Downtrend in Pound / New Zealand Dollar Exchange Rate Remains Intact: GBP/NZD Week Ahead Forecast

Image © Rafael Ben-Ari, Adobe Images

- GBP/NZD's short-term downtrend is intact

- Downtrend expected to extend in week ahead

- The main release for the Pound is GDP data;

- NZD eyes RBNZ meeting

Pound Sterling remains under pressure against the New Zealand Dollar short-term with the pair quoted at 1.9497 at the start of the new week, ensuring the pair nurses a 4% loss for the past month of trading.

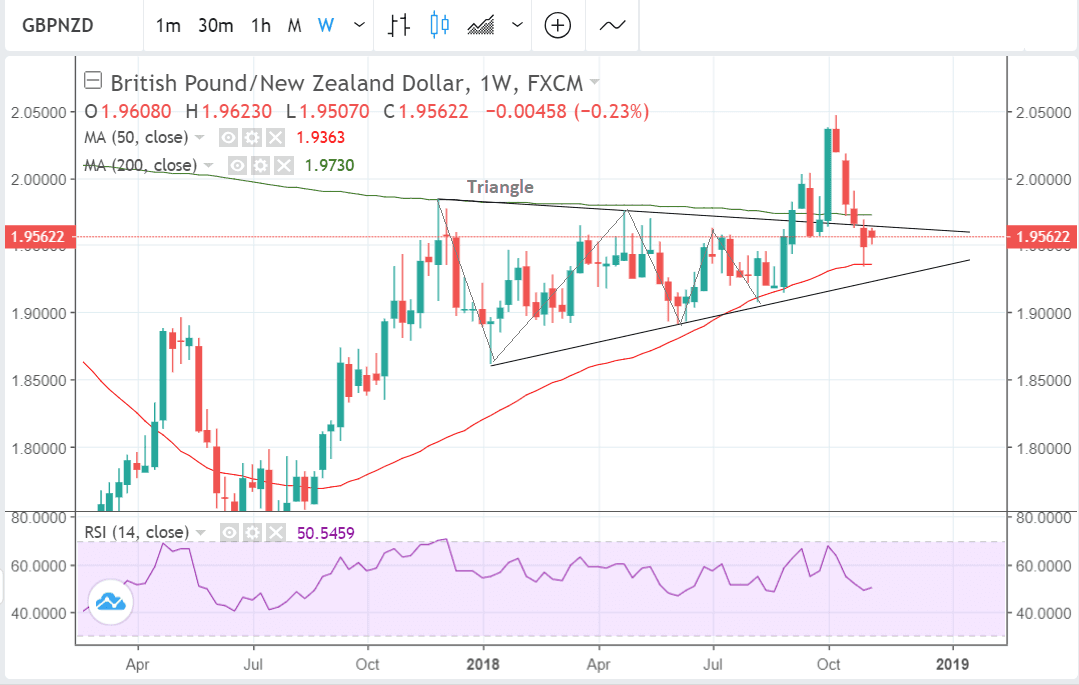

GBP/NZD peaked at the beginning of October but since then has been in decline.

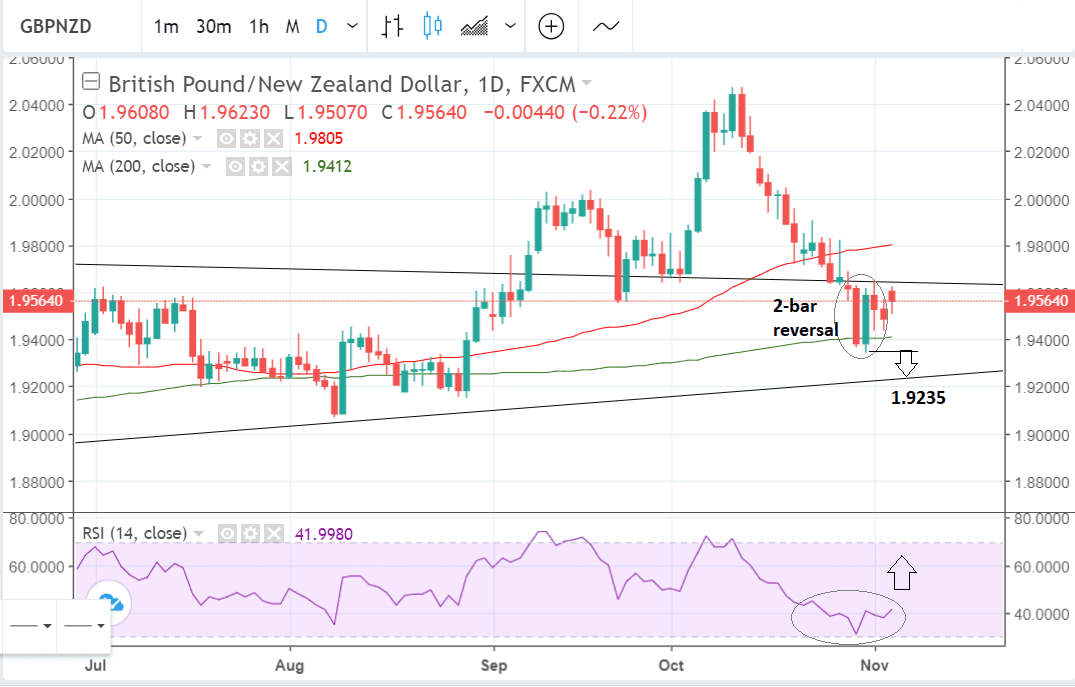

Fresh hopes of a compromise in Brexit negotiations helped the exchange rate find a floor in the 1.95/6 area last week but the strength of the support remains sketchy at best.

