Britain's Pound in Biggest 1-Hour Jump of 2018 as Germany Eases Path to a Brexit Deal

Above: Reports suggest Angela Merkel might have made a concession to allow Brexit negotiations to progress. Image © European Council

- Reports suggest Germany is willing to drop a key demand

- Barnier confirms he is confident of striking a deal

- But analysts sceptical Pound Sterling will hold gains

The British Pound has overturned earlier losses to record a strong gain against the Euro, Dollar and other major currencies late in the mid-week session as the currency's Brexit yo-yo continues.

It appears a report about the potential softening of demands made by the EU, combined with comments from chief EU negotiator Michel Barnier, are behind the move.

Bloomberg report "the British and German governments have abandoned key Brexit demands, potentially easing the path for the EU and UK to strike a deal."

People familiar with the matter said Germany is ready to accept a less detailed agreement on the UK’s future economic and trade ties with the EU in a bid to get a Brexit deal done.

The news snippet did however encourage a strong bid for Sterling.

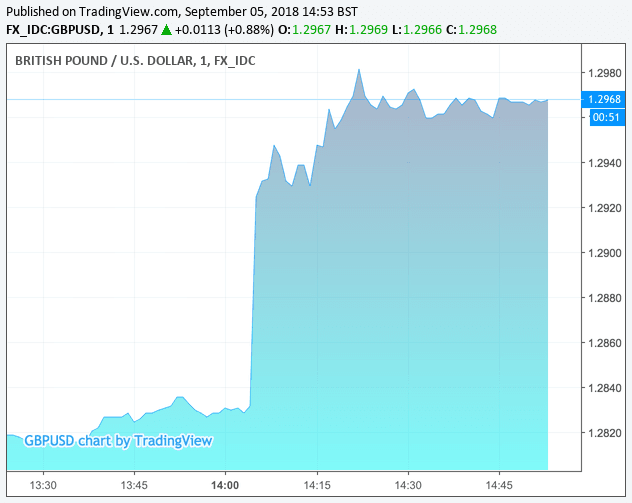

"The Pound surged around 1.5c GBP/USD in 15 minutes on the latest Germany/UK Brexit murmurings," says David Jones, an analyst with Capital.com.

Above: Sterling-Dollar's impressive jump on the latest "Brexit murmurings"

"GBP/USD has registered its biggest one-hour rise of 2018 on Brexit hopes," says Martin Miller, an analyst on the Thomson Reuters currency desk. "Momentum positive, scope for further gains to last week's 1.3043 peak".

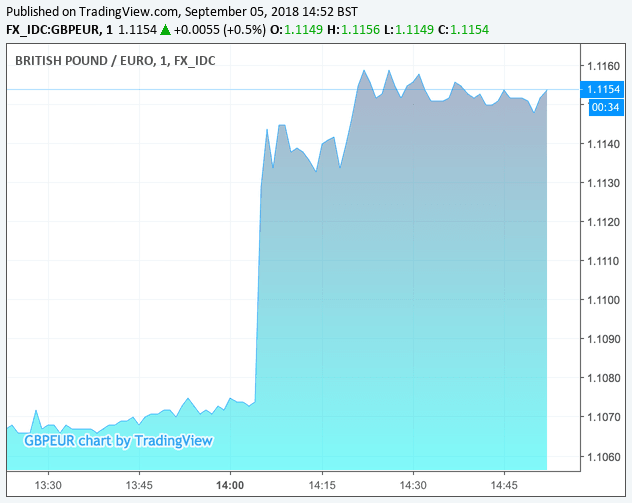

Above: The Pound-Euro rate moves higher

"Who needs Brexit details! GBP showing how it is much more sensitive to good news vs. bad news. May not last (like post Barnier) but dips make GBP attractive," says Viraj Patel with ING Bank N.V.

“Stop me if you’ve heard this before, but the Pound has jumped to session highs on reports that Britain and Germany are ready to drop key Brexit demands, potentially easing a path to a deal before the year end. The reports indicate that both sides are prepared to forego ironing out some details on the future relationship now, in order to get a deal done," says Neil Wilson, Chief Market Analyst with Markets.com.

EU chief negotiator Michel Barnier meanwhile struck a positive tone on Brexit negotiations, saying he is looking forward to meeting his counterpart Dominic Raab again tomorrow.

Barnier confirms he is committed to continuing work on the Brexit Withdrawal Agreement & on finding common ground between the EU Council's March guidelines and Chequers with a view to creating "a new, ambitious partnership."

The comments are familiar - it was exactly a week ago that Barnier gave warm comments regarding Brexit negotiations which sparked a short-covering rally in the British Pound.

Report suggests Germany willing to accept less detailed agreement on post-Brexit arrangement. Ensuing short squeeze seems disproportionate with "kick can down road" tactic, IMHO. Look to fade after options expiry?

— Marc Chandler (@marcmakingsense) September 5, 2018

However, those gains and warm sentiment were soon overturned when Barnier effectively trashed a key foundation of Theresa May's Chequers proposals.

And it is with this in mind that markets will likely not want to be burnt by 'positive' Brexit news again; we would not be surprised if gains in the Pound are tempered.

Capital.com's Wilson says there are a couple of health warnings to be aware of regarding this last jump:

"First, Germany does not – despite its clear dominance of the bloc economically - actually speak for the EU position. Michel Barnier may well have something to say about this report. As might Theresa May.

"Second, we’ve heard these kinds of rumours lift the pound before and it should be treated with caution. There is a strong chance that this rally could run out of steam and retrace in fairly short order.

"But, it nevertheless it does still point to a degree of softening in the general tone of talks and that a deal is more likely than not.”

Indeed, headlines coming across the newswires say a German government spokesman says the German government's position on Brexit is unchanged.

Responding to this newswire denial, ING's Patel says "we will probably get a lot of this. Rumours knocked backed by officials. All part of the Brexit negotiation games - neither side wants to show signs of weakness (concessions). But equally no smoke without fire."

Nevertheless, following the reports of the German concession, the Pound-to-Euro exchange rate was quoted at a weekly best at 1.1164 before paring gains to 1.1100 in the Asian session of Thursday, 06.

The Pound-to-Dollar exchange rate rose to a weekly high of 1.2933, having been as low as 1.2810, it is currently quoted at 1.2911 at the time of writing.

"The GBP experienced a choppy session, spiking to a high of 1.2983 after news that the UK and German governments had abandoned key demands in order to make it easier to strike a Brexit deal. But later gains were pared back, sending the GBP back down to 1.29, after reports that Germany’s position on Brexit is unchanged," says a client briefing from ANZ Bank.

In further developments, Dominic Raab, the UK's Secretary of State for Exiting the European Union told a Parliamentary committe that a Canada-style free trade deal favoured by some Brexit advocates would be unacceptable.

"Those advocating a Canada-style free trade deal have to explain why that would not lead to the Northern Ireland backstop arrangements staying in place for perpetuity," said Raab.

There have been suggestions that a Canada-style deal is the inevitable destination of Brexit negotiations as this is a model favoured by Brexiteers and is accepted as an option by Barnier himself.

However, it is does not offer the UK and EU as close a relationship as businesses would like. Therefore, news that the two sides are moving closer to a bespoke deal is on the margin positive.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here