks.

The RBNZ is currently undertaking a fundamental view of bank capital requirements, with an initial view that capital levels will need to increase.

However, it appears the report didn't deliver any sizeable moves in the market.

Looking ahead, markets will be watching ANZ business confidence numbers out overnight. This is the tier 1 indicator for markets as confidence and own activity at recessionary levels are the RBNZ’s key concern.

Prior activity at +7 (investment -3, employment flat) and confidence at -37 are off the lows, but a long way from portraying above-trend growth lies ahead.

"A material improvement in this report to boost OIS and swap yields and the NZD," say TD Securities.

China-U.S. Relations Key

The New Zealand Dollar is more likely to be influenced by geopolitics than homegrown concerns in the near future.

Of note will be the progression of U.S.-China trade tensions, with markets expecting something positive to come out of this weekend's meeting of Trump and Xi on the fringes of the G20 meeting in Argentina.

New Zealand's export economy and its currency are highly dependent on China which is its largest trading neighbour. News headlines from the meeting of the G20, at the end of this week, therefore, could be a key driver for the exchange rate.

Trade tensions between China and the US will therefore be in focus. These have eased somewhat recently, supporting the Kiwi (and other China-dependent currencies), but it remains to be seen whether the talks planned between President’s Xi and Trump at the summit bear fruit.

Of particular significance will be whether the US decides to go ahead with its plan to increase the tariffs on the $250bn of Chinese imports already tariffed at 10%. The current plan is to increase the tariffs to 25% from the 1st of January 2019.

If the US still goes ahead with this it will be seen as negative for China and global growth and weaken the Kiwi. News about the outcome of the talks may not filter out completely until the end of the summit on Saturday, December 1.

On the domestic data front, the most important recent release for the Kiwi was trade balance data, which saw the trade deficit fall to -$1.3bn in October, compared to -$1.6bn in the previous month of September; this was, however, not as low as the -$0.8bn forecast. The lower the deficit the better for the currency.

The bi-annual Reserve Bank of New Zealand (RBNZ) financial stability report is another recent release. It showed that the RBNZ think financial stability risks are easing and recommended an easing in regulation governing lending due to the reduced risks to the economy.

Sentiment data and surveys come in later in the week. These often provide a good heads up of what is to come on the hard data front.

Thursday sees the release of ANZ business confidence in November which showed a balance of -37.1 in October.

ANZ Roy Morgan consumer confidence is out at 21.00 on Thursday, which showed a result of 115 previously.

NZ Building permits is forecast to show a rise of 1.1% in November from 1.5% previously when released at 21.45 on Thursday.

Advertisement

Bank-beating GBP exchange rates: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here