It then formed a bullish 2-bar reversal pattern, however, follow-through higher was been disappointing and not indicative of a bullish reversal.

The pair remains in a short-term downtrend which is favoured to extend. A break below the 1.9342 lows would indicate such a continuation of the downtrend.

The next downside target is at 1.9235 at the lower border of a triangle pattern which formed during most of 2018.

Whilst the pair could also recover on a strengthening pound there is insufficient evidence as yet to suggest that eventuality is the more likely.

Yet the bullish-looking RSI also cautions us not to be too bearish. The RSI momentum indicator in the bottom panel of the daily chart looks like it is more likely to rise than fall, which would also be indicative of a rise in the underlying exchange rate as well.

Advertisement

Bank-beating GBP-NZD exchange rates: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The New Zealand Dollar: What to Watch this Week

The main event for the New Zealand Dollar in the week ahead is the Reserve Bank of New Zealand (RBNZ) monetary policy meeting on Wednesday, November 7, at 20.00 GMT.

The RBNZ is not expected to change its monetary policy settings at the meeting but the market will, nevertheless, take note of the RBA's forward guidance, which is the trajectory which it expects interest rates to take in the future, and for this, they will look at the accompanying statement.

Higher interest rates - or the expectation thereof - tend to appreciate currencies as they attract greater inflows of foreign capital drawn by the promise of higher returns; and vice versa for lower rates.

New Zealand's interest rates are expected to remain low for sometime because of low inflation.

The inflation rate has been below the midpoint of the 1% to 3% target band for most of the time since 2012, necessitating lower interest rates from the RBNZ and the adoption of what analysts call a "loose" monetary policy stance. This is likely to remain the case for some time.

"Any likelihood of rising interest rates impacting New Zealand asset prices is years away, and is not a factor in the very near-term outlook," says a note from Wells Fargo on the matter.

The RBNZ's 'loose' policy outlook is likely to help stimulate growth in the economy.

"Weighing the near-term positives against the near-term negatives, we remain very comfortable with our view that New Zealand’s housing market and the economy will pick up a little in the very near term," says Wells Fargo.

Another important release in the week ahead for the New Zealand Dollar is labour market data, which is forecast to show a 0.5% rise in employment in Q3 and an overall unemployment rate of 4.5% when it is released at 21.45.

A strong result would boost the New Zealand Dollar but Wells Fargo are more pessimistic, expecting unemployment to edge higher to 4.6% in Q3.

"We expect the September quarter labour market surveys, released on Wednesday, to register another small rise in unemployment, from 4.5% to 4.6%. The labour market is cooling a little following the economic slowdown that occurred over 2017, " says the bank.

Finally, another major event for the Kiwi is the Global Dairy Trade (GDT) auction on Tuesday at 14.30.

Dairy prices are extremely important to the New Zealand economy as dairy products are its largest export. If prices rise it is generally positive for the Kiwi and vice versa if they fall. The GDT index has declined during 2018 and the last auction saw prices fall -0.3%.

The Pound: What to Watch this Week

For Sterling, Brexit remains central to the outlook with the swinging in sentiment on whether or not a deal will be agreed by year-end being the main driver of the currency.

"Headlines on Brexit will intensify, but short of a material sign that negotiations are progressing (or that we are heading towards a ‘no deal’), they are unlikely to trigger a decisive directional shift in Sterling," says Daniel Been, Head of FX Research with ANZ Bank.

Data releases have however moved Sterling over recent days, but the moves tend to be short-lived in nature and therefore tend to be faded.

Nevertheless, there are some important numbers to watch.

Services PMI for October is another important release for the Pound in the week ahead. It is released on Monday at 9.30. It is forecast to slow to 53.3 from 53.9 previously.

The PMI numbers already released this week have been mixed with manufacturing PMI released Thursday disappointing while construction on Friday beat expectations.

The key release for the Pound in the week ahead is GDP data, out on Friday, November 9 at 9.30 GMT.

Month-on-month GDP is forecast to have only grown 0.1% while third quarter GDP is forecast to show a 1.5% rise on an annualised basis (1.2% previously) and a 0.6% rise on a quarterly basis (quarter-on-quarter) compared to 0.4% previously.

If growth accelerates as much as expected it may boost the Pound - if it beats expectations it could rise even more strongly.

Industrial and manufacturing production for October are out on Friday at 9.30 and forecast to show -0.1% and 0.1% changes in October on a monthly basis. While the data will be important we feel that from a Sterling perspective it will be overshadowed by the more timely monthly statistic.

Also on Friday are trade data with the balance forecast to reveal a deficit of £11.40BN in September.

Apart from this, there are also several housing metrics out including Halifax house prices at 8.30 on Wednesday and the RICS house price balance at 0.01 on Thursday.

The British Retail Consortium's retail sales monitor is often a good leading indicator for retail sales in general and it is forecast to show a 0.6% rise in October when released at 0.01 on Tuesday.

Advertisement

Bank-beating GBP-NZD exchange rates: Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